The end of 2025 will mark an important change for all electricity consumers in France: the end of nuclear supply at the unbeatable rate of €42/MWh (named the ARENH mechanism). The 2025 Finances Act defines the “post-ARENH” schemes. EDF, the French nuclear energy supplier, will now be free to decide on a strategy for the sale of its nuclear electricity, although the hasty replacement of the CEO of EDF removes certain degrees of freedom…

In this article, we will analyse the consequences of the end of the ARENH mechanism and the options available to French consumers for electricity supply by 2026.

When and why was the mechanism created?

The ARENH (which in French means “regulated access to historic nuclear energy”) was created in 2011 in the context of the opening of the electricity market to competition. The law that provided a framework for this opening-up had the main objective of enabling all consumers to benefit from the competitiveness of the French nuclear fleet. Before the ARENH, EDF was the main electricity supplier, covering 95% of the French territory (the rest being covered by local distribution companies). Under the ARENH, so-called alternative suppliers (i.e. other than EDF) obtained access to a regulated price (€42/MWh) for the electricity produced by EDF’s historic nuclear fleet within a volume limit of 100 TWh per year. This is equivalent to almost a third (27.64%) of 2024 French nuclear production (361.7 TWh).

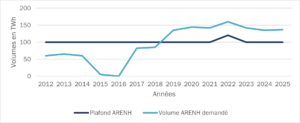

Evolution of the volume of ARENH requested by suppliers – Source: CRE

As the graph shows, the inflection point took place between 2018 and 2019. Before this date, the volume of ARENH requested was below the ARENH limit.

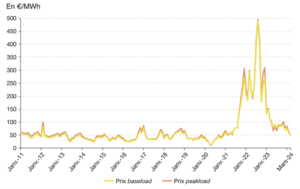

Average monthly price on the European Power Exchange (Epex) Spot France market 2011-2024 – Source: Epex spot

This change can be explained by the increase in electricity prices on the wholesale markets that loomed in 2017 and the rise in the number of alternative suppliers seeking to benefit from ARENH to offer competitive tariffs.

End of the ARENH mechanism on 31 December 2025

The ARENH mechanism was slated to last until December 31, 2025. Despite the approach of the end date and the need to start sourcing for contracts for 2026 and beyond, it was only in November 2023 that the French government and EDF announced an agreement on the regulation of nuclear sale prices in the form of long-term contracts; “CAPN” (which we will mention in more detail later in the article).

Then, in February of this year, the 2025 Finances Bill and article 17, which provides a framework for the regulation of nuclear production and sales, definitively signalled the demise of the ARENH. Thus, what is commonly known as the “post-ARENH” system (but which has nothing to do with this mechanism) will come into force on the 1st of January 2026 and is based on two pillars.

The first is the creation of a “tax on the use of nuclear fuel for the production of electricity“; levied by the State on EDF when revenues exceed certain thresholds (50% above the “taxation threshold” and 90% above the “capping threshold”). The second, a “universal nuclear payment”, which will be collected and redistributed to end consumers. In essence, it is a sort of cap on the selling price of electricity produced by French nuclear power plants. The redistribution can be modulated according to the consumption profile and will be calculated each year based on CRE (French energy regulatory commission) forecasts. However, some grey areas remain, as the thresholds have yet to be validated (the law only indicates ranges) and the redistribution to be specified.

The taxation threshold is defined by the full cost plus €5 to €25/MWh. According to the CRE, the full cost of nuclear power is estimated at €60.7/MWh for the period 2026-2030. Thus, for this period, the tax threshold is between €65.7 and €85.7/MWh. Today, since the price of electricity below the level of taxation, the mechanism does not apply. (The forward price as of 28/03/2025 is €61.9/MWh).

Is EDF free to decide on its sales strategy?

EDF has offered different commercial strategies to adapt to the evolution of the nuclear market. These strategies have evolved over time. Here is a summary of EDF’s main commercial approaches:

- Market contracts with a 4 – 5-year horizon, open to all market players.

- Industrial partnership contracts backed by the nuclear fleet, the “CAPN”.

- Medium-term supply contracts with its own customers based on market price references, in addition to standard market offers and regulated tariffs whose price is set by the public authorities.

- Simplified nuclear contracts (name “CNS”) built on the model of the CAPN for the electro-sensitive industrial sector – under development

“CAPN” (which means in French nuclear production allocation contracts) are contracts that allow partners to benefit from a share of the effective production of the nuclear fleet in exchange for sharing the associated costs and risks. They are established over a long period of 10 to 15 years, are designed to reduce exposure to price volatility, and their cost is close to the production costs of the nuclear fleet.

Initially, these contracts were reserved for electro-intensive consumers, but at the beginning of March, EDF announced the expansion of the scope with the opening of a call for tenders and included industrial companies that consume less electricity (more than 7 GWh/year) and alternative suppliers. Associations representing electro-intensive consumers immediately expressed their anger! (« EDF ne doit pas tourner le dos à l’industrie française », Uniden, 7th March 2025). This precipitated the fall of EDF CEO Luc Rémont. Under the CAPN scheme, EDF plans to make an annual volume of 1,800 MW of electricity, or approximately 10 TWh, available, with deliveries set to begin on 1 January 2026. For the time being, the use of these offers remains limited because the prices offered for CAPN contracts are considered too high compared to the current prices of the forward market.

The marketing of nuclear electricity at a free price has not been as successful as expected, and the electro-intensive companies are hoping that the new CEO of EDF, Bernard Fontana, will come up with attractive proposals for a nuclear electricity supply at the best price.

Future of nuclear power made in France

The aim of this commercial strategy by France’s historic nuclear power producer is to generate significant economic benefits and finance heavy investments for the maintenance of the existing fleet and the construction of new EPR2 reactors. In mid-March, the French Nuclear Policy Council gave a progress report on the implementation of the “EPR2” programme, which aims to build 6 new high-power reactors, available for energy production by 2038 (for more details on EPR technology, see the article “Is nuclear energy finally green?”). The financing plan is based on a state loan covering at least half of the construction costs and a contract for a difference on nuclear production at a maximum price of €100/MWh. Negotiations with the European Commission are due to begin shortly to validate the project. The French nuclear fleet is getting a facelift! Let’s hope that the lesson taught by the Flamanville EPR has been learned to avoid an additional cost 5 times higher than the initial cost and a 12-year delay in commissioning.

What other electricity supply solutions for consumers by 2026?

On the horizon, several electricity supply solutions will emerge for consumers, particularly in France, following the end of the ARENH mechanism. Here is an overview of the main electricity supply options:

- Medium- and long-term renewable contracts (PPA). For medium-term hedging needs (2-3 years), brownfield projects (converting existing assets or projects to exit a regulated tariff) are particularly suitable. On the other hand, for long-term hedging needs (10-20 years), greenfield projects (new projects) offer the price stability necessary to secure supply over the long term. The volume, whether fixed or intermittent, must be negotiated with the off-taker according to the specific features of the project. These are complex contracts that require the support of experts to assess the risks.

- Self-consumption solutions (with energy storage). Companies will be able to turn to self-consumption energy solutions, such as on-site solar panels, complemented by storage systems (batteries) to optimize their energy management in the long term.

- Structured products adjustable to the consumer profile. Some market players offer structured products, adjustable according to the consumption profile, which provides greater control over exposure to the spot market. These offers, which vary in terms of price and volume, require an in-depth analysis to ensure their relevance to the specific needs of consumers.

- Wholesale electricity market. Consumers above a certain size can position themselves in future markets. This requires a flexible and well-structured supply contract, as well as a hedging policy to limit the risks associated with price volatility.

- Flexibility contracts. Flexibility contracts allow consumers to reduce or shift their demand during periods of high consumption or high prices. These solutions are particularly suitable for large companies that can adjust their consumption according to market signals.

In conclusion, the end of the ARENH scheme makes us realize just how protective this mechanism was and how it gave consumers access to a supply with a share at a fixed price. For 2026 and beyond, there are various solutions available to consumers to secure their supply. At Haya Energy Solutions, we recommend studying the different offers to optimise the supply contract and asses the risks. And we can support you every step of the way. On EDF’s side, strategic policy must meet several challenges: defending French industry and, at the same time, EDF and accelerating and ensuring the EPR2 programme, while respecting European competition rules. The post-Arenh soap opera is not over, new twists and turns are to be expected.

Céline Haya Sauvage & Lourdes Granados Mesa