The French capacity mechanism, established to guarantee the security of electricity supply during consumption peaks, will undergo significant changes starting in the winter of 2026–2027. Faced with the limitations of the current system, price volatility, operational complexity and information asymmetries, the reform is part of a European dynamic aimed at simplifying the system and providing greater security for investments.

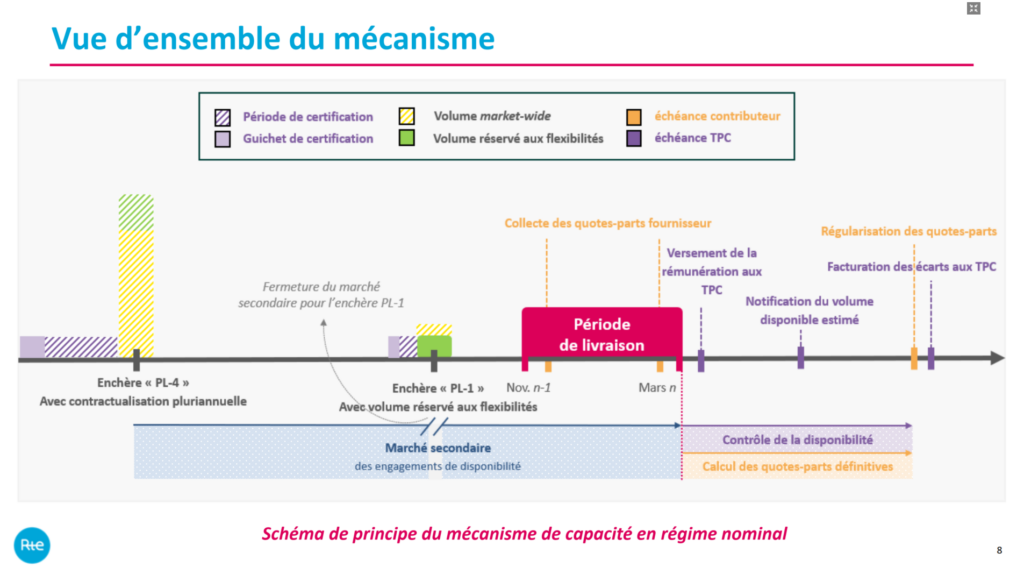

Now centralised, the mechanism places RTE (France’s transmission system operator) as the sole purchaser, organising annual auctions to contract the necessary capacity. Producers and aggregators must certify their available capacity in advance, while the rebalancing system is replaced by a secondary adjustment market.

The reform has two objectives: to encourage the emergence of new carbon-free capacities, such as load shedding, battery storage and low-carbon thermal resources, while controlling the impact on consumers in a context marked by the gradual end of the ARENH (French nuclear supply at the rate of €42/MWh) (see previous article: End of French nuclear “doping”). However, it also poses new challenges for producers. In terms of long-term visibility, cash flow management, and auction participation strategy, making an optimized approach is essential to anticipate risks and opportunities.

Established in 2017, the French capacity mechanism has been a pillar of electricity supply security (see previous article: The mechanism of opportunities). It has made it possible to maintain peak resources on the market (thermal power plants, industrial load shedding, flexibility solutions) which, without additional remuneration, would not have been economically viable given their low number of operating hours. This decentralised system, based on exchanges between producers and suppliers, has helped secure winter peaks, which are essential in a country where consumption is very sensitive to the cold.

After nearly ten years of operation, several limitations have emerged: the complexity of the system, the volatility of capacity certificate prices, the preponderant weight of certain players such as EDF, and the lack of predictability regarding the actual availability of certified capacity.

In 2022, the public authorities and RTE decided to re-examine the purpose of the mechanism, without taboos. RTE launched a consultation in April 2022 and, in 2025, published the first draft of the new rules. The objective of this overhaul is to simplify the mechanism, send a clear price signal for long-term investments, and control consumers’ bills, in the context of the end of the ARENH.

Basic principles of the new mechanism

- Centralised architecture: RTE becomes the sole purchaser. Consumers and suppliers no longer participate directly in the auctions but pay a tax. Each contributor is taken at their reference power level. The exact allocation by type of consumer is still unknown. According to RTE’s ‘working groups’, contributors remain free to pass on their share, even if the Minister for energy could ask the main suppliers to communicate their methodology to the CRE (French energy regulatory commission).

- Certification of capacities: producers, aggregators, and demand response operators must certify their capacities. Each certification entity (“Entité de Certification (EDC)” in French) receives a certified volume (“Vcertified” in French). This volume may be increased in new certification windows, but it is forbidden to decrease the volume.

- When the new mechanism is solidly in place, two auctions will be organised:

- A main auction in DP-4 (Delivery Period “Période de Livraison (“PL”) in French), with the entire bid including, if necessary, the provision of multi-year contracts.

- A secondary DP-1 adjustment auction, where a volume will be reserved for carbon-free flexibilities (load shedding, batteries, etc.). This reserved volume will bring out a clearing price specific to flexibilities.

*The entire certified volume must be presented at the auction for which the volume was certified. The volume selected at auction constitutes the auction volume and is automatically contracted between RTE and certification perimeter holder (“Titulaire de Périmètre de Certification (TPC)” in French). This contracted volume is the availability commitment and entitles the holder to remuneration under the mechanism.

** Certification entities (“Entité de Certification (EDC)”) are paid on a pay-as-clear basis.

- Secondary market: the old rebalancing mechanism is abolished and replaced with a secondary market that allows players to adjust their commitments. Participation in auctions is a prerequisite for the secondary market.

- First delivery period: winter 2026–2027. To limit cash flow discrepancies, an advance contribution from consumers is planned from summer 2026.

- Intermediate Cap Price: applies to existing capacity to limit the cost of the mechanism and avoid excessive rents.

Source: RTE working group n°14 – Consultation on the overhaul of the capacity mechanism

Provisional schedule

For the first periods (delivery period, “période de livraison (“PL”) in French, 2026–2030), only one auction is planned:

| Delivery period (DP) | Certification | Main Auction |

| DP 2026 – 2027 | 1st semestre of 2026 | Fall 2026 |

| DP 2027 – 2028 | 2027 | Fall 2027 |

| DP 2028 – 2029 | 2028 | Fall 2028 |

| DP 2029 – 2030 | 2029 | Fall 2029 |

Conclusions

The new capacity mechanism brings several advances, including simplification for consumers through centralisation via RTE, a clearer price signal with DP-4 auctions, and a main auction covering most volumes, which should reflect the balance of the system.

For producers, several challenges appear:

- in DP-4, anticipating the expected revenues on the energy market for each asset for the delivery year to calculate the shortfall (‘missing money’) to be included in their bids during auctions

- if their vision evolves between DP-4 and DP, they will have to try to adjust via the secondary market, without guaranteeing that they will find the necessary volumes;

- finally, deferred remuneration in DP+1 is likely may weigh on their cash flow.

For consumers, uncertainties remain about prices for winter 2026–2027, as the auction will not take place until the first half of 2026, while the budget process begins as early as 2025. Nevertheless, from 2030 onwards, visibility is expected to improve thanks to DP-4 auctions.

However, this change is taking place in a specific context: the current mechanism will end in March 2026, while the new mechanism will start in winter 2026–2027. During this period, the two systems will overlap, generating additional complexity for producers and consumers.

In this context, it is crucial for producers to develop an optimized strategy to manage risks and opportunities. And for consumers, it is important to closely monitor changes to the mechanism in order to anticipate price developments. HES team supports producers in the definition and implementation of their strategy, to transform these constraints into levers of value creation.

Lourdes Granados Mesa