The recent blackout in the Iberian Peninsula has highlighted the vulnerabilities of the electricity system. This has made energy security a highly relevant issue.

But… What is security of supply? It is conceived as the capacity of a country to guarantee a continuous, decarbonized, and affordable energy flow, the three points constituting the energy trilemma.

- Obsolete network structure

The electricity generation model has evolved significantly in recent decades, moving from centralized generation, which prevailed in the 20th century, to distributed generation, which dominates today.

This change has posed challenges to the infrastructure, since electricity grids designed for a centralized scheme are not adapted to distributed generation. As a result, grid infrastructure has lagged behind the generation structure.

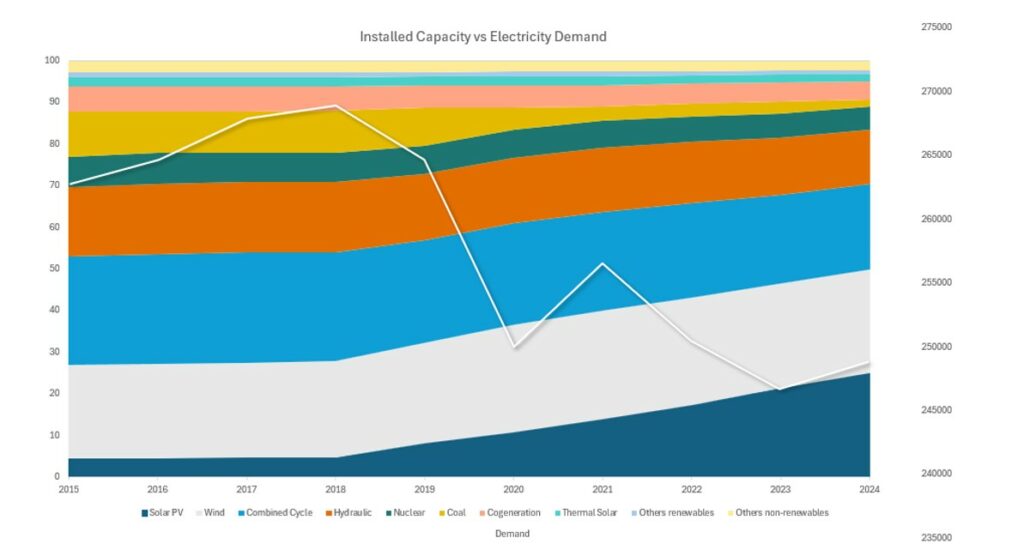

At present, the Spanish electricity system is characterized by a high level of installed capacity based on renewable technologies. A clear example is the note published on February 4, 2025 by the REE, which highlighted the milestone of solar photovoltaic energy surpassing wind power for the first time as the technology with the largest installed capacity in Spain. Both technologies together account for 50% of the total installed capacity in the country.

The figure below shows the evolution of installed capacity by generation technology together with electricity demand over the last decade.

Regarding the evolution of demand, a mostly upward trend has been observed until 2018. Thereafter, demand has stalled at lower levels. A significant drop in 2020 stands out, attributable to the impact of the COVID-19 pandemic. Subsequently, in 2021, demand showed a slight recovery, followed by a decreasing trend in the following years, with a slight rebound in the last year analysed. However, current values remain below those recorded in 2018.

This decline in demand coincides with a notable growth in photovoltaic capacity, which has contributed to increasing the vulnerability of the electricity system.

This evolution in the structure of the generation system is key within the energy trilemma, since it has contributed to the decarbonization of the system. It has also altered the price structure, giving rise to negative prices in the wholesale market, which entails a series of risks in terms of the stability of supply.

In relation to the above, the evolution of the energy mix in the last decade shows how some traditional technologies, such as coal and combined cycles, have lost relative weight compared to photovoltaic, which has increased its contribution fivefold.

This has serious consequences for the stability of the power system as it reduces the inherent rotational inertia capacity of the system. Conventional plants have synchronized generators that operate at grid frequency. Therefore, they provide inertia to the system that acts as a buffer against failures, providing time for other generation sources to respond.

Thus, by decreasing the inherent rotational inertia band of the system, the frequency responds more quickly to disturbances, increasing system volatility. To mitigate this effect, frequency regulators, especially primary regulation, play a crucial role.

As mentioned above, renewable energy sources such as wind and photovoltaic (50% of the installed capacity as a whole) do not contribute inherent rotational inertia. In the case of photovoltaic, the total absence of rotating elements means that it does not contribute inertia to the system. Wind power does contribute mechanical inertia, but this cannot be transferred directly to the frequency of the AC grid. Although wind turbines rotate, their speeds do not match the grid frequency.

In line with the above, both experts and regulatory bodies have been warning about the signals that the Spanish electricity system is currently reflecting with respect to this issue. Good proof of this is the statement made by Comisión Nacional de los Mercados y la Competencia (CNMC) in early 2025, when they warned that the high integration of renewables, together with a drop in demand, could lead to high voltage swings that could cause blackouts.

- Network oscillations

The power grid in Spain operates at a nominal frequency of 50 Hz, the control of which is essential to ensure system stability in the face of imbalances between generation and demand. The grid only admits small variations in frequency; sudden changes cause automatic disconnection of the plants to avoid damage.

Spanish regulations establish that installations must be able to support frequency variations of up to 2 Hz per second, in addition to complying with certain voltage conditions. In particular, the installations must operate without disconnecting if the frequency remains between 48.5 Hz and 51 Hz. If these limits are exceeded, disconnection may occur after 30 minutes.

Regarding voltage, plants connected to transmission networks (>110 kV) must be able to withstand overvoltages of 11.8% indefinitely and other variations for 60 minutes. On the other hand, plants connected to distribution networks (<110 kV) have stricter limits: in the event of a 10% overvoltage, resistance is only required for 1.5 seconds, and in the event of a 15% overvoltage, just 0.2 seconds.

Plants can therefore be disconnected due to persistently low or high frequencies, voltage collapses, or excessively high voltages.

Thus, in recent times there has been an increase in stress signals in the grid, especially in the form of voltage and frequency oscillations. These oscillations were the cause of the incident that occurred on January 9, 2025, when unit II of the Almaraz nuclear power plant had to perform an automatic shutdown due to oscillations in the high voltage grid, forcing the regulator to switch to manual mode. Finally, the low excitation voltage in the electric generator started up the turbine protections, automatically shutting down the reactor.

Similarly, on April 22, 2025, there were several incidents resulting from oscillations in the electrical grid. On the one hand, the railway network between Madrid and Asturias suffered disturbances due to an excess of voltage that activated the protections of the substations from Chamartín to Pajares, according to the Minister of Transport. On the other hand, the Repsol refinery in Cartagena (Murcia) experienced an unexpected stoppage, which is also attributed to technical problems in the electricity supply.

- The Big Blackout

The collapse of the Iberian electricity system on April 28, 2025, popularly known as “the blackout”, is the greatest evidence of the significant vulnerabilities of the system in terms of security of supply. This event, initiated from frequency oscillations, is the subject of an exhaustive analysis. For a detailed technical overview, we recommend consulting the flash info provided by Haya Energy Solutions. This serves as a basis for highlighting the most relevant aspects of this phenomenon in terms of security of supply.

The beginning of this event corresponds to a series of frequency oscillations that resulted in a loss of generation of approximately 2.2 GW in the southern half of Spain. This caused the frequency to drop to the critical point of 48 Hz. As a result, the interconnections with Portugal and France were automatically disconnected, followed by the complete failure of the grid.

System recovery was gradual and depended on the black-start capability of key facilities. The success of a Portuguese plant with this capability at 16:11 CEST underlined the importance of having infrastructures ready to restart the grid without relying on other connections.

- Network infrastructure

One of the key points highlighted by the blackout is the saturation of the grid infrastructure in Spain, which requires urgent and significant investment. This situation is a consequence of the aforementioned paradigm shift from a centralized generation model, for which the Spanish electricity system was designed, to one based on more distributed generation.

However, the saturation of the electricity grid is not a direct consequence of the blackout, as sector associations such as the electricity employers’ association AELEC had been forewarning of the need to massively reinforce the grids.

If the necessary investments are not made to strengthen the electricity grid, Spain runs the risk of becoming practically isolated, with a very limited exchange capacity with other countries and a high degree of saturation in many of its internal lines.

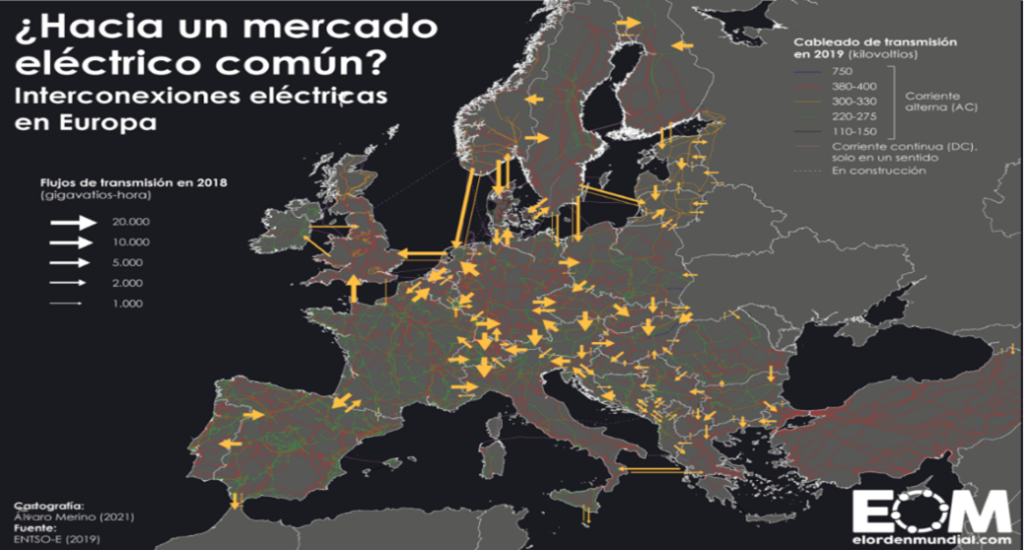

This situation is compounded by the fact that electricity interconnections with the rest of Europe are still very limited. In the event of a crisis or specific need, this low connection capacity significantly reduces the possibilities of receiving support or importing energy from surrounding countries. Electricity interconnections are therefore key to guaranteeing the security and stability of supply in Europe, especially in situations of high demand or energy crises.

As can be seen in the image above, the Spanish electricity transmission grid has significant limitations, especially due to its limited interconnection with the rest of Europe. The system operates practically as an “energy island” within the European Union, with an interconnection capacity of only 3 GW with France and 4 GW with Portugal.

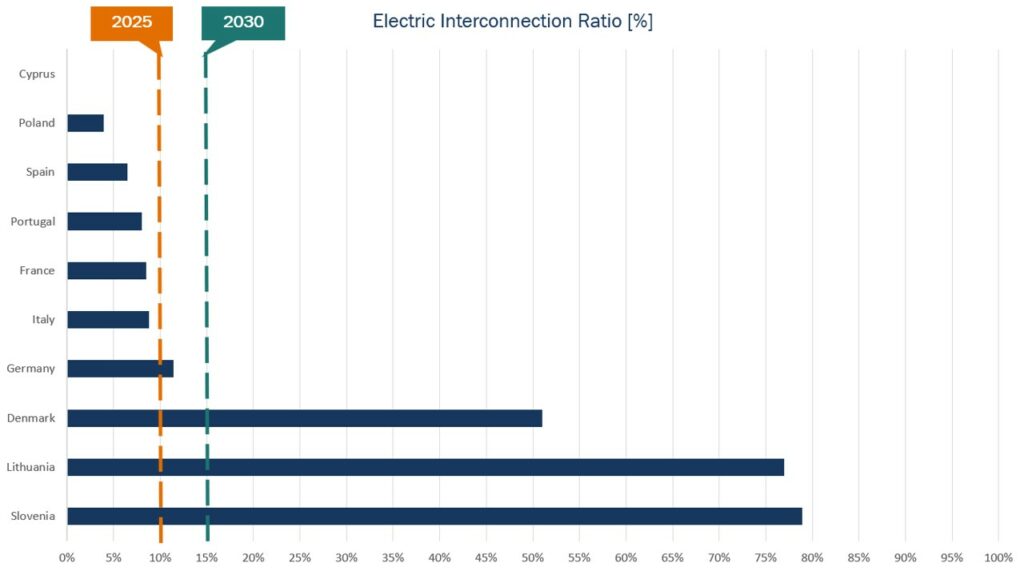

Currently, only 6.5% of the electricity produced in Spain can be exported to surrounding countries, which places Spain as the country with the third worst interconnection ratio in the European Union, only ahead of Cyprus and Poland. If Portugal is excluded, interconnection capacity with the rest of the continent is reduced to 2%.

Even though the European Council has set a target for all member countries to reach an interconnection of 10% by 2025 and 15% by 2030, Spain barely exceeds 4% in 2025, which represents half of the target set for that year and only a third of the target set for five years from now. This low connection capacity with the rest of Europe is reflected in that, during 2024, the link with France was saturated more than 67% of the time, which shows the urgency of improving this infrastructure.

However, the graph reveals a great disparity between EU countries: while Slovenia, Lithuania or Denmark currently exceed even the European target of 15% interconnection by 2030, other countries are far below it. They even fall short of the 10% target set for the current year.

Spain, to mitigate this situation, has begun a new underwater interconnection with France, consisting of four cables that will add 2 GW of capacity, bringing the total to 5 GW. It is scheduled for completion in 2028.

- Network investors

In the current energy transition and with the increasing integration of renewables, electronic inverters play a key role in providing the inertia previously provided by synchronous generators. However, not all inverters perform equally.

On the one hand, grid-following inverters are the most common in grid-connected solar and wind installations. Their operation is based on synchronizing their voltage, frequency and phase with the values of the existing grid. They require an external reference to operate and cannot operate autonomously if the grid goes down or disconnects.

On the other hand, grid-forming inverters can autonomously generate and maintain voltage and frequency without the need for a pre-existing grid. Thanks to advanced control algorithms, they can operate in island mode and provide synthetic inertia, which improves system stability. Although they have a higher cost – about €100/kW additional to grid-following – they are essential to guarantee supply reliability in grids with high renewable penetration, as they replace the mechanical inertia of conventional power plants with virtual inertia through power converters.

- Batteries

In an electricity system increasingly dominated by renewable generation, fast and flexible backup technologies are indispensable. In this context, batteries, also known as BESS (Battery Energy Storage Systems), play a key role.

Thanks to their ability to inject energy in a matter of milliseconds in the event of any imbalance or unexpected interruption, they have become a critical tool for stabilizing the grid and guaranteeing the security of the electricity supply. In fact, their effectiveness has already been demonstrated in real situations. An outstanding example took place in South Australia, where a battery managed to respond with a 100 MW variation in less than a second after a disconnection between regions, surpassing even the speed of response of hydroelectric power plants.

In this new energy context, characterized by a growing penetration of renewable sources, it is necessary to adopt new strategies for managing the electricity system. It is not a question of directly comparing the security of renewable systems with that of conventional systems, but of recognizing that they require different operation and control. In this sense, storage is positioned as a key element, as it guarantees the stability of the system, minimizes the spillage of renewable energy and ensures a continuous and reliable supply.

In Spain, the implementation of battery storage systems is emerging as one of the fundamental pillars of the energy transition. These systems not only make it possible to store surplus renewable energy for release at times of greatest need, but also provide balancing services to the electricity system, help to reduce market volatility and reinforce the resilience of the grid.

In line with this vision, the new Proyecto de Real Decreto que modifica el Real Decreto 413/2014, de 6 de junio, introduces a significant regulatory change: renewable energy facilities that incorporate storage systems and do not consume power from the grid are given evacuation priority, placing them ahead of all other facilities in grid access.

At a time when industry players are carefully evaluating when to launch innovative initiatives, our HES team is ready to provide expert advice and optimization solutions that maximize asset performance.

If you would like to learn more about the role of batteries in the Spanish electricity system, we invite you to consult our specialized newsletter: The role of batteries in Spain.

International comparison

International comparison

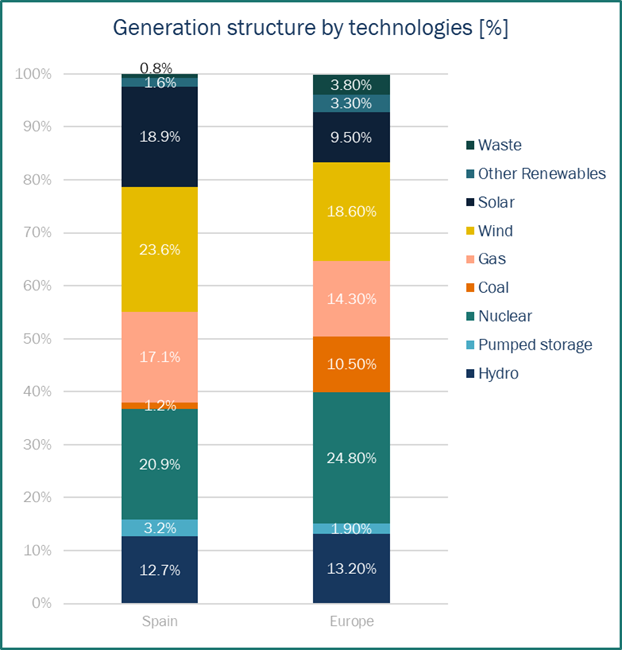

The Spanish electricity system has distinctive characteristics in comparison with other large European countries, such as France, Germany, and Italy. It stands out for its high penetration of renewable energies and a low level of interconnection with exterior energy sources. This singularity can be appreciated when analyzing the Spanish generation structure compared to that of the rest of Europe, as shown in the following figure corresponding to the year 2024.

Energy production in Spain during 2024 was strongly influenced by the contribution of renewable energies. In this context, wind energy was the technology with the highest contribution, reaching 23.6%. In contrast, on the European continent, nuclear energy was the predominant technology, with 24.8%.

Nuclear energy plays a key role in countries such as France, where approximately 70 % of electricity comes from this source. This contribution provides the system with a high degree of inertia and stability in base-load generation.

France’s large nuclear fleet consists of 56 reactors. In addition, a growing regional interconnection confers a more stable generation profile not only to France, but also to surrounding countries with good connections, such as Germany, which has a higher penetration of renewable energies.

Among the most significant differences when comparing the generation mix is the case of solar energy, whose percentage weight in Spain is approximately double that of Europe as a whole.

- Looking forward

The transformation of the Spanish electricity system towards a more sustainable and renewable model has brought important benefits in terms of decarbonization.

However, it has also exposed structural weaknesses that compromise security of supply. These include a lack of rotational inertia, increasing frequency and voltage volatility, and a grid with limited interconnections. These vulnerabilities became particularly evident after recent episodes such as the major blackout of April 28, 2025.

Spain faces the challenge of adapting its infrastructure and regulation to a new energy paradigm. This implies urgent investments in electricity grids, in back-up technologies such as grid-forming inverters and battery storage systems, as well as in the development of new market mechanisms that guarantee the availability of firm capacity.

International experience shows that these challenges are not exclusive to Spain, although they do require solutions adapted to local characteristics.

At Haya Energy Solutions, we highlight the need to move towards a more resilient, flexible and interconnected electricity system that can sustain a high renewable penetration without compromising supply stability. Only in this way, it will be possible to ensure a secure, efficient and aligned energy transition with European climate objectives.

Irene Sánchez-Haro Montero & Pablo Gandullo Romero