We are approaching the energy winter, typically considered the period from November to March when the system becomes more strained due to low temperatures. As it is becoming a tradition in HES, this article will analyse the state of the energy market as we enter this period (see article published in October 2024: Winter perspectives and energy supply security). We will investigate the specific situation of France’s nuclear fleet as the energy cornerstone of Europe, the situation of gas and hydro storages, as well as get into a light analysis on the impact of the geopolitical situation on EU energy market balance, mainly through the analysis of the LNG supply.

The energy situation of Europe starts from a comfortable position this winter; the balance of supply and demand seems unfazed, coming into the winter once again with the French nuclear parc functioning at full throttle, the new addition of Flamanville 3 to the portfolio contributing considerably. However, while the situation may seem more tense than in 2024 due to a lower storage of gas (due to the relaxation of European restrictions), the levels are still above compliance, and hydro storage has remained high since last winter. Additionally, LNG imports remain high, stable, and competitive, supported by the maintained easing of Asian demand and the push towards liquefaction facilities of USA on their pursuit to be the key player of global gas supply.

Security of supply can be considered assured, though the balance is still tight and prices could be responsive to cold spells, geopolitical distortions affecting LNG and Gas markets, and changes on the LNG global demand distribution due to external factors. In addition, electric bills could rise even if prices remain stable, due to the TSOs system charges, especially in Spain due to a tighter control from its network operator after last April’s black-out.

Situation of supply

- Nuclear Fleet

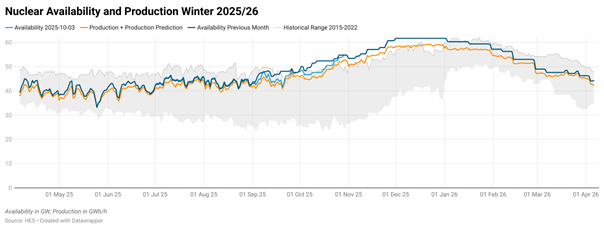

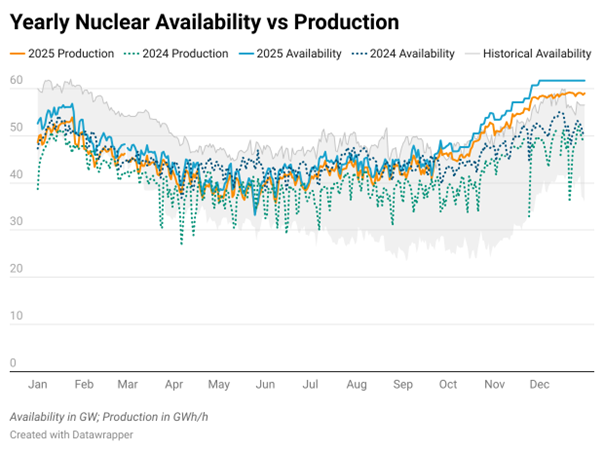

This winter we are seeing availability surpass historical maximums in France. The addition of Flamanville 3 (1.6 GW) and recent maintenance of other plants are likely influencing EDF’s prediction of having 61.7 GW throughout December. Production will range between 45 to 58 GWh/h throughout winter, with a consistent peak during December of around 58 GWh/h, based on our prediction of production.

Source: RTE (Availability and production); HES (Production prediction)

Source: RTE (Availability and production); HES (Production prediction)

We can conclude that French Nuclear fleet enters the upcoming winter strong and dependent, adding great stability to the European Network.

- Gas Storage

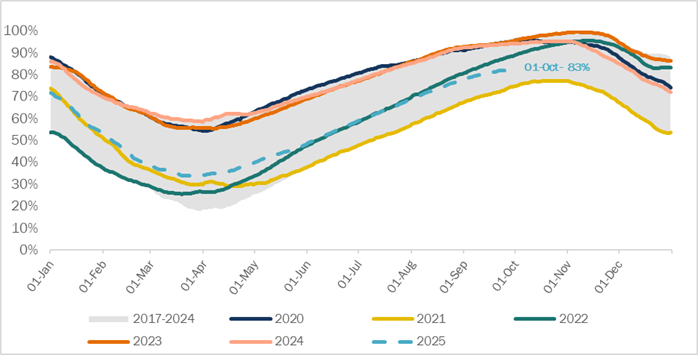

After the war in Ukraine began, Europe reparametrized its objective minimum level of gas storage from 80% (2022) to 90% (2023, 2024) on the 1st of November of each year to prepare for the high-demand months inside the gas winter. Since then, the storage levels of gas at the beginning of winter have always been comfortable.

In April 2025, European governments agreed upon loosening the gas storage rules to avoid inflating energy prices due to European increased demand during the summer period by: (i) allowing storage to reach the 90% level at any moment between the 1st of October and the 1st of December, (ii) allowing deviations of up to 10 percentage points from the target (with possible 5% extra via delegated act if adverse market conditions were to appear).

European gas storages were filled at 83% on the 1st October, below the immediate precedent years, which could seem as an extra risk factor for price spikes during this winter if cold spells appear, but considering the previously mentioned policy update and the current low price levels of European gas markets, it seems the general feeling may be signalling towards the opposite, a system well secured ahead of the winter season.

Evolution of European gas storage filling level (%) – Source: AGSIE (Aggregated Gas Storage Inventory)

Moreover, during August and September, Norway’s gas fields in the North Sea (the main pipeline gas source for Europe since the Ukraine conflict) entered their yearly maintenance program, while the market remained unaffected and even bearish — gas prices fell to their lowest levels since Q1-2024, underscoring the strong security of supply in the current market situation.

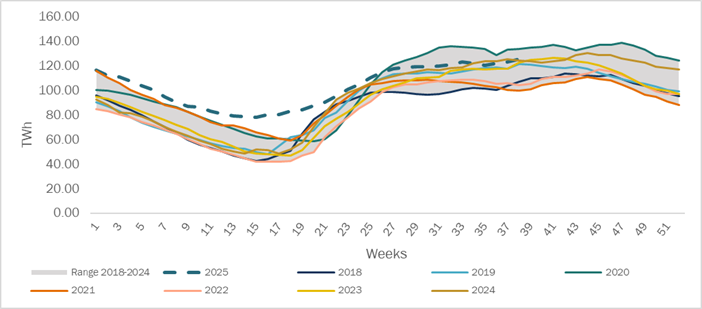

- Hydraulic Storage

This year has shown a deviation across European countries in respect to hydraulic stocks, however, we find an overall high and stable storage, mainly driven by countries like Sweden, Switzerland, and Spain, where Spain in particular experienced a period of specially heavy rainfalls during March-April, which filled reservoirs to their best levels in years, a situation which is still maintained today, above 2018-2024 maximums.

Hydraulic Stock Evolution in Europe: Aggregated of Spain, Italy, France, Switzerland and the Nordic countries (Norway, Sweden and Finland). – Source: ENTSOe.

- LNG Situation

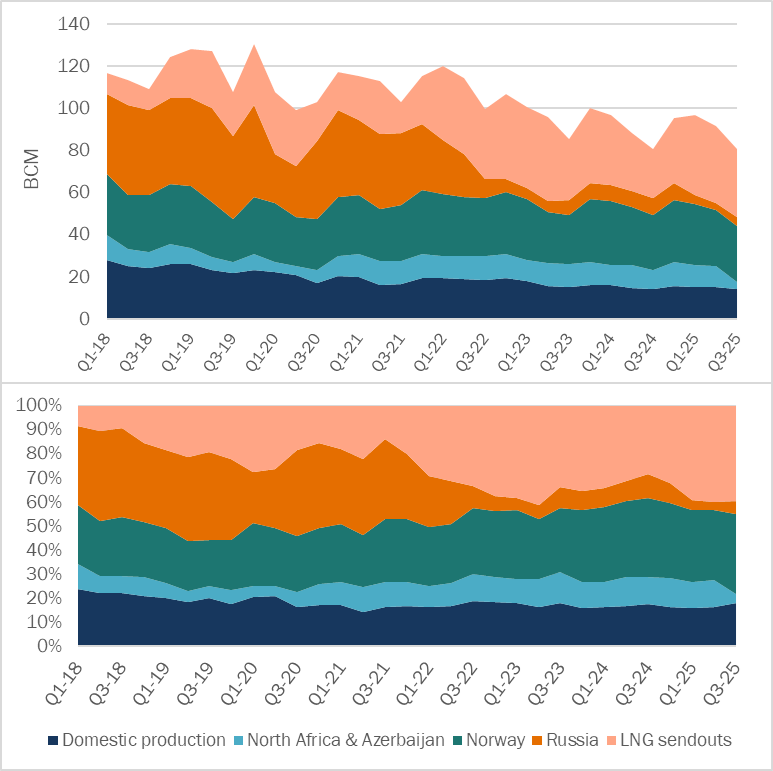

Since the war between Ukraine and Russia, the gas panorama in Europe has shifted towards an increased diversification of sourcing of gas both geographically and methodically. In this sense, Europe has greatly increased their pipeline gas imports from sources alternative to Russia, whose direct supply has been reduced to zero since 2022, and only arrived to European countries through Turkey and Ukraine, and now only through Turkey (TurkStream pipeline) since the Ukraine-Russia long-term transit contract formally ended on January 1st.

Additionally, European sourcing of gas relies more and more on LNG. This, added to the downward trend of European gas demand, which we analyse further in the article, has positioned LNG as the dominant source of gas, accounting for up to 40% of the total gas supply to Europe, only comparable to Norwegian Pipeline gas supply, which is second.

European Gas Sourcing Evolution in BCM and % – Source: EnergieScan (ENGIE).

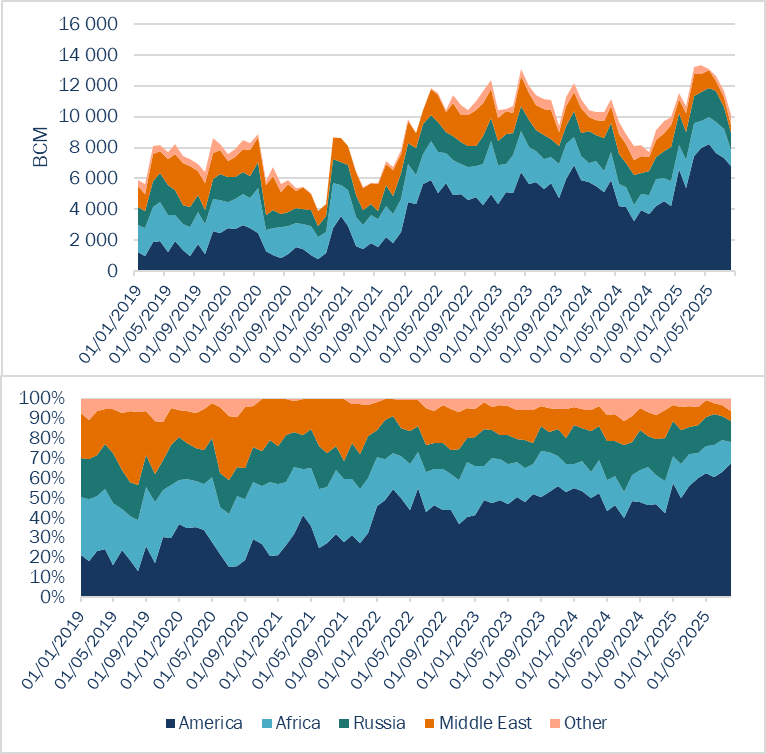

However, even if European gas sourcing is more diversified than it was in the past, it is still dependent on dominant actors. As of today, 60% of the total LNG supply of Europe is acquired from USA, shown in the graph below. On the other hand, the US LNG market is based on competition and formed by many different exporters, liquefaction plants, and companies, so, even if there is a persistent country risk that underlies any counterparty, there is little risk of monopoly.

European LNG Sourcing Evolution in BCM and % – Source: EnergieScan (ENGIE).

It is important to recall, as it can be inferred from the graphs above, that the European commission ban on Russian gas applies to gas from pipeline and not to LNG. However, this will change after the 19th sanctions package of the European Commission tackles Russian LNG imports by “turning off the tap” officially starting January 2027. And while it should not apply for the upcoming winter, LNG supply could start progressively shifting towards other sources earlier, tightening European LNG balance, which should rely on alternative sources.

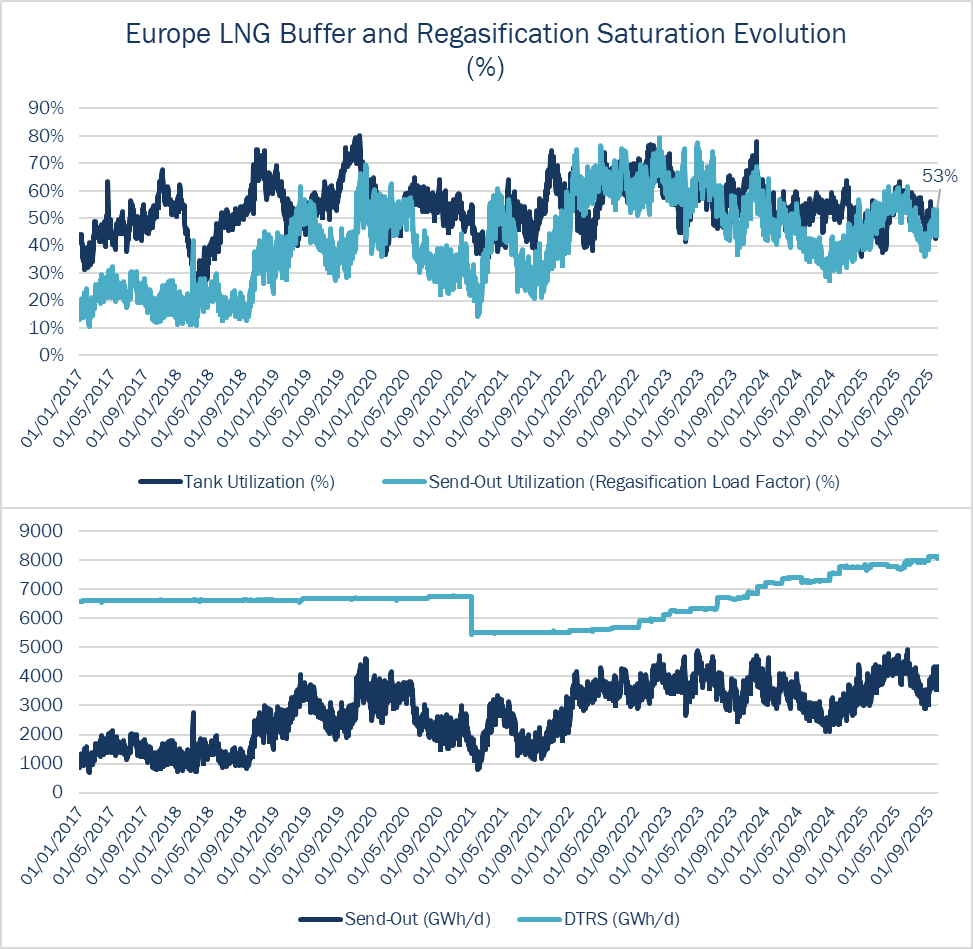

On the bright side, Europe has invested in both LNG Terminals and regasification plants which has enabled LNG USA exports to multiply since 2022 without saturating the system, which means that Europe has capacity to “digest” more LNG from the USA and other sources, leaving a system secured for the winter.

European LNG Buffer and Regasification Saturation Evolution – Source: GIE, AGSI.

*Send-Out (GWh/d): Actual volume of gas regasified and effectively injected into the network per day.

DTRS (GWh/d): Maximum technical capacity available at LNG terminals to regasify and inject gas into the network per day.

It is key to not forget that LNG is a global market with a lot of competition in both supply and demand, and the state of global demand can shape the LNG supply price for Europe. As an example, last year a drought in Brazil brought their hydro output capacity down for a period, which pushed their LNG imports, pressing LNG global prices higher and thus, European gas prices along with them.

Historically, Asian demand has shaped LNG markets across the globe, being the preferred buyers leaving the rest after in the supply chain. Recently, China’s growing pipeline capacity and LNG imports from Russia are gradually reducing its reliance on spot LNG cargoes, freeing more U.S. and Qatari volumes for other markets. This rebalancing has helped ease pressure on Europe’s gas supply chain, tempering LNG price spikes despite persistent volatility. However, by deepening its energy ties with Russia, China is also absorbing volumes that might otherwise reach global markets in the future.

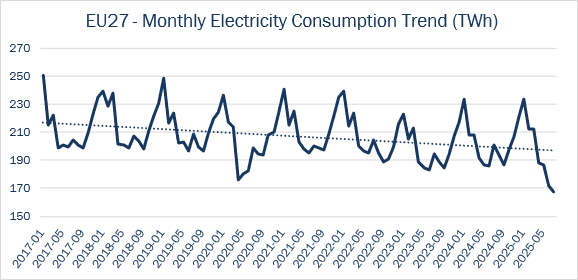

Situation of consumption

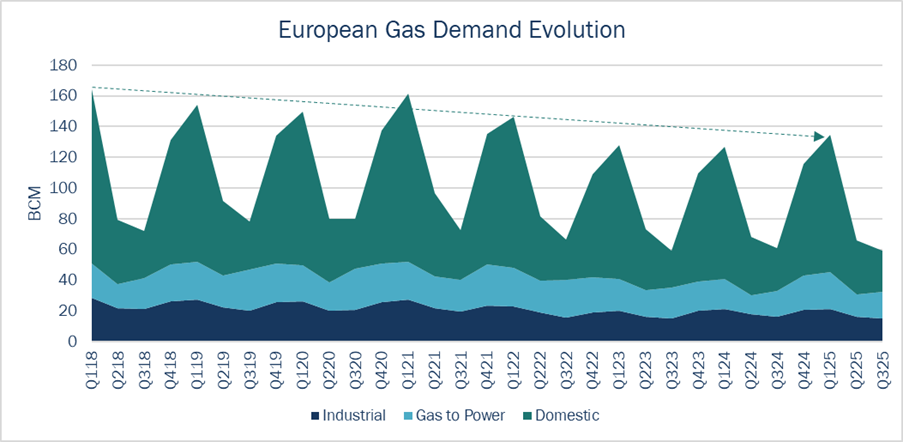

Following the profound shifts triggered first by the COVID-19 crisis and later intensified by Russia’s invasion of Ukraine — when energy prices surged to unprecedented levels — European energy consumption has continued to decline steadily year after year. This structural reduction reflects not only the short-term impact of price shocks but also the lasting effects of widespread energy-sobriety measures, efficiency improvements, and behavioural adaptation across Member States.

Although consumption has rebounded slightly from the exceptionally low levels of winter 2022/23, as energy prices have stabilized, Europe has largely maintained its new culture of energy restraint. Through 2024 and 2025, this mindset — supported by improved building efficiency, industrial optimization, and strengthened policy frameworks — has consolidated the continent’s resilience and reshaped its energy-consumption.

Source: EuroStat

This newfound resilience has applied to both electricity and gas, the latter of which was also affected by the high price level and tight supply left after Russian supply reduction, which pushed demand down on the industrial and domestic sectors.

Source: EnergieScan (ENGIE)

In conclusion, Europe — and particularly France — approaches this winter with a reassuring level of energy supply security, underpinned by a strong nuclear fleet, robust storage levels, diversified import routes, and stabilized LNG inflows. These fundamentals support a cautiously optimistic outlook for price stability, with a downward tendency if current conditions persist.

However, factors remain that could cause a sudden change in this stability; geopolitical tensions in Eastern Europe and the Middle East, evolving sanctions on Russian hydrocarbons, and shifts in global LNG demand — particularly from Asia — all have the potential to swiftly alter the balance.

Here and now, the market stands stable and reliable, as current gas prices show, but winter’s uncertainty still looms, so keep a watchful eye for news that could impact the market. From HES we will remain at your disposal to inform you of the latest news and steer confidently through an ever-changing energy landscape.

Guillermo Llanos Macías