Since the start of 2025, Europe’s gas markets have experienced significant pressures, with supply and demand remaining delicately balanced. Prices have risen compared to the previous year, driven by geopolitical tensions in the Middle East and Russia, supply disruptions, low storage levels, a constrained balance between LNG supply and demand, and variations in temperature. Nevertheless, it is anticipated that prices may stabilize in the medium term as new LNG projects are developed and Europe continues to diversify its supply sources.

Gas demand has diminished during periods of peak renewable energy generation, and any advancements in the resolution of the Russia-Ukraine conflict could contribute to a reduction in prices. Countries such as Australia and Qatar are projected to increase their LNG exports, while the United States has established itself as a prominent player in the gas market due to its substantial LNG export capacity and low domestic gas prices. This development is expected to alleviate the restrictions implemented by Europe regarding the importation of Russian pipeline gas.

Let’s take a closer look at the gas outlook:

• What is the status of the market at the end of winter.

• Trends influencing the coming months.

• Updates on the ongoing tensions impacting supply and prices.

Low gas storage levels at the end of winter

According to HES pre-winter analysis (Winter perspectives and energy supply security, October 2024), gas storage levels in Europe were comfortable at 94.37% on the 30th of September. It should be reminded that since the start of the Russian invasion, the minimum level of gas storages was raised from 80% to 90% on the 1st of November in the EU mandate. This measure needs to be implemented each year by each country to be prepared for the high-demand months inside the gas winter.

At the end of February 2025, natural gas stocks decreased to below 40% for most European countries. The gas storage levels had fallen considerably if compared to the same date on 2024 (see table 1)

Table 1: Gas storage levels, 04/03/2025 – Source: GIE (Gas Infrastructure Europe)

Levels are low compared with previous years in a context of cold temperatures, industrial recovery (lower than pre-crisis level) and strong demand. In France, for example, the winter of 2024/2025 has been the coldest in 7 years. What’s more, the phenomenon of “Dunkelflaute” (German term for a period of low sunshine and wind that causes renewable electricity production to fall) is becoming more frequent in winter all over Europe, which favours gas-fired power generation. In addition, European gas demand saw a strong 7% year-on-year increase in Q4 2024 due to:

- Gas-fired electricity generation surged during the last quarter to compensate for low wind and hydro power generation, but the long-term trend points to decreasing gas demand in this sector due to renewable energy growth and nuclear availability. Short term gas spikes will normally occur due to cooler weather periods.

- Modest, fragile rebound in industrial gas demand continued, but it remains well below pre-crisis levels, hindered by weak manufacturing output and economic uncertainties.

- Colder temperatures in Q4 led to a slight increase in gas demand for heating, but consumer energy-saving habits persist.

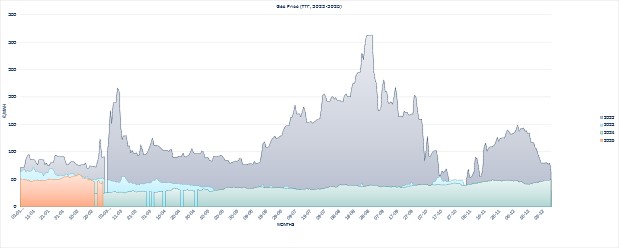

Over the past six months, TTF spot gas prices have risen by 18.49%. Day-ahead contracts on the Dutch TTF reached 55.90 €/MWh on 10 February.

Gas Day-ahead contracts TTF, 01/2022 – 02/2025 – Source: HES

Tensions in the gas supply

Table 1: Gas storage levels, 04/03/2025 – Source: GIE (Gas Infrastructure Europe)

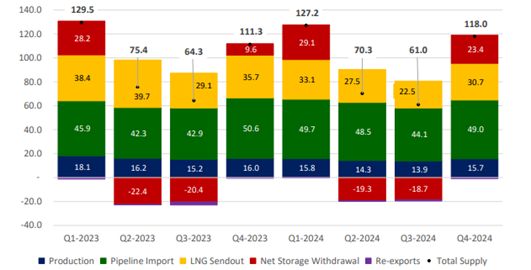

The pipeline imports were the major gas source into Europe in 2024. Norway remained the main pipeline gas supplier to the UE, accounting for 42% of the inflows, second positioned is Russia 18% and Argelia 16%.

The share in total volume of gas coming from Russia decreased from 40% to 9% (2021 & 2023) but Russian natural gas imports increased to 18% in 2024. The EU remains a big customer of Russian natural gas and LNG; in October’24 the EU bought 49% of Russia’s LNG exports and 50% of all its pipeline gas exports.

At the beginning of 2025, the end of the Gazprom-Naftogaz gas transit deal brought higher uncertainty to the gas market in Europe. This meant less gas supply coming to Europe, leaving the TurkStream line as the only route for Russian gas importation into Europe. In addition, the war between Russia and Ukraine is continuing. The latest news is about renewed contacts between Russian and US officials which were shown during February 2025 are towards the potential of a deal to bring a stop to the war, but yet excluding the Ukrainian side. There were further talks during the beginning of March’25 to explore economic and investment opportunities between Ukraine and the US that could bring an end to the war and find “peace” throughout a deal with Russia.

Since the beginning of Russia’s full-scale war against Ukraine, Europe has added 78.6 bcm of new LNG regasification capacity, expecting a strong transition into LNG import, out of which the EU has added 70.9 bcm. However, the average utilisation rate of the EU’s terminals fell from 58% in 2023 to 42% in 2024, and some projects are being stalled or cancelled. The main EU LNG importers were USA (45%), followed by Russia (19%), Qatar (12%), and Algeria (8%).

The United States is urging the European Union to buy more American LNG and has threatened tariffs if demands are not met. In response, Brussels has sent envoys to Washington to discuss an LNG deal, despite still sourcing some LNG from Russia.

In global terms, in 2024, the Asia-Pacific region (key driver of LNG demand) accounted for almost 45% of the additional growth in gas consumption, driven by continuing economic expansion. Meanwhile China demand outpaced moderate economic growth, Japan demand declined as more nuclear plants restarted. This competition for LNG demand has had an impact on prices, which are international and dependent on the appetite for gas in other parts of the world.

Europe stands to benefit from transformations in global markets. An expected ban by the European Union on the importation of Russian liquefied natural gas (LNG) may result in a decrease in gas prices, given that supplies could be redirected to Asian markets, thereby reducing competition from U.S. LNG. While the supply and demand dynamics for LNG are projected to remain tight in 2025, a surplus is likely to develop by late 2025 or early 2026.

The hope towards more stable gas prices is related to the increase of LNG coming to Europe from the US and Qatar, which the latest is expected to increase by 60% through 2030. In addition, Brussels plans to pursue a different strategy by engaging reliable suppliers to find cost-competitive imports from current and future LNG export projects. The EU also aims to help buyers secure long-term contracts to make energy more affordable.

In parallel, the geopolitical tensions in the Middle East continue impacting global energy developments due to the crucial role of the region in oil and gas production, thus jeopardizing Qatar LNG exports to Europe. If the conflict extends again into the Persian Gulf, it could affect the flow of LNG shipments coming to Europe from Qatar. The traffic through the Gulf is estimated to make up around 20% of the global gas exports.

The long-term implications of the conflicts in the Middle East are still uncertain and are likely to be influenced by the ongoing dynamics of these conflicts as well as the broader geopolitical context of the region. As nations strive to navigate this intricate environment, the relationship between political developments and global oil prices will remain a crucial factor in shaping gas prices.

The main consequence of the combined situation just described results in a higher risk exposure of Europe global LNG price pressure, since LNG imports are and will be needed to fulfill the demand in the short and medium term.

Is the situation under control for the coming months?

Levers that will have an impact on the security of gas supply in the short term:

To conclude, tensions and uncertainties remain in the medium term for European gas markets prospects, and even minor unforeseen disruptions on the supply side, such as LNG shipments shifting to Asia, or on the demand side, like an exceptionally cold end to winter, or an increase in gas consumption for power generation due to reduced renewables could trigger significant price spikes. This first semester is likely to be another period of high gas price volatility as we have seen during January and February’25 already.

While some countries are relaxing fuel stockpiling rules to ease pressure, a buffer will still be needed for next winter. Also, restoring Russian gas supplies remains uncertain. Though US President Trump’s push for a swift end to the Ukraine war has affected prices, lasting peace looks unlikely soon.

European gas reserves are still under 45% full, and the region faces a pressing need to re-fill storage ahead of the next winter season. Even with warmer temperatures and a surge in LNG imports, supply conditions are expected to remain tight until new LNG projects come online.

Gas remains crucial for energy security in Europe, providing flexible electricity generation to complement renewables.

Céline Haya Sauvage & Cheyenne Rueda Lagasse