Key information on PPAs

Index

What is a PPA?

A PPAS (Power Purchase Agreements) , or renewable PPAS, is a long-term contract between a producer and a consumer, or between a consumer and an energy trader.

This agreement defines the power purchase price and the conditions for volume delivery.

At Haya Energy Solutions, our PPA experts advise companies throughout all phases of the contract — from technical and economic analysis to negotiation and risk management.

Types of PPAS

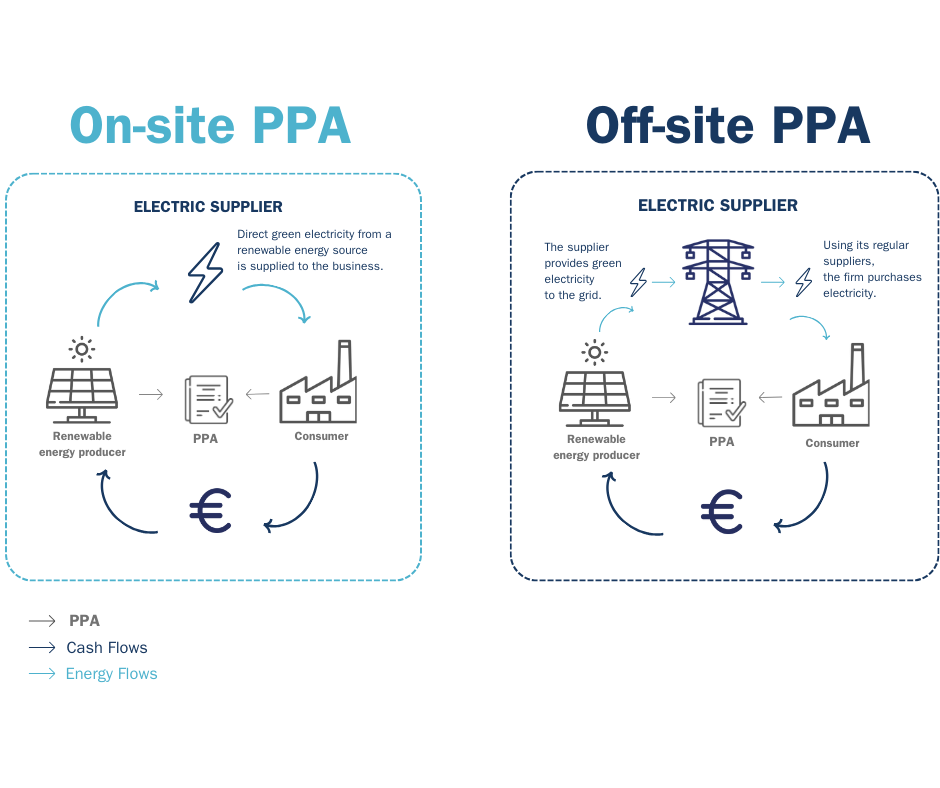

On-site PPA

An on-site PPA is a contract for the supply of electricity from an ad hoc renewable plant located on the customer’s property and connected to its internal network. The renewable developer makes the investment and designs, installs, operates and maintains the plant. Afterwards, the developer sells the produced energy to the customer.

Off-site PPA

An off-site PPA is a contract associated with a renewable plant, which is connected to the transmission or distribution network of a country to take energy from its point of origin to the consumption point.

Based on how the energy is delivered

Physical PPAS

Basic content of the PPA contract: this includes how much energy is supplied, duration of the contract, price, measure and point of delivery of the energy and the guarantees established for cases of non-payment risk, regulatory changes, potential price review formulae, penalties regime and contract termination regime. Deviations must also be regularized.

Financial PPAS

Financial PPAs are Contracts for Differences (CfDs) settlements, with a fundamentally financial content. The main content focuses on settlements and how these are made; also, what to do if there are any discrepancies. Normally, they do not focus on a specific installation, or physical or regulatory aspects of the electrical system. However, as they are linked to the state of the electricity market, it is necessary to establish a clause for any potential change of law and resulting causes and consequences of early resolution.

Based on how much energy is delivered

Baseload PPA

The customer consumes the gross generation from the plant. This is the most competitive product when it comes to price; however, it is also the riskiest product for the customer as generation from renewable sources is not predictable.

As-generated PPA

The renewable developer converts the gross generation from the plant into a baseload product. This is the most common product among customers, as there is an interesting balance between cost and risk. However, not all developers are able to offer this type of PPA

As-consumed PPA

The renewable developer converts the gross generation into a curve which faithfully mirrors the customer consumption curve. This is the most common product among non-expert customers as this is the product in which the developer gives most added value to the customer. Only companies with a large generation portfolio can compete for this type of PPA.

Outlook: European context

In May 2022, the Commission proposed a series of measures in its REPowerEU package to achieve three key objectives: saving energy, producing clean energy and diversifying the EU’s energy supply sources.

'' Renewables Power Purchase Agreements are expected to become a major driver in the coming years '' HES.

2022 was a historic year in the energy sector, marked by a triple crisis (gas supply disruptions, unavailability of the French nuclear fleet and shortages of hydroelectric production).

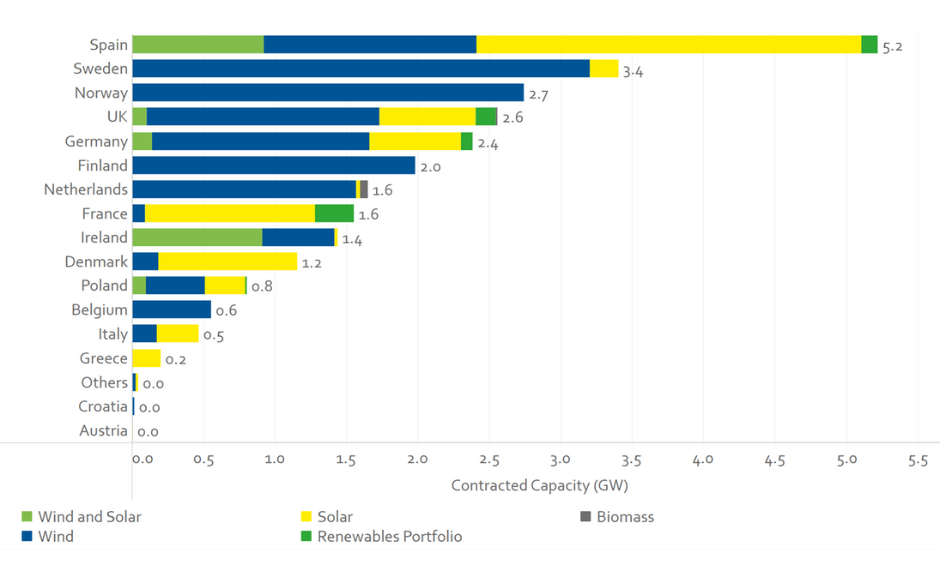

However, the number and volume of PPAs signed remained in continuity with the growth of the previous five years. For the fourth consecutive year,

Spain occupied the first place, with 3.2 GW of PPAs signed.

The two main sectors that signed PPAs were IT and heavy industry (Metalury & Mining).

Contracted Capacity in PPAs per Sector (as of March 2023). Source: RE-Source European platform for corporate renewable energy sourcing

Regulation in the European Union

The Council adopted its stance (overall strategy) with regard to a proposal for legislation to ensure the integrity and openness of the wholesale energy market (REMIT). By outlawing trading based on insider information and discouraging market manipulation, the plan seeks to support a free and open market for wholesale energy in Europe.

The remaining components of the reform, which seek to reduce the dependence of electricity prices on unpredictable fossil fuel prices, safeguard consumers from price spikes, hasten the deployment of renewable energies, and enhance consumer protection, will be decided later.

Optimal support conditions include: i) a growing market of renewable energy projects, ii) high liquidity of power futures, thus enabling long-term hedging, iii) simplified procedures enabling the signature of direct contracts between consumers and clients and iv) public tenders that are compatible with corporate PPAs.

"The current electricity market design has delivered an efficient, well integrated market over many decades, but tight global supply and Russia’s manipulation of our energy markets has left many consumers facing massive increases in their energy bills. We are today proposing measures that will enhance the stability and predictability of energy costs across the EU. Driving investment in renewables will help us reach our Green Deal goals and make the EU the powerhouse of clean energy for the coming decades."

Kadri Simson, Commisisioner for Energy - 14 /03/2023

PPAS advantages

Governments

PPAs offer an alternative way to finance the deployment of renewables.

Trading companies

Renewable PPAs are a guarantee of stable and expected revenues over along period of time; possibility to finance their projects and installations

Renewable energy project developers

PPAs are an alternative and/or complementary source of stable income compared to public support schemes or commercial markets.

Consumer companies

- Electricity supply costs are fixed for a long-term period

- Risk of volatility associated to the electricity market price is

reduced - Green energy consumption is proven by certifying GOs

(Guarantees of Origin)