In November 2024, France experienced a period of significant dynamism in the field of electricity generation, driven primarily by the variability in wind power production. During this month, wind generation levels fluctuated considerably, directly impacting market prices.

One of the most notable milestones occurred during the passage of Storm Bert on November 24th, when, thanks to exceptional weather conditions, French wind turbines reached a record production of 19.3 GW at 5:00 PM. Additionally, this peak in generation happened on a Sunday, a day when electricity demand is traditionally lower, posing a challenge to the electrical system due to high production on a low-demand day.

Here the expected outcome would have been low prices or negative prices. However, that same weekend, nuclear availability dropped by more than 17 GW in just a few hours, only to increase by the same amount shortly after. This type of flexibility is not common and is a remarkable achievement for the French electrical system.

In this article, we will analyze the events of November 24th, a day that, with its impressive figures, marks a crucial stage in the operational development of French market actors.

To understand the challenges posed by the situation on November 24, it’s important to remember that the electrical grid must maintain an almost absolute balance between production and consumption in real time.

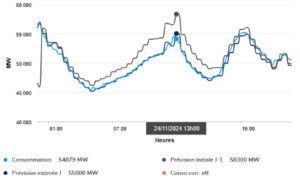

From the demand perspective, since it was a Sunday, lower energy consumption was expected compared to the rest of the week, specifically from an average demand of 60.1 GW from Monday to Friday of that week, Sunday’s demand was 50.0 GW. Additionally, during the peak demand period, the effective demand was 4.3 GW lower than the forecast made the previous day and 1 GW less than the estimate for that same day.

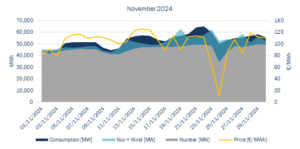

During the week of November 18 to 24, the three dominant production sources in the mix, accounting for an average of 93% of total production, were wind, hydro, and nuclear (17%, 10%, and 67% respectively):

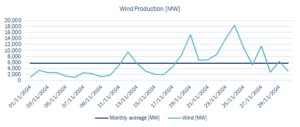

WIND: As mentioned earlier, November 2024 was a month marked by significant fluctuations in wind generation. During this period, maximum wind production peaks were recorded on the 19th (15.3 GW daily average) and the 24th (18.4 GW daily average). This can be seen in the following graph, which compares daily wind production for that month to the average production for the rest of the month.

An hourly breakdown of wind production on that day is shown above, allowing for a clearer view of how generation changed over time.

HYDRO: On November 24, 4.9 GW was produced, of which 3.9 GW came from run-of-river hydro (which remained almost stable throughout the period as it is less modifiable) and the remaining 1 GW from pumped storage (which saw a reduced contribution to the mix compared to previous days when production levels reached up to 3 GW/day).

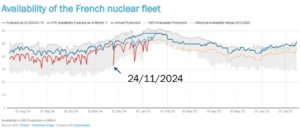

NUCLEAR: The expected availability of the French nuclear fleet at the beginning of the week was 53 GW. However, by November 24 the maximum available capacity was 48.3 GW. This indicates that EDF decided to shut down 6.7 GW, or six plants, in an unplanned manner (as these shutdowns were not included in the long-term maintenance plan).

Furthermore, the energy generated by these 48.3 GW of available nuclear power dropped to less than 30.5 GW, representing a load reduction of more than 35% on average across the available fleet.

How much less costly is it to stop and start up than to lose from production?

According to the CRE report on negative prices: “As an illustration, in the first half of 2024, the market spot valuation of observed production during negative price hours for the French fleet corresponds to a loss of around €80 million (mainly from nuclear and run-of-river hydroelectric).” In other words, in the first half of 2024, it was more profitable to produce at a loss of €80 million than to stop and later restart production.

However, in the second half of 2024, a paradigm shift occurred.

To put the events of this day in context it’s important to mention that in France, due to the high percentage that nuclear energy represents in the generation mix, reactors were designed or adapted to modulate their electricity production, allowing generation to be adjusted to demand fluctuations.

EDF performs modulation tasks for three main reasons:

- To provide adjustment services to the electrical system.

- To manage nuclear fuel savings between cycles.

- To perform economic optimization when market prices are lower than the marginal production costs of the nuclear fleet due to lower electricity consumption or high renewable production levels.

The latter two are purely economic reasons, particularly the third, based on market price levels comparing either the variable costs of each reactor or a user (or “opportunity”) cost to optimize the available fuel stock until the next refueling stop.

However, EDF’s strategy not only involved modulating, i.e., reducing its fleet capacity to adjust for increased renewable energy and reduced demand, but also, for the same economic reasons, shutting down six nuclear reactors (reducing production to zero) between November 23 and 25, resulting in a cumulative shutdown of 6.9 GW over those three days. Interestingly, during this period, unplanned nuclear outages of more than three hours represented 50% of all unplanned outages in November. The following illustration shows the drop in the French fleet’s availability observed on that day. Although we have been seeing more nuclear reactor modulations recently, November 24 stands out for the complete shutdown of six reactors, a milestone that has not been repeated.

As a result, the French electricity market reached its highest wind generation level on Sunday, November 24, with the peak recorded at 5:00 PM, reaching 19.3 GW. At that time, wind energy accounted for 31% of the national electricity production, although still behind nuclear generation, which maintained a 58% contribution. However, as we have mentioned and as can be seen in the following graph, there was a significant reduction in nuclear production that day, even cutting production entirely in several reactors.

The growing penetration of renewables, with their low costs and intermittent nature, is driving a greater need to adjust nuclear production. When demand is low, and renewable generation is high, market prices can fall below the operating costs of nuclear plants, forcing EDF to reduce its production. This scenario, known as “economic shutdown,” has been rare until now, representing less than 1 TWh annually. However, RTE estimates that by 2035, this figure could reach up to 15 TWh due to the growth of renewable capacity in the energy mix.

In the long term, such modulation presents additional challenges, particularly in terms of the impact on the lifespan and maintenance of reactors. The International Atomic Energy Agency (IAEA) has identified potential adverse effects, such as metal fatigue, corrosion, and premature wear of components. Overall, this study shows that modulation increases plant maintenance requirements.

To ensure the safety of production modulation, including reactor shutdown and reactivation, EDF will need to conduct detailed analyses and studies of these effects, a key activity for the development and long-term role of nuclear energy in France. Just as combined cycle plants became more modifiable than initially planned a decade ago, nuclear plants will need to adapt, always ensuring their technical limits are respected.

In conclusion, nuclear modulation in France responds to technical, economic, and system stability needs. The degree of modulation demonstrated by EDF in recent weeks positions the French nuclear fleet not only as a base of energy security for Western Europe but also as a safeguard against the negative prices increasingly seen across Europe. However, its evolution poses new technical and maintenance challenges for nuclear infrastructure, as this practice becomes more frequent and more profound.

Paloma Hepburn Jiménez & Pablo Gandullo Romero