Power demand is a major factor that influences the behavior of other commodity markets. In this article, we analyze the power demand trends over the past five years in five European countries: Spain, France, Italy, Germany, and the UK. Demand varies significantly across these countries, with northern countries exhibiting the highest levels of demand. To meet these demand requirements, each country employs a different mix of technology. This article contextualizes the production from renewable and fossil fuel technologies, examining the changes over time and current levels in relation to the contractual framework.

- From 2020 to 2025, major European markets exhibited clear winter-dominant electricity demand patterns.

- Despite the economic disruptions of 2020 and 2021, electricity demand has modestly recovered, though it has not yet exceeded pre-pandemic levels. This is attributed to efficiency improvements and electrification offsetting overall consumption growth.

- Southern markets, such as Spain and Italy, show significant summer demand, while northern markets, including France, Germany, and the UK, continue to be primarily driven by heating needs in the winter.

- The ongoing strong seasonal variations highlight the critical importance of balancing flexibility as the share of renewable energy in electricity generation increases.

Reality towards the energy needs in Europe is breaking with the expected growing trendline forecasted sometime ago in 2023 by the IEA. As already described in other articles, 2024 was expected to be higher than 2023, and in fact, it was. Though the growth was not the expected one.

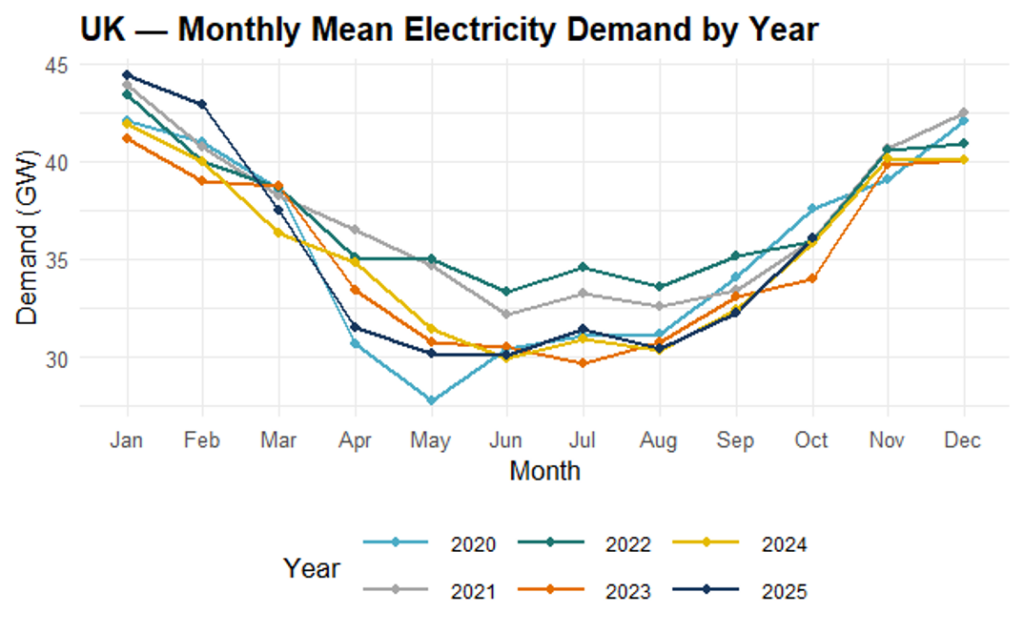

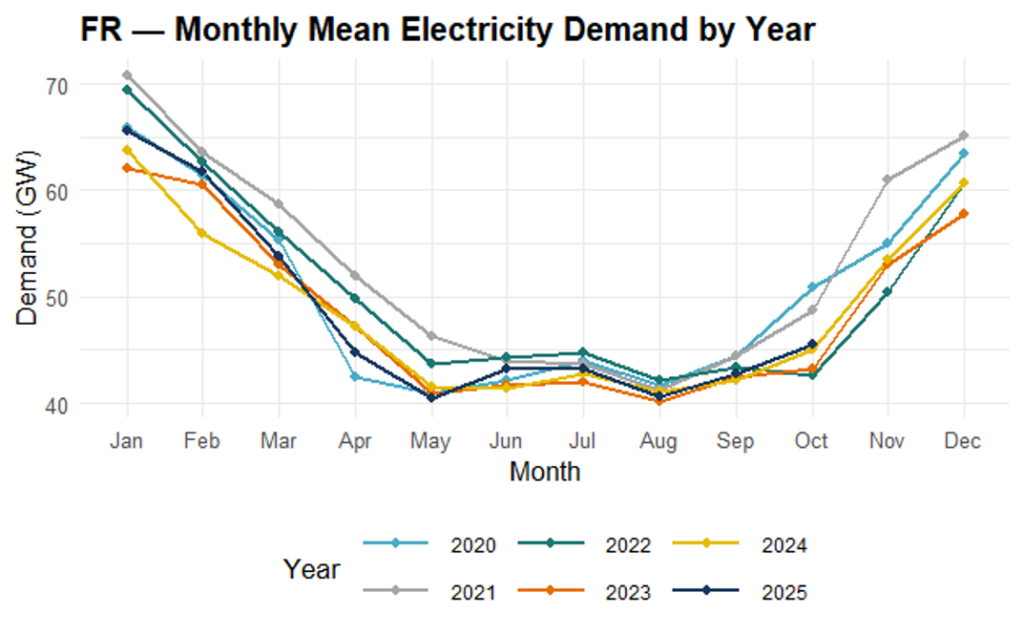

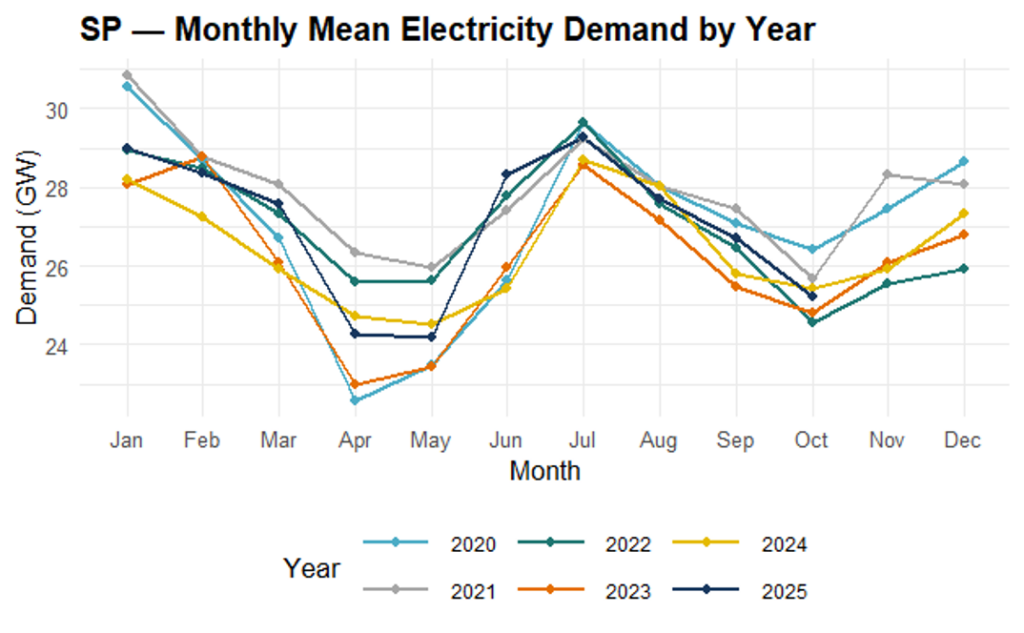

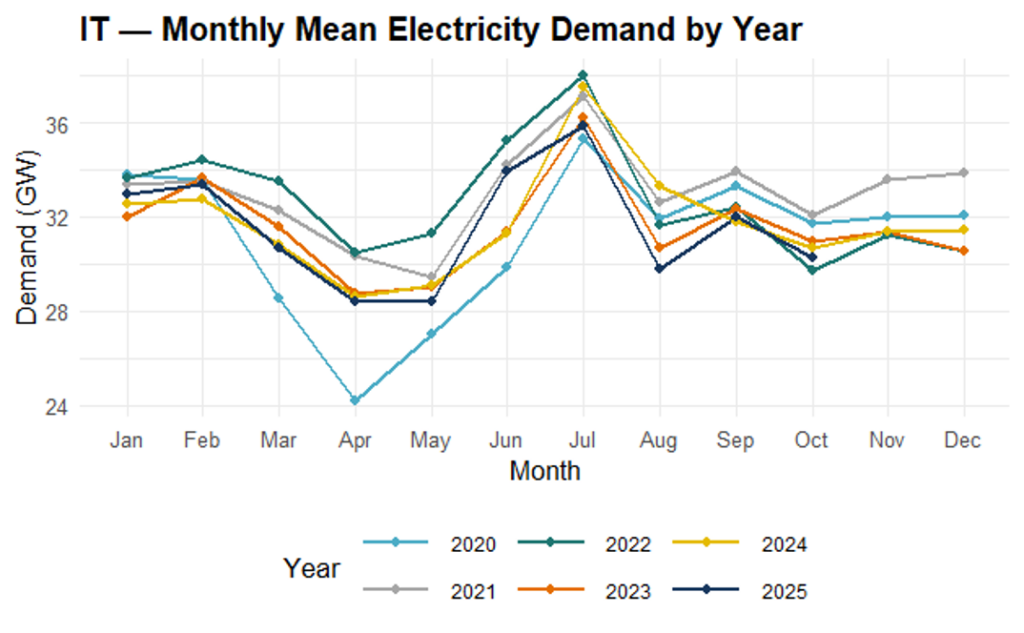

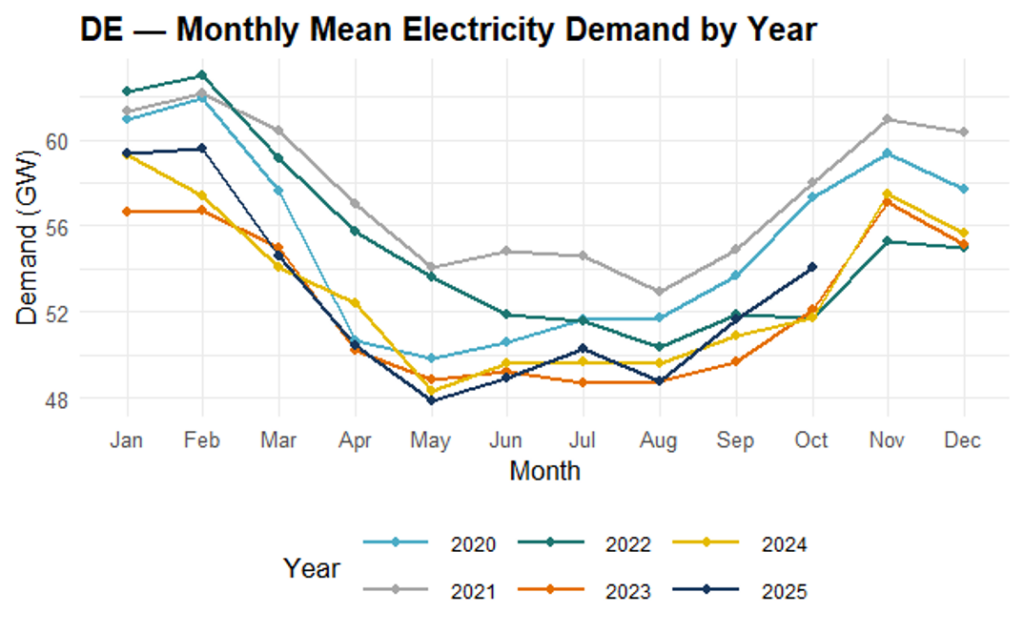

Below, the energy consumption has been analyzed and plotted to show the annual trends and their differences among each month. To describe a general context for all years:

2020–2021: During these years, all countries experienced a decrease in overall demand due to reduced industrial activity and mobility restrictions. It covers the COVID-19 pandemic period, with a contrast decrease in March 2020 for all countries, reducing power demand and lowering its levels with respect to 2021-2022.

2022–2023: Demand began to rebound, though it did not surpass pre-2020 levels. This lighter growth may be correlated with improvements in structural efficiency and ongoing efforts toward decarbonization in Europe.

2024–2025: A slight rise in energy demand suggests that transition policies and efficiency improvements are moderating consumption growth, but levels remain below 2021.

Data Sources used for the whole article: ENTSOE (IT, DE), Elexon (UK), Réseau de Transport d’Électricité (FR), Red Electrica de España (SP).

France demonstrates the highest levels of electricity demand, ranging from approximately 40 to 70 GW. This is largely due to its sizable electricity-intensive economy and the prevalence of electric heating. The demand peaks during winter months are especially pronounced, highlighting the temperature sensitivity of electricity consumption in the country. From 2020 to 2025, electricity demand has remained stable, with a slight decline, likely due to improvements in energy efficiency and possibly milder winter conditions.

Germany’s demand for electricity ranges from approximately 48 to 66 GW, which is slightly lower than France’s but exhibits a similar contrast between winter and summer. The demand curves for 2024 and 2025 indicate a slight recovery in consumption following 2023, when electricity usage was lower. The curve for Germany is smoother and less temperature-sensitive than France’s, reflecting its industrial base and a heating mix that is less affected by weather conditions.

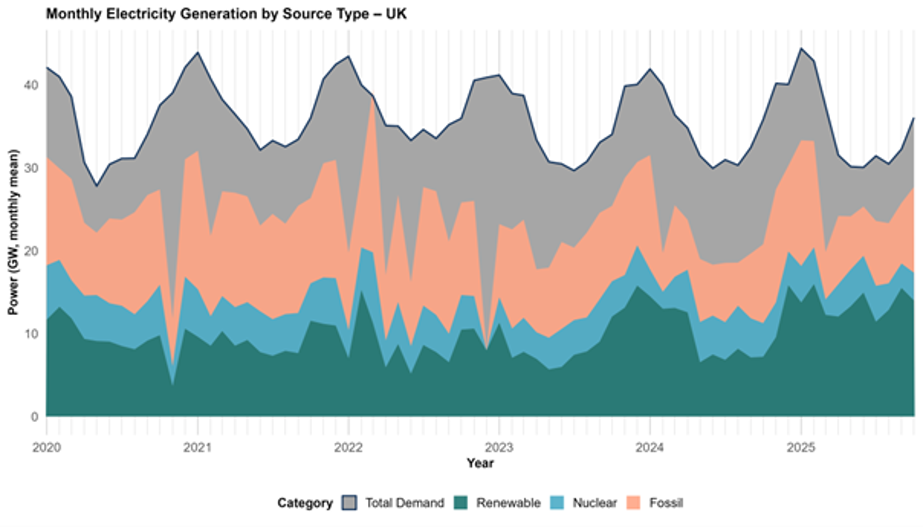

The demand pattern in the UK mirrors that of France and Germany but at a lower magnitud, ranging from 30 to 45 GW. The difference between winter and summer demand is smaller, showing less dependence on electric heating and more use of gas or other fuels in homes. The stability seen in recent years (2023–2025) indicates that growth in electrification, such as electric vehicles (EVs) and heat pumps, has not yet outpaced the improvements in efficiency.

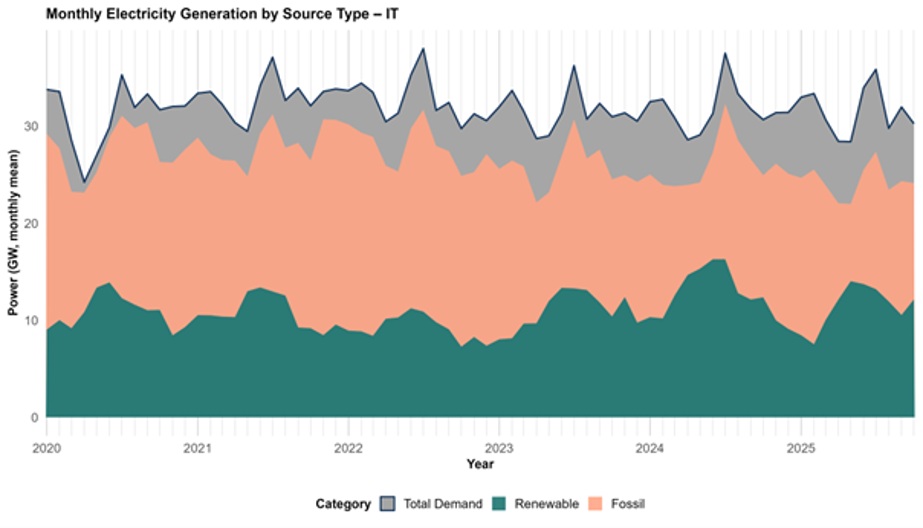

In Italy, the demand demonstrates a similar pattern but exhibits a slightly smaller difference between winter and summer, which aligns with the milder Mediterranean climate. There is a noticeable increase in demand during the summer months (June and July), likely due to air conditioning usage, contrasting with trends observed in northern Europe. In recent years, demand has remained relatively stable, showing no significant upward trend, which suggests limited demand growth despite economic recovery.

The electricity demand in Spain is similar to that of Italy, but at lower levels, ranging from approximately 24 to 32 GW. The spring minimum and summer rebound in demand are more pronounced, highlighting the influence of cooling needs during the warmer months. The dip in demand noted in 2020 is evident and aligns with the impact of the pandemic. Last, the recovered power demand after 2023 was higher for almost whole 2024 and for 2025.

What do the energy demand levels have in common among the five countries?

- Demand peaks in winter (January–February) due to heating and reduced daylight.

- A decline in spring, hitting a low in May–June with moderate temperatures and minimal heating or cooling needs.

- Demand levels off in summer in the northern countries, before rising again in autumn and winter (October–December) as heating requirements return. Different situation for Spain and Italy that shows a peak during the summer period due to the warm weather.

- This “U-shaped” curve is observed in UK, DE, FR every year, reflecting the strong influence of temperature and daylight on electricity consumption in Europe. A diverse shape of “W shaped” is found for Italy and Spain, reaching in July the highest for all years.

- Year-to-year fluctuations are modest compared to these seasonal changes.

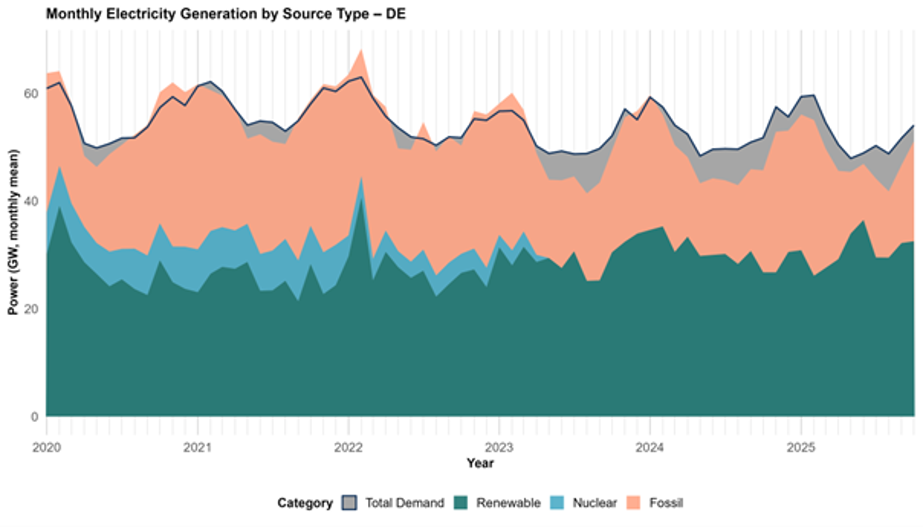

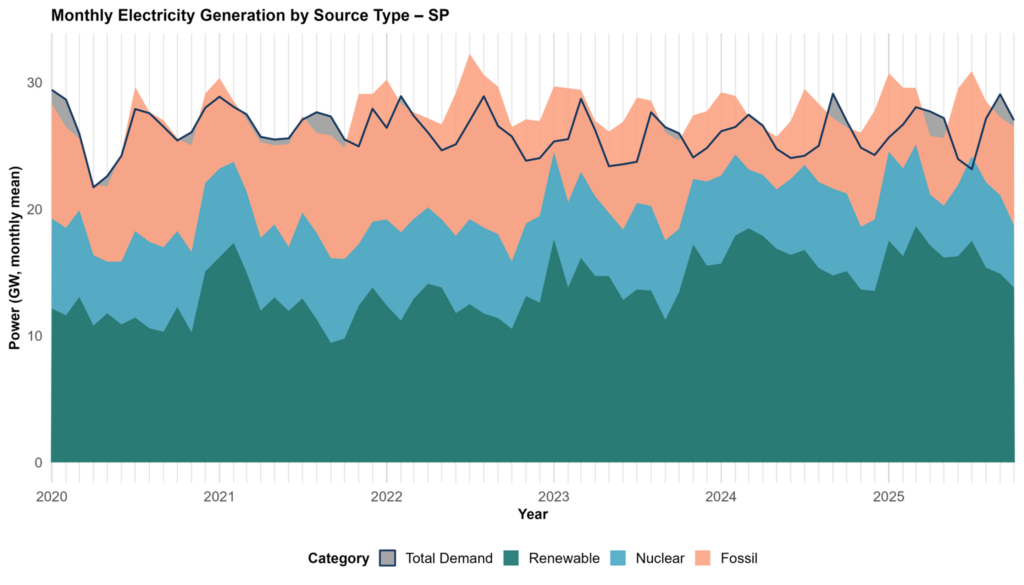

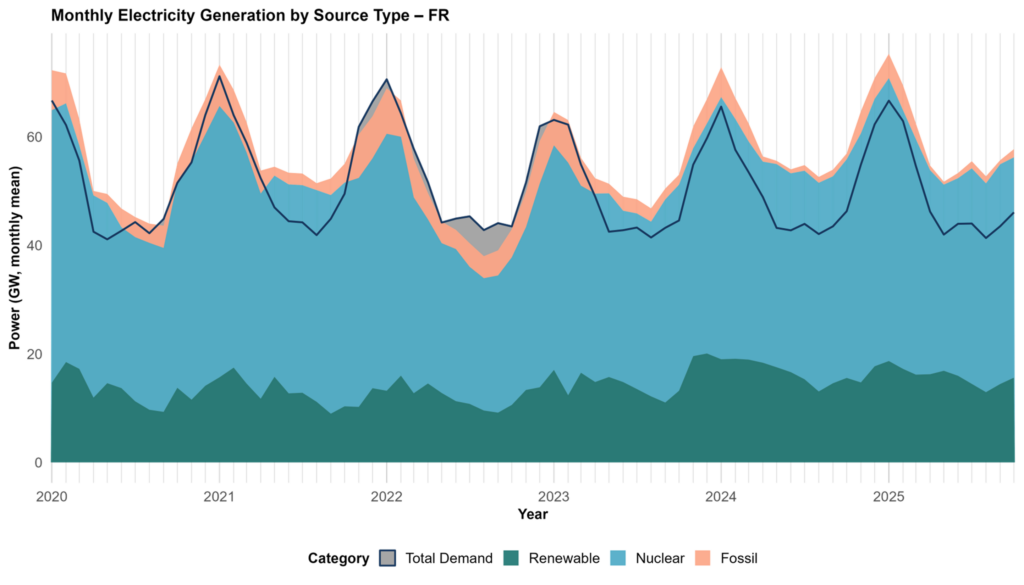

To continue with the analysis, we have segmented all generation sources into three main ones as renewable, fossil and nuclear. This is displayed for the same five countries to compare and check how the transition is moving.

Germany

Renewable energy sources are steadily expanding their contribution, effectively lowering carbon intensity while still not yet completely overshadowing the need for baseload power. Nuclear generation was shut down from the system in Germany (DE), but instead, fossil fuels continue to play a role in bridging seasonal energy demands. Coal power production was extended until 2038, this being the deadline for the phase-out of coal-fired power generation.

Spain

The composition in Spain (SP) illustrates a low-carbon energy system, whereas nuclear energy serves as a cornerstone, ensuring the grid remains stable and reliable, providing a steady foundation amidst fluctuations. Renewables, such as solar and wind, are ramping up to capture an increasing share of energy demand. They adeptly absorb some of the variability that fossil fuels once managed, showcasing their growing resilience and versatility. Fossil fuels are transitioning to a more supportive role; while still essential for short-term flexibility and backup energy, their overall significance diminishes as the system evolves. The nuclear phase-out deadline is set for 2035 in Spain, being the first plant planned to be decommissioned beginning of 2027. Currently, this is a politically discussed hot topic due to its potential repercussions on grid stability and baseload power production that needs to be provided, otherwise fully exposed to volatile renewable production and a lack of a capacity mechanism to support other fossil technologies.

France

France (FR) energy grid embodies an innovative system that seamlessly integrates renewable energy with nuclear power. This change not only underscores the accelerating momentum towards decarbonization but also highlights a greater diversity in energy generation sources, forging a path toward a more sustainable and resilient future. Renewable energy sources now set the pace for the grid, effortlessly fulfilling a majority of generation needs while shaping seasonal energy trends. Meanwhile, nuclear energy plays a critical role as a steadfast foundation, providing a reliable source of power during periods when renewable generation may wane. Note fossil fuel generation noticeable decline serving as a clear indicator of progress on the journey toward carbon neutrality. The energy mix in France is primarily based on a leading role of nuclear energy, which serves as a stabilizing force, while also showcasing promising growth in renewable technology as the hallmark of a resilient clean-energy mix.

UK

In UK a dynamic mid-transition power system that showcases the evolving landscape of energy sources. Renewables have emerged as the dominant force in this new paradigm, surpassing all other energy sources in volume. However, their inherent intermittency introduces significant volatility, creating challenges in maintaining a consistent energy supply. In contrast, nuclear energy acts as the steadfast backbone of this system; its predictability plays a crucial role in stabilizing the energy grid amidst the fluctuations presented by renewable resources. Fossil fuels, once the cornerstone of energy production, have now taken on a secondary role. Despite their diminished prominence, they remain essential for bridging the gaps when renewable sources fall short. Collectively, this energy mix exemplifies a power system in the late-transition phase, where renewables are spearheading growth, nuclear energy is ensuring stability, and fossil fuels are steadily being phased out.

Italy

The landscape in Italy (IT) continues to be heavily reliant on fossil fuels, underscoring the dominance of traditional energy sources. Fossil fuels remain the structural backbone, but their persistent dominance points to a system still early in its transition. Renewables are present and growing slowly, but not yet sufficient to challenge fossil predominance. This stage reveals a stark reality: progress in decarbonization remains limited, highlighting the ongoing challenges of moving toward a more sustainable energy future.

The portion of the demand being satisfied by non-dispatchable technologies is growing, and this is more noticeable in UK, Spain and Germany. The portion of demand supplied by dispatchable technologies is referred to as residual demand, which tends to be higher in Italy, due to its strong dependence on fossil fuels, and in France, when nuclear power is considered a dispatchable source. This part could be a potential topic for another newsletter, to discuss further possibilities for those fossil fuel technologies that will supply the leftovers of the residual demand.

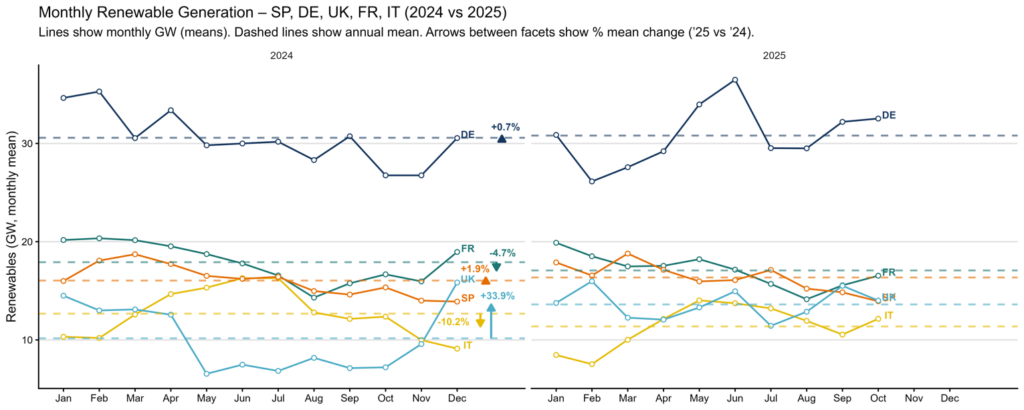

In 2024 and 2025, Europe’s largest economies — Germany, France, the UK, Spain, and Italy — showed mixed results in renewable energy generation.

In Germany, renewable output rose modestly, with generation gaining in May and June, helped by relatively wetter conditions towards the end of the spring, which eased hydrological stress. In France, renewables fell by 4.7% following a severe summer heatwave and drought that intensified in August, driving water-shortage restrictions and undermining hydropower performance. The UK bucked the trend with a roughly 33% increase in renewables, benefiting from strong wind conditions and a dry spring that, while challenging for hydro, boosted wind output and offshore deployment. Spain saw only a marginal uptick of around 2%, anchored by steady solar output but probably hampered by less wind generation. Italy suffered a steep decline of about 10%, as prolonged dryness and elevated heat in the Mediterranean region reduced hydropower availability and lowered solar yields in the hottest months.

Monthly data show that actual energy generation depends on conditions, making reliability and variability key concerns for renewables. Even year-to-year, renewable performance can vary greatly due to weather or asset issues, highlighting the importance of energy storage, grid flexibility, and diverse generation portfolios. In the context of the ongoing development of renewable energies, these trends are closely aligned with the latest EU regulations under the European Green Deal, which aim to:

- Achieve 42.5% renewable energy production by 2030.

- Enhance Europe’s energy production independence, accelerating clean energy transition and reducing dependence on fossil fuels.

Yet, there are a lot of changes to come during the next couple of years, since each member of the UE must materialize what has been described in the paper to accomplish each of these decarbonization objectives. The European power system is evolving toward an ambitious, cleaner and more variable generation mix. As the share of intermittent sources expands, managing residual demand and developing system flexibility become essential to maintaining grid stability and reliability, while advancing the EU’s long-term goals of decarbonization and energy independence. This comparison highlights Europe’s distinctive pathway —an early, coordinated decarbonization model emphasizing policy integration and energy autonomy.

Cheyenne Rueda Lagasse