Key Insights from the French Market Analysis

Analysis of the French energy market is key to understanding the dynamics and trends affecting the sector both locally and internationally. In this detailed analysis, we address the important factors influencing energy prices, supply and demand, and the latest regulatory policies. This comprehensive overview will allow you to keep up to date with weekly changes and anticipate possible market variations, both in France and in other relevant markets such as Spain.

Table of Contents

August 2025

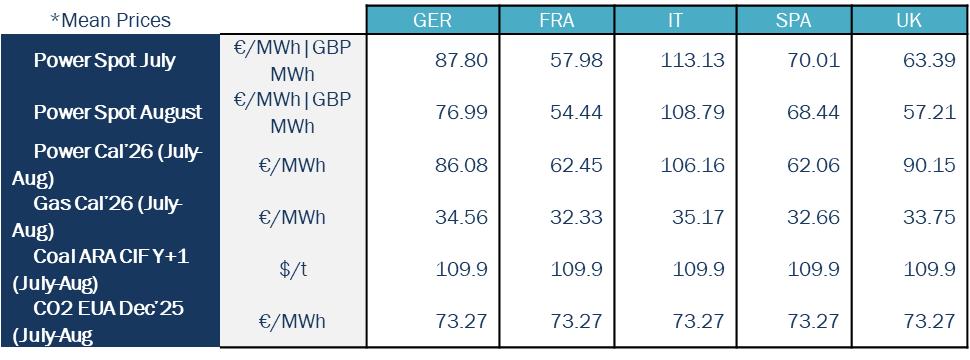

Key figures of the month

Energy demand and generation mix

In August 2025, electricity consumption in France during peaks in demand averaged 46.6 GW. The peak in electricity demand in August was reached on Wednesday 13 August, with 51.9 GW, well above the levels seen the previous month (58.6 GW).

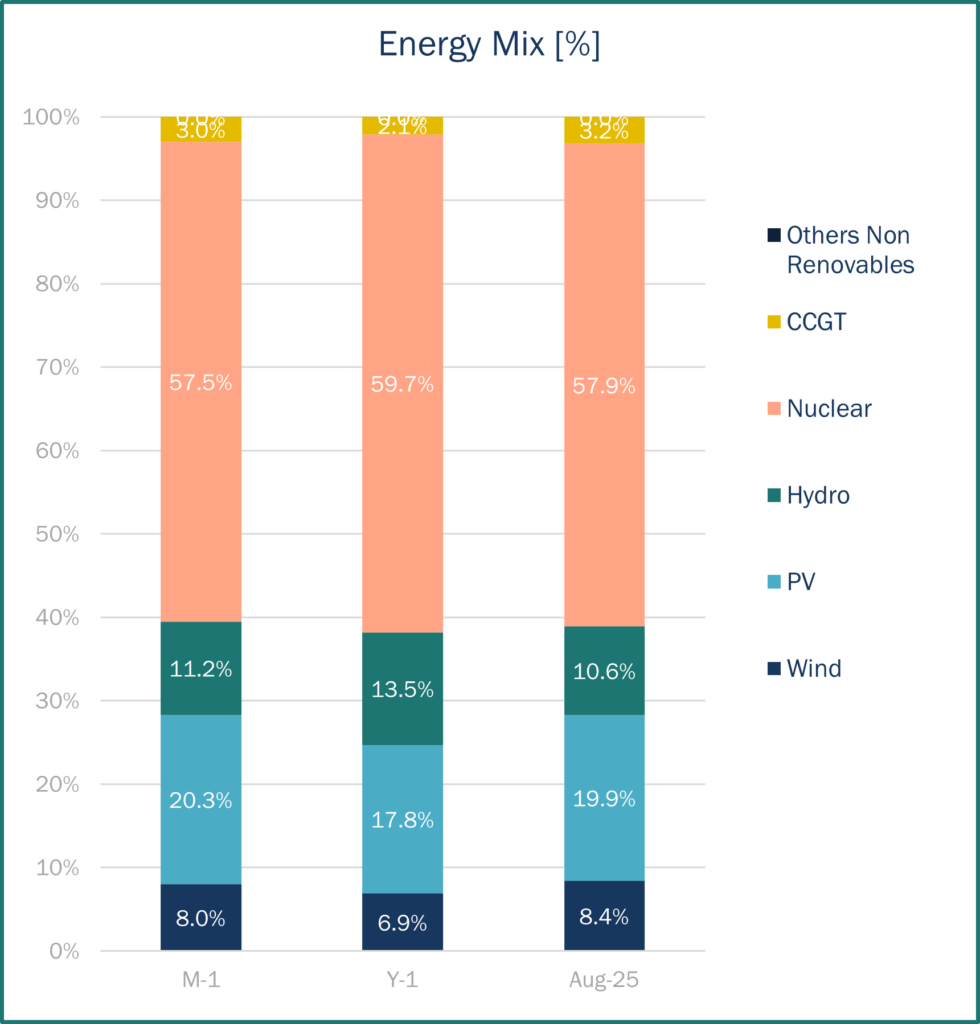

In terms of the generation mix, average nuclear generation in August was 41.7 GWh. The average maximum output was reached beginning of the month (44 GWh), and the average minimum output was reached on Tuesday 12th. During summer, high river temperatures forced curtailments at up to six reactors, including Bugey, Tricastin and Golfech. The last week of the month, 17 reactors in the French nuclear fleet were on scheduled shutdown. EDF maintained its production target for 2025–2026 at 350–370 TWh annually but delayed the full-power start of the 1.6 GW Flamanville 3 reactor from late summer to the end of autumn.

In terms of renewable energy sources, as you can see from the graph, PV production comes second in the total energy mix, representing a 19.9% out of the total production and first in the renewable energy category. In the last three months, PV production has represented more than 19% of the energy mix. Hydro energy comes third in the total energy mix, representing 10.6%. Hydroelectric stocks decreased from 2,423 GWh (at the end of August) to 2,559 GWh (at the end of July), below last year’s level (3,119 GWh).

Source: Haya Energy Solutions

Energy prices & market panorama

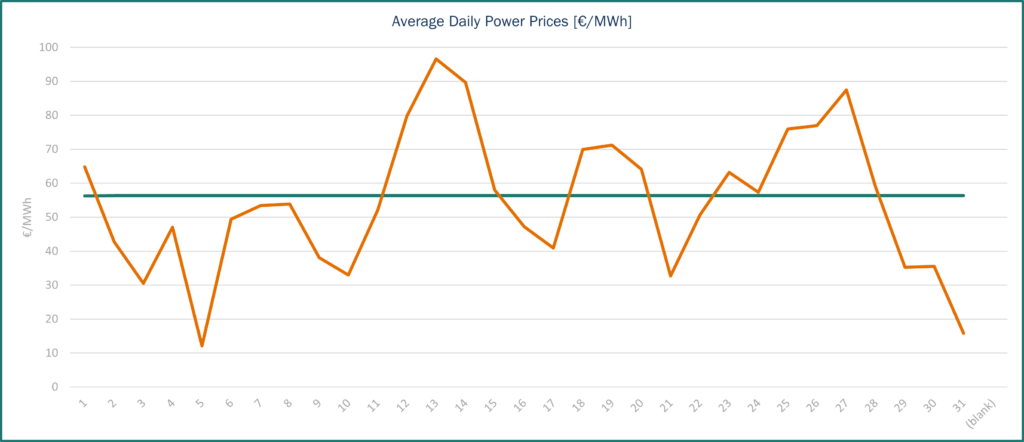

Average electricity prices for day-ahead base contracts in France reached €53.49/MWh, lower to July’s levels (€60.29/MWh). As the graph shows, prices fluctuated considerably throughout the month with the minimum price for the day-ahead base contract being €30.48/MWh on 04th August, and the maximum price €96.56/MWh on 12th August. In August 2025, elevated temperatures boosted demand. The cooling period then caused demand to fall. In addition, the combination of stronger wind generation and stable nuclear output helped to reduce evening prices.

Source: Haya Energy Solutions

Regarding imports and exports, in August, France was in a position of net exporter with all its borders, except for Spain. France remained a key player in regional power flows, maintaining strong exports exceeding 10 GW per day in August. The maximum level of exports for the month was 19,102 MW.

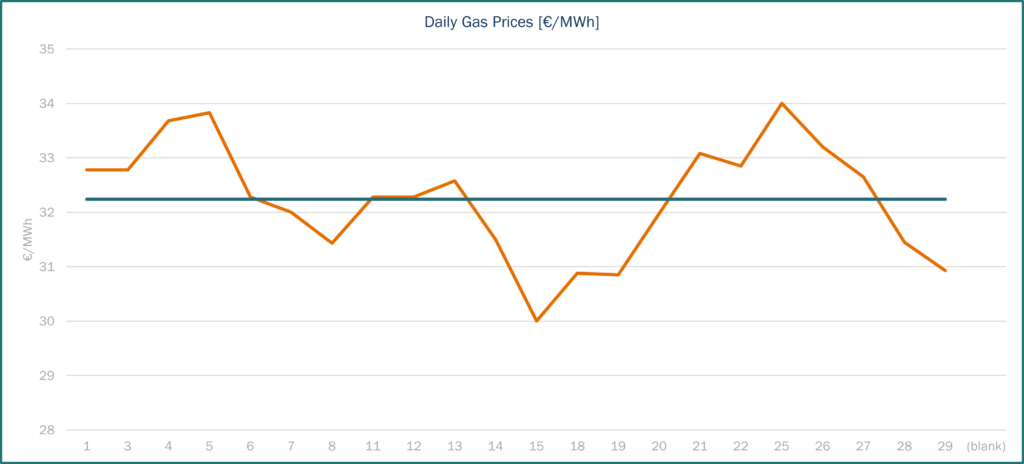

Gas prices, the TTF spot contract closed at €30.93/MWh on 29th August. In the last three months, the trend has been upwards, until mid-June when TTF gas reached its peak price (€41.98/MWh 19/06/2025), after which prices fell in fits and starts. On 15th August, TTF spot contract reached its lowest price since the beginning of the year (€30/MWh) due to the bank holiday and the summer break.

EU gas stocks are 77.3% full on average, compared to 92.39% last year. France’s gas storage levels are at 86.56%, below 2024 (90.12%). According to discussions held during a European Parliament committee meeting in May, EU member states introduced greater flexibility into the bloc’s mandatory gas storage rules. Gas storage facilities must be filled to 90% capacity between 1st of October and 1st of December (rather than by November 1st), which eases the pressure.

Source: Haya Energy Solutions

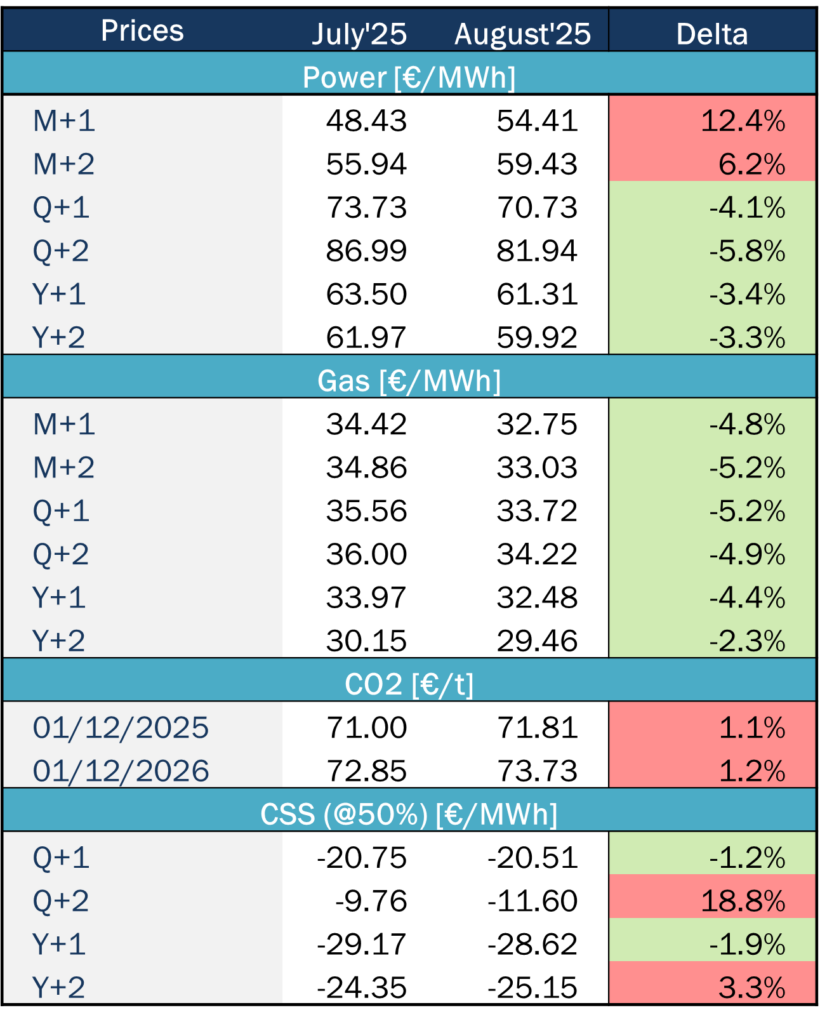

Market trends and futures

Source: Haya Energy Solutions

During the week of 18–20 August 2025, energy markets were largely shaped by geopolitical developments and weather-driven power dynamics in Europe.

On 15 August, U.S. President Donald Trump met Russian President Vladimir Putin in Alaska to discuss the conflict in Ukraine. While no agreement was reached, the meeting marked a significant shift in U.S. policy, with Trump showing readiness to align more closely with Moscow’s call for a peace deal rather than the ceasefire first supported by Ukraine and European allies. Trump has since pressed Ukrainian President Volodymyr Zelensky, whom he met in Washington on 18 August, to participate in a trilateral summit with Russia and the United States. Although both meetings produced no concrete results, the softer U.S. tone has raised market expectations of a potential easing of sanctions on Russian oil and gas exports, including Arctic LNG 2, which could increase global supply.

Brent crude prices dipped by over 1%, and European gas prices (TTF Cal+1) fell by 4.07% over the week as a result of this shift.

Regulation

The European Union confirmed on 21 August a major framework agreement with the United States to purchase up to $750 billion worth of U.S. LNG, oil, and nuclear products by 2028, aiming to accelerate the replacement of Russian energy supplies.

First draft rules for the new French capacity mechanism – published july 29, 2025

RTE has released the draft rules for the upcoming capacity mechanism on Concerte as of July 29, 2025. This document reflects the discussions held during the working group meeting on July 15, as well as insights from parallel technical workshops.

According to RTE, this draft is “a working version that incorporates proposals from the July 15 working group and various technical workshops conducted in parallel. The consultation process remains open. Early publication of these rules aims to foster stakeholder acceptance of the new mechanism, especially given the tight deadlines for operational implementation.”

Some elements remain incomplete or under review. Moreover, the draft is based on certain assumptions about the future regulatory framework, which may lead to changes once the implementing decree is issued. By publishing this initial draft, RTE reaffirms its intention to launch the new mechanism on schedule and prevent a gap year. However, the timeline remains highly constrained, and the risk of a blank year in the capacity market has not been fully ruled out.