As Europe intensifies its efforts to achieve energy independence and decarbonize its energy systems, biogas has emerged as a pivotal component of the renewable energy landscape. Derived from organic materials through anaerobic digestion, biogas offers a sustainable alternative to fossil fuels, contributing to waste reduction, greenhouse gas mitigation, and energy security. This article delves into the current state of European biomethane, its market dynamics, key technologies, country-specific developments, and the evolving support mechanisms shaping its future.

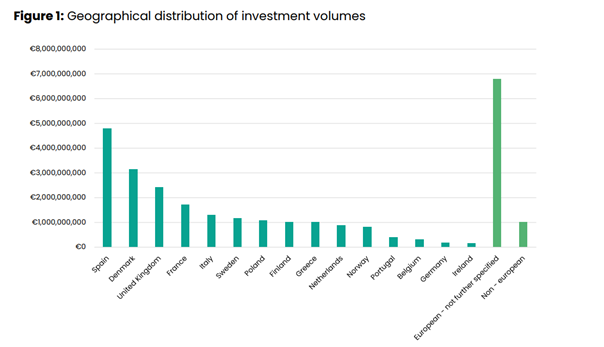

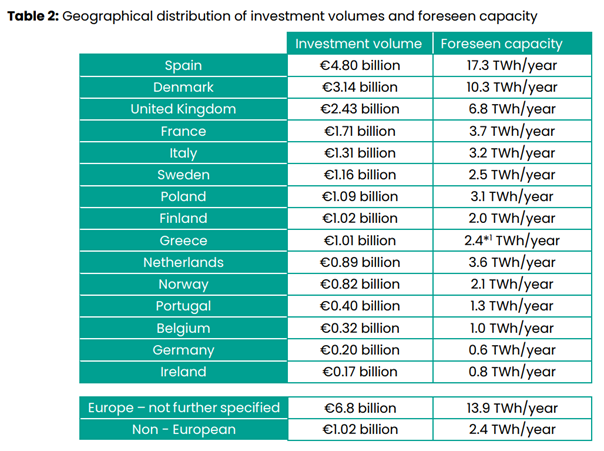

Source: EBA Biomethane Investment Outlook 2025

Source: EBA Biomethane Investment Outlook 2025

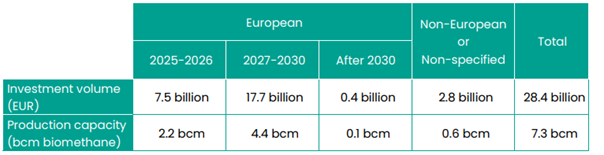

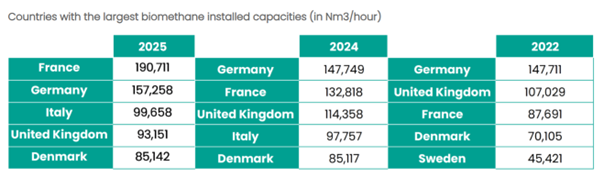

According to the European Biogas Association (EBA)’s 2025 , installed biomethane production capacity in Europe hit 7 billion cubic meters (bcm) annually by the end of Q1 2025, representing a 9% increase from 2024. Despite this growth, momentum is beginning to slow, highlighting an urgent need for clearer policy strategies and binding targets to sustain the sector’s expansion. The outlook identifies a robust industry commitment, with €28 billion allocated for investment in biomethane production (a €1 billion increase from last year), projected to deliver 7.3 bcm/year of biomethane capacity by 2030. The total number of biomethane plants in Europe also increased from 1,548 to 1,678 between 2024 and 2025, with 165 new plants becoming operational.

Key European Market Dynamics & Biogas Technologies

Europe’s biomethane market is shaped by ambitious goals and evolving regulations. Initiatives like target 35 bcm of biomethane by 2030, while Fuel III (REDIII) drive demand by mandating renewable fuels and promoting diverse, sustainable feedstocks.

Supply is driven by feedstock availability and conversion technology, with transport costs and yield being key considerations. On the demand side, ESG requirements and legislative changes like the phase-out of free emission rights under the EU Emissions Trading System (ETS) are significantly boosting biomethane’s appeal.

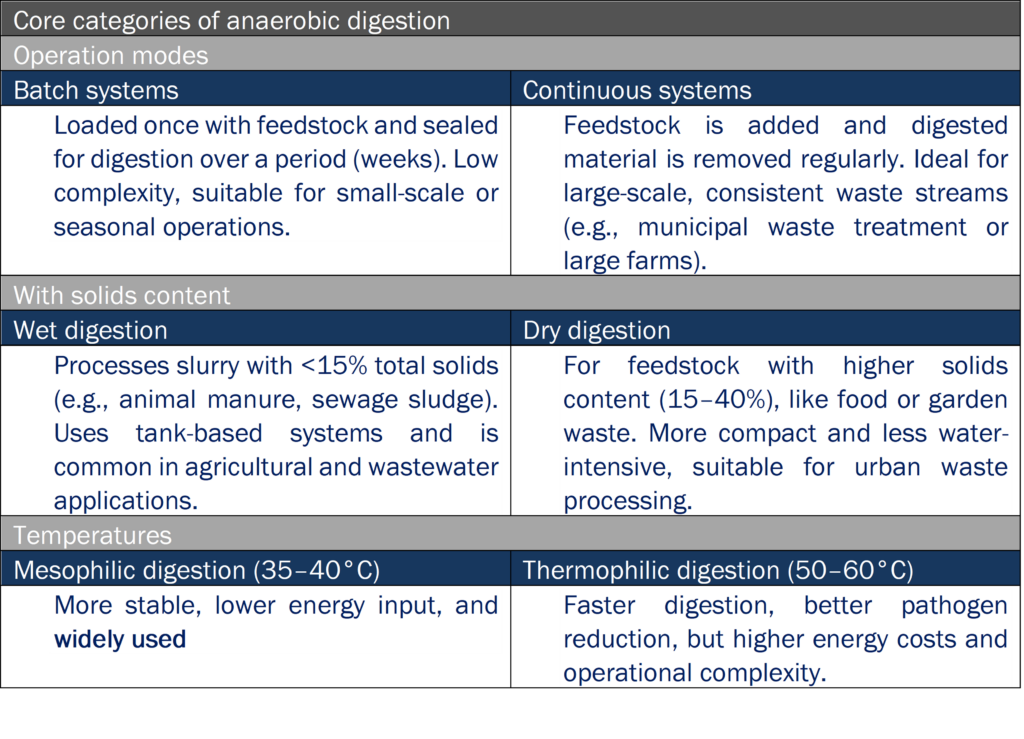

Biogas production is largely dependent on anaerobic digestion (AD) technologies. These systems vary in scale, complexity, and cost. Here are the main characteristics:

Hence, various designs exist regarding the digester of a biogas plant depending on the infrastructure available and the scale of the operation:

Cost Dynamics of Biomethane Production

The Levelized Cost of Energy (LCOE) for biomethane production globally typically ranges from €50 to €130 per MWh, influenced by feedstock type, plant scale, technology choice, geographical location, and pre-treatment needs. Beyond direct costs, biomethane delivers significant value through environmental attributes (like Guarantees of Origin or Proof of Sustainability), its role in waste management, production of bio-fertilizer, and enhancement of energy security and independence.

Country Focus: France, Spain, and Germany

France: A Leading Contributor

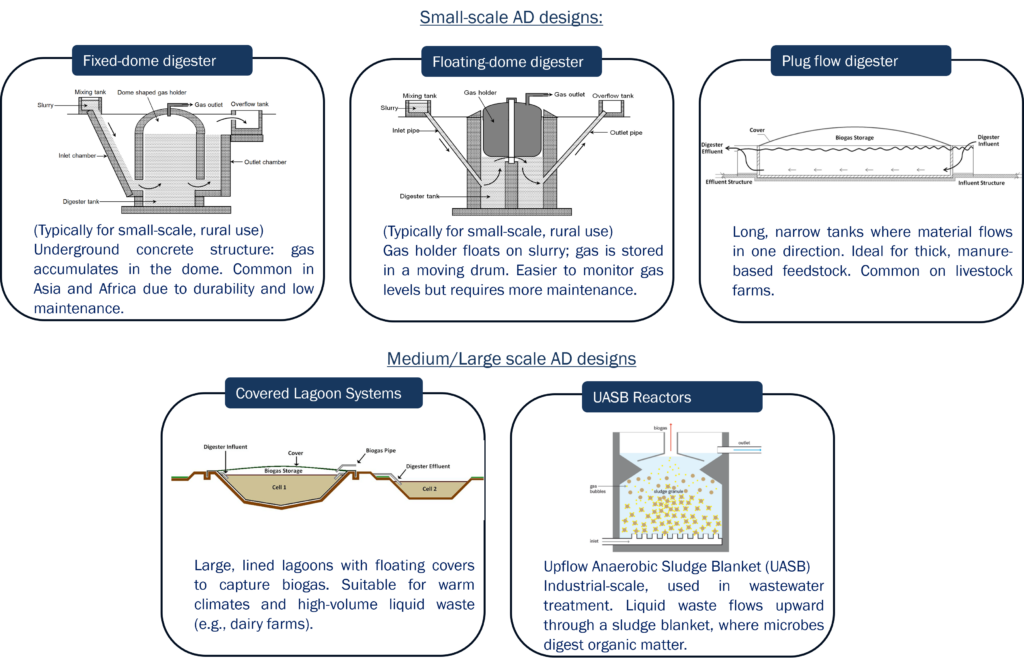

Source: EBA Webinar 25 June 2025 “Momentum matters: Mapping biomethane rollout and investment trends across Europe”

France now leads biomethane production in Europe, having overtaken Germany with a 21% higher production share and a threefold advantage in plant numbers. Despite this leadership in plant count, French installations maintain a smaller average size of 251 Nm³/h. The new French energy and climate strategy (PPE3) sets an ambitious goal of 44 TWh for injected biomethane by 2030. This growth is largely supported by public mechanisms, especially the “obligation d’achat” (feed-in-tariff) scheme, which provides a guaranteed purchase tariff. Additionally, the introduced “Certificats de Production de Biogaz (CPB)”, obliging gas suppliers to ensure a minimum proportion of biomethane, creating a new market incentive.

An audit by the French energy regulator, CRE, covering around 700 installations, provides crucial economic insights into the sector. The median Levelized Cost of Energy (LCOE) for French plants is approximately €130/MWh. This cost is higher for industrial installations (around €175/MWh) compared to agricultural ones (around €130/MWh), primarily due to higher operational expenditures.

Regarding costs, Investment Costs (CAPEX) declined by 6% annually from 2017 to 2021 before increasing by 11% in 2023 due to inflation. Operational Expenditures (OPEX) are also higher for industrial territorial plants (around €100/MWh) than for agricultural plants (around €70/MWh), with a 6% increase in 2023.

Project profitability, measured by the Internal Rate of Return (IRR), is generally healthy with a median of 13.9%. However, profitability varies significantly: agricultural autonomous installations show a median IRR of 15.4%, while agricultural territorial projects are at 11.2%, and industrial territorial plants are much lower at 4.5%. These differences have led the CRE to recommend adjusting support mechanisms to improve targeting and efficiency.

Spain: Emerging as a Biogas Powerhouse

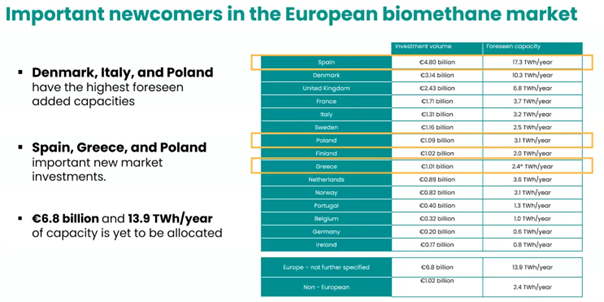

Recognized by the EBA for its high biomethane potential, Spain is rapidly increasing its focus on biogas, driven by national and EU renewable energy targets. Its abundant agricultural and organic waste resources position it for significant expansion. Spain is identified as a forerunner with the highest volume of planned investments, securing €4.8 billion for future projects, translating to 17.3 TWh/year of foreseen* capacity, and is highlighted for important new market investments.

Source: EBA Biomethane Investment Outlook 2025

Source: EBA Biomethane Investment Outlook 2025

Crucially, the transformation of this potential into actual operational plants in Spain is largely being de-risked through long-term commercial Biomethane Purchase Agreements (BPAs), rather than relying primarily on traditional feed-in tariffs. This approach suggests a market-driven strategy that could position Spain as a producing country primarily for biomethane export in the future, leveraging its considerable domestic resources to meet international demand.

Spanish regulators now tend to propose targeted subsidies and enhanced feed-in premiums, particularly for high-efficiency agricultural projects in underserved regions.

Germany: A Mature Market Leader

Germany is a long-standing leader in European biogas, with the largest installed capacity. Its mature market, initially boosted by strong feed-in tariffs, now focuses on upgrading biogas to biomethane for grid injection and transport. Germany’s extensive network of plants provides a robust foundation for continued growth and innovation, particularly in integrating biomethane into its energy mix.

Germany, a long-standing leader in European biogas production, has almost stagnated recently due to regulatory uncertainty. Its market is mature, having benefited from strong feed-in tariffs in earlier phases. While raw biogas production for electricity generation remains significant, there’s an increasing focus on upgrading biogas to biomethane for grid injection and transport. Germany has a foreseen* investment volume of €0.20 billion, leading to 0.6 TWh/year of foreseen* capacity.

Germany’s federal authorities are now reevaluating support schemes to address the aging plant fleet, promote repowering, and better incentivize sustainable feedstock use—especially in light of climate neutrality goals for 2045.

Geographical differences summary

| Key Category | Spain | Germany | France |

| Market Stage | Emerging biogas powerhouse | Mature, established market | Current EU leader in biomethane production |

| Foreseen Capacity | 17.3 TWh/year planned | 0.6 TWh/year planned | 3.7 TWh/year by 2030 (target) |

| Main Support Mechanism | BPAs (Biomethane Purchase Agreements) | Historical Feed-in Tariffs (EEG); future support under review | Feed-in Tariff (“Obligation d’Achat”) + Biogas Production Certificates (CPB) |

| Strategic Direction | Biomethane export hub leveraging domestic resources | Modernization + repowering of aging fleet for net-zero by 2045 | Domestic growth to meet 2030 targets with state-driven support |

Evolving Support Mechanisms and Future Outlook

Source: EBA Webinar 25 June 2025 “Momentum matters: Mapping biomethane rollout and investment trends across Europe”

Across Europe, regulatory support is shifting from traditional subsidies to tendering systems. Countries are implementing biomethane quotas for energy suppliers and promoting it as a transport fuel through tax exemptions. The recognition of biomethane in the EU Emissions Trading Scheme (ETS) also fosters Biomethane Purchase Agreements (BPAs). Spain, Denmark, and the UK are leading in planned investment volumes, while Denmark, Italy, and Poland have the highest foreseen* added capacities, and Spain, Greece (€1.01 billion investment, 2.4 TWh/year capacity), and Poland (€1.09 billion investment, 3.1 TWh/year capacity) are identified for important new market investments.

Despite challenges posed by energy crises and inflation, Europe’s biomethane sector demonstrates remarkable resilience and growth. Ongoing efforts to refine support, diversify feedstocks, and explore new valorisation pathways signal a dynamic future. The collective commitment from industry, policymakers, and researchers is crucial to realizing the full potential of this vital renewable energy source.

Comparing Biomethane with Natural Gas

While biomethane offers significant environmental and energy security benefits, it currently operates at a cost disadvantage compared to fossil-based natural gas. As of early 2025, the average wholesale price of natural gas in Europe ranges between €25 and €45 per MWh, fluctuating due to geopolitical and seasonal factors. This is substantially lower than the LCOE for biomethane, which ranges from €50 to €130 per MWh depending on the country, feedstock, and plant type.

In terms of sheer scale, Europe’s biomethane production capacity reached 7 billion m³ (bcm) annually by Q1 2025. That stands in sharp contrast to the EU’s total natural gas consumption, which was approximately 332 bcm in 2024: biomethane constitutes just over 2% of the EU’s gas use.

Despite its current cost premium, biomethane delivers superior climate value, supports local economies, and enhances supply resilience—particularly important in a post-Russian gas supply context. Moreover, with carbon pricing tightening under the EU Emissions Trading System (ETS), and the growing value of sustainability attributes (e.g., Guarantees of Origin), the economic gap between biomethane and natural gas is expected to narrow in the coming years.

* “foreseen capacity” is the expected annual biomethane production (in TWh/year) resulting from currently planned or committed investments.

Lourdes Granados Mesa & Thibault Uhl

(Last update October 2025)