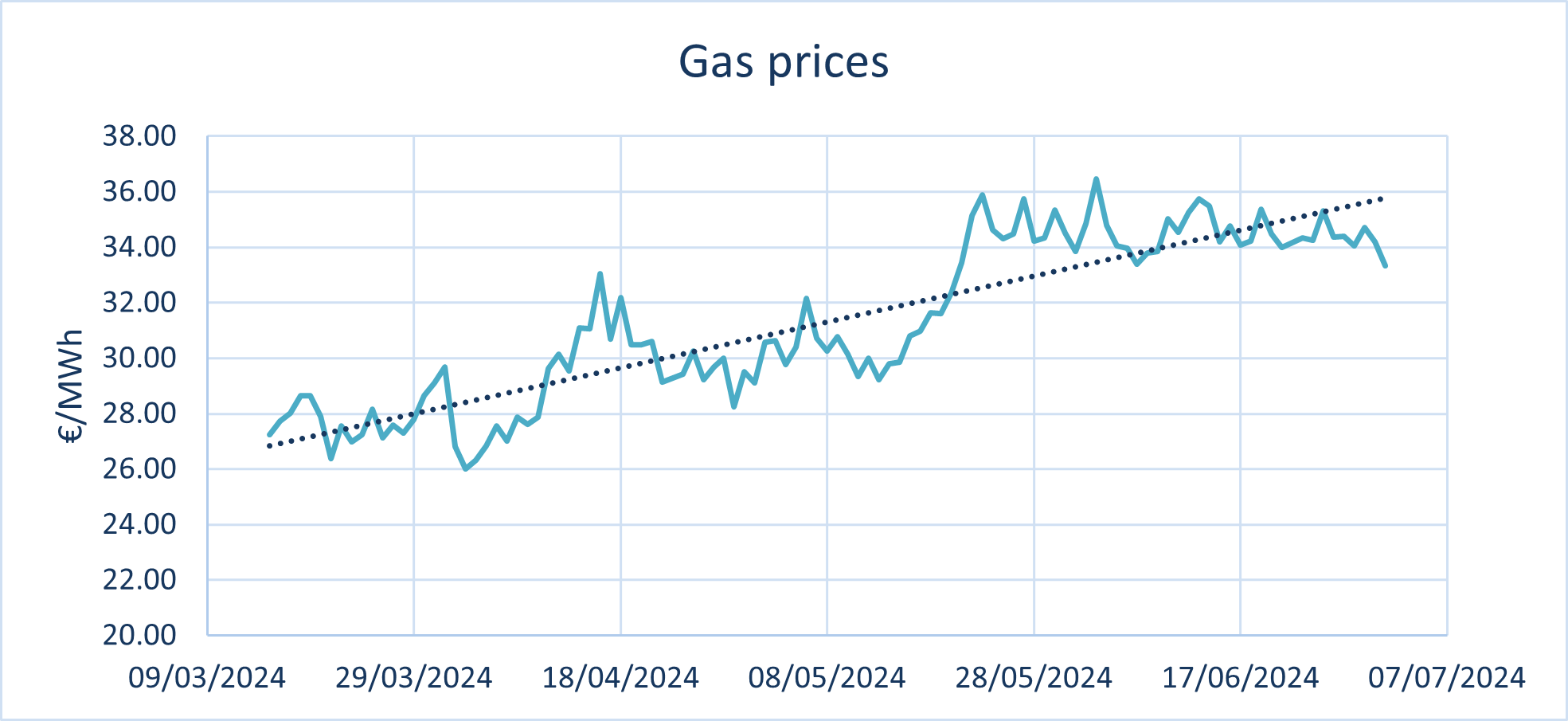

Currently, the gas market in Spain changed its decreasing trend in gas prices experienced at the end of 2023 and began to increase again after February 2024. This rise in gas prices can be attributed to several interconnected factors:

- The economic recovery after COVID-19 has resulted in higher energy demand due to increased industrial activity and consumer spending.

- The disruptions in supply chains due to geopolitical tensions or logistical issues, and stricter environmental regulations increase production costs.

- The global transition to renewable energy may affect gas infrastructure investments and supply.

Figure 1. Gas prices (Day ahead prices) – Haya Energy Solutions

However, by the beginning of summer, Spanish underground storage was filled, nearly to 98%, with over 35,000 gigawatt-hours (GWh) of gas. It is expected that storage will be full by August.

- High storage levels are likely to stabilize or potentially reduce gas prices, as having ample reserves lowers the risk of supply shortages and sharp price increases.

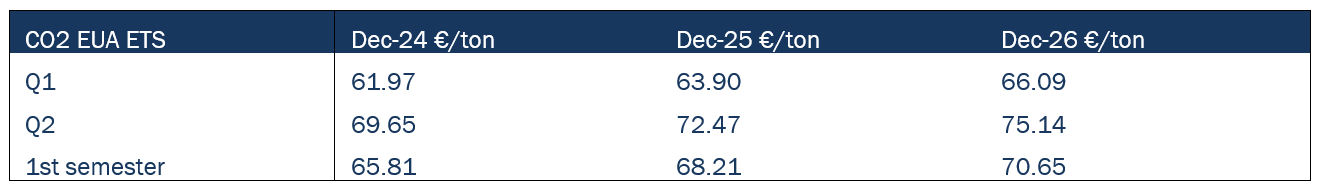

The price of CO₂ EUA ETS impacts electricity prices primarily by affecting the operating costs of fossil fuel power plants. Higher CO₂ prices increase the cost of burning fossil fuels, which can lead to higher electricity prices. Additionally, higher CO₂ prices make renewable energy sources more competitive, potentially shifting the market dynamics and influencing overall electricity costs.

- As a fossil fuel, natural gas emits CO₂ when burned, so fluctuations in CO₂ prices directly impact the operating costs of natural gas. The average prices of CO2 for December ‘24, ‘25 and ’26 are shown in the following table:

Figure 2. EUA CO₂ ETS Prices

In Q2 prices were higher than in Q1, due to expectations of shortages, fulfilment of obligations established by UE, higher anticipated demand, market speculation, and seasonal adjustments. Moreover, implementing ETS (Emissions Trading System) in the maritime sector may also cause an increase in CO2 prices.

The Royal Decree 203/2024, effective from February 28, 2024, regulates the free allocation of CO2 emission rights for 2026-2030, imposing stricter conditions for energy efficiency and emission reduction. Installations that do not comply with efficiency recommendations may see their free allocations reduced by 20%, which could increase operational costs and consequently electricity prices.

Seems as this regulation will be in at sooner rather than later in 2026, involving the urgent need for CO2 EUA ETS allocation just in time.

Cheyenne Rueda Lagasse