In the past few years, the energy sector has gone from largely unnoticed to a hot topic. The reason? The sudden and brutal increase in gas and electricity prices and their impact on economic activity. As prices have risen, companies have had to find solutions to mitigate the impact on their bottom-line results. Some have been forced to reduce their production, and most have recorded extraordinary losses in 2022 and 2023. Procurement and risk management strategies have become a topic of discussion at the board level.

To recall, the year 2022 was marked by a triple crisis: Russia’s invasion of Ukraine, which led to a gas crisis, historic unavailability of the French nuclear fleet, and a shortage of hydroelectric generation across Europe due to exceptional weather conditions. These factors compounded, causing gas and electricity prices to reach record highs.

As a background trend, the growing presence of renewable energies (intermittency) in electricity production results in very volatile prices. For example, in Spain, during March, 65.2% of the energy generated came from renewable sources, thus, the highest daily spot price recorded was 173.82 €/MWh, while the lowest was 0 €/MWh.

To complete this energy picture, we should not forget to mention geopolitical tensions. A few months after the start of the latest conflict in the Middle East, the price of Dutch TTF natural gas rose for several reasons: the threat of an escalating conflict and the drifting of shipping routes for vessels carrying LNG (Liquefied Natural Gas) to avoid the Red Sea, resulting in longer sailing times and higher fuel consumption.

To sum up, these examples alert us to the unpredictability of the energy sector and the imbalances suffered by prices in the markets. From Haya Energy Solutions, we recommend that our clients identify, measure, and manage risk to limit its impact on the company’s results. The solution is to implement a hedging policy.

The design of a risk and hedging policy is essential in the context of market price volatility. This risk policy is the ex-ante-defined rules and limits that are applied in the process of buying (for consumers) or selling energy (for generators). Hedging is the instrument used for the protection of the company’s activity.

Several steps are necessary for the elaboration of the risk policy.

Defining the “risk framework”.This is the structure and set of procedures established to identify, assess, mitigate, and monitor the risks to which the company is exposed. It consists of creating “rules of the game” in which to move clearly and safely.

- Governance. Definition of instances, roles, responsibilities, and decision-making processes.

- Risk identification and assessment.Although each company has risks intrinsic to its activity, some common elements could be considered in the risk identification phase:

- Volume risk and/or operating restrictions. In the case of electricity producers, we could speak of operating restrictions linked to the production assets (start-up time, maintenance, downtime, availability of assets, etc.). In the case of consumers, we could refer to the uncertainty of forecasting the volume consumed, and the risk of variation in the consumption profile.

- Regulatory risk. New regulations may require a change in the company’s strategy and uncertainty about future regulatory changes can make long-term planning and strategic decision-making difficult.

- Price and counterparty risk. The volatility of market prices, lack of market liquidity, and increase in risk premiums, various risks with the counterparty (non-compliance with its obligations or incompletion with the company’s values and principles).

- Development of hedging strategies.Once the risks have been identified and assessed, a hedging policy is constructed to mitigate these risks. This may include the implementation of price and volume limits per period or the use of financial instruments such as futures contracts, options, swaps, or other derivatives.

- Monitoring and review.Continuous process of monitoring and review of hedging strategies and risk management framework.

If we focus on hedging strategies as a risk mitigation tool, there are multiple possibilities. The choice of one or the other will depend on several factors within each company: the maturity of the team, market access contracts, the hedging instruments allowed in the risk framework, and the risk appetite of each company.

Two types of hedging mechanisms will be presented:

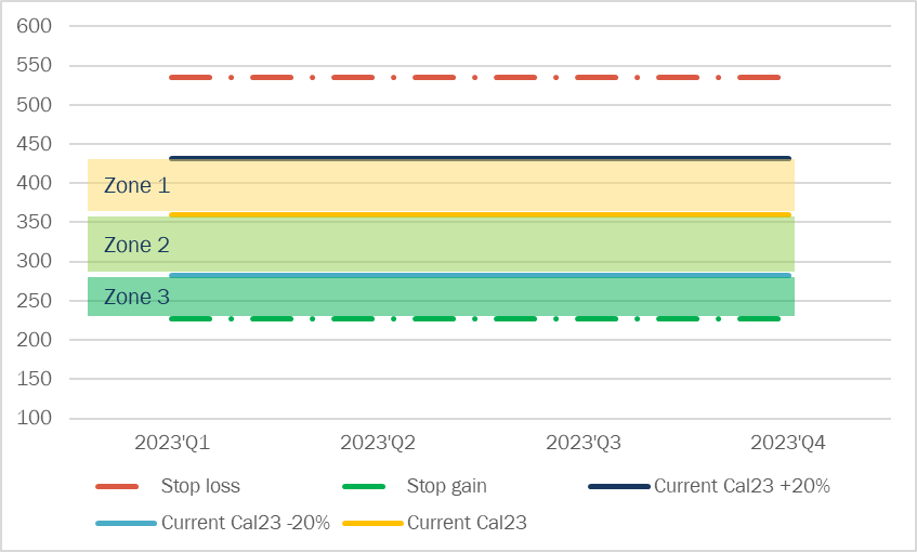

- Stop-loss mechanism

The stop-loss mechanism consists of defining a price level, that when reached, implies buying or selling all or part of the forecasted volume. This mechanism is adapted to small/medium-sized companies without a dedicated energy department. It does not allow one to take advantage of market opportunities, but it does ensure that the initial budget is maintained and that no risk is taken in the face of potential prices fluctuations.

Figure 1 : Stop-loss mechanism – Source: Haya Energy Solutions

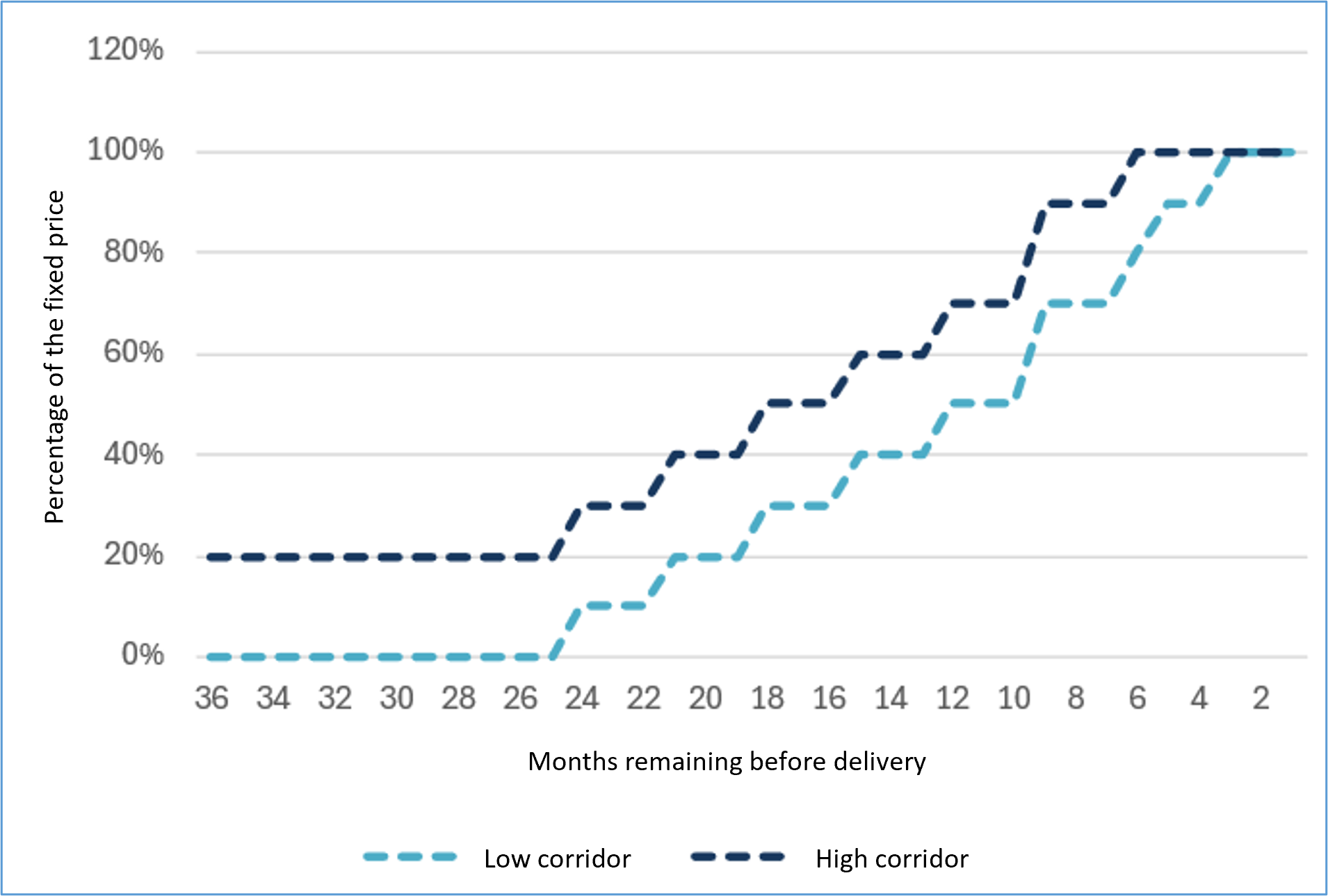

- “Tunnel” mechanism

The “tunnel” mechanism proposes a corridor with a minimum and maximum volume: X months before the delivery date, the executor of the strategy must have ensured a minimum volume of purchases without exceeding another maximum volume. The growing corridor makes it possible to follow market evolutions over time to ensure a supply in line with the market. At the same time, it provides the buyer with a playing field on which to optimise purchases. The slope and width of the corridor should be defined according to the risk appetite of the consumer/producer. This mechanism can be applied in companies with an energy purchasing or sales department or outsourced to experts.

Figure 2 : “Tunnel” mechanism – Source: Haya Energy Solutions

Developing an effective hedging strategy and risk management framework is essential to protect a company against financial risks in the energy market. Haya Energy Solutions assists its clients in the various stages of risk management: defining risk policy and risk mitigation actions, regulatory and market follow-up, and monitoring the execution of policies.

Céline Haya Sauvage & Lourdes Granados Mesa