I would like to start this article by quoting F. Brottes, chairman of the French Transport System Operator (RTE), referring to Wednesday 25 January this year: “Our company had never before (…) experienced such a tense situation, at the limits of the supply-demand balance, because we had never had such shortfall in production (…) We covered demand but only just. In the event of a contingency, loss of a nuclear plant for instance, it is likely we would be obliged to impose interruptibility”.

For those who don’t know, interruptibility was the first of the exceptional steps announced by RTE that could affect 21 high-demand users in order to relieve the system by some 1.5 GW. RTE’s escalation measures then move to a reduction of 5% in voltage (dropping 4 GW). This does not have any visible impact on the customer, but does reduce quality of service. The final stage would mean RTE activating “programmed load shedding”, involving selective power cuts. In a cold spell during the winter, it is most unpleasant to be without electricity, even for a few hours. But if the stability of the system were threatened, steps have to be taken quickly, and RTE was ready.

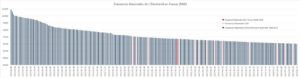

The worst thing is that we came so close to activating the full arsenal of responses to a peak demand of 93 GW, a long way from the record level of 102 GW (January 2012). How did we arrive at this situation? Is the French system no longer prepared for climatic variations? Or is it just a temporary situation, some undesirable and unrepeatable elements coinciding?

A simplistic analysis of the situation of the system would show us that it is just the EDF nuclear plants which are to blame, with all the problems that led to an unusual failure situation. But the fact is that on 25 January, we fell short in terms of supply by some 4 GW of nuclear, compared to the normal winter situation. This means that, in a normal nuclear supply situation, the system would have been less stressed, but in any case it would not have been possible to reach the historic peak without taking extreme measures.

Looking more closely, it is interesting to see that renewable output (solar, wind and bio-energy) at this precise risk moment was only providing 2.5 GW to the system (compared with the 20 GW of installed power). Clearly, at 19:00hrs in winter there is no sunlight, and solar power contribution is zero. Similarly, cold spells are often accompanied by anti-cyclones, so there is a reduction in wind power. These are structural facts. So, the more we rely on renewables for our system, the greater the risk of failure at the very peak of demand on the system.

Looking outwards to our neighbours, they could only offer us 5 GW. This is a familiar situation for RTE: when it’s cold in France, it’s also cold across continental Europe and the neighbouring countries, even if they are less temperature-sensitive than we are. They also see their demand rise, and can only provide partial relief for peak demand on our system.

So what kept things afloat in this case? First of all, hydro-power, the oldest and most flexible of renewable energy systems. France has an enviable 25 GW of supply. Almost all of the plant was operating, but with normal operational limitations, only 13 GW was available to balance the system.

But this was not enough. According to RTE’s records, there was still a big shortage of energy to keep demand and supply in balance. It’s hard to believe perhaps, but it was the thermal generators, more often the offenders, which saved the system. A full 16 GW was operational at the critical moment. The very one no one wants, the CO2 emitter, which is in a state of chronic collapse, survives with transfusions from its shareholders. The very one which would have closed down on 31 December, if the unilateral French carbon tax had come into force (see newsletter 03). It was thermal generation that avoided disaster.

So everything is for the best. France does have a safety back-up for the tense situations such as those of this winter. If nuclear recovers from its tribulations and its foot-dragging, there will be no problems in future. Sadly, I dare to predict this won’t happen. Thermal generation is a species on the road to extinction (or rather, “potentia non grata”) and if no solution is found, the system back-up will no longer be available in time of need.

The basic issue is that thermal generation survives only on its market sales. Because of the massive penetration of subsidised renewable energy, the market has practically vanished (at least, wholesale prices have fallen to unsustainable levels). So owners of thermal plants (their shareholders) have lost everything (massive write-downs by Engie, Uniper, Eon, RWE, Enel, Vattenfall, etc.). These shareholders have no interest (or obligation) in continuing to lose money in plants that operate only in extreme circumstances. In such conditions, the response from the owners is to decommission them (for obsolete installations) or mothball them (for the most efficient and up-to-date). This is what we have been seeing across Europe over the past 5 years.

Back in France, the situation is beginning to be problematic. France is the most temperature-sensitive country in Europe, and we have already seen that reserves are not as generous as might be thought. In terms of output, many of the thermal facilities installed are obsolete, polluting, and extremely expensive as back-up. This segment, by which I mean the fuel-oil and coal-fired plants, is destined to disappear soon. A second segment, co-generation plants, heavily subsidised until recently, does not provide back-up for the power grid (since they have to operate according to the thermal demands of industry). Most co-generation plants will also disappear, unless a decision is made to continue subsidising their hosts.

Finally, we still have CCGT (combined cycle gas turbines) and GTs (gas turbines), much more efficient and environmentally-friendly technologies, which are flexible enough to provide occasional support for the grid. The solution now designed to maintain these assets available for the national system, and avoid their being mothballed, is the capacity mechanism, recently installed in France (see newsletter 03). While we are only at the start of this new market, it does not yet meet the expectations of the generators. For instance, for a standard CCGT of 400MW, the 10K€/MW from the December auctions now provide around 4Mll€ annual revenue. This is just enough to pay GRT Gaz, the gas transport network, for the cost of transporting the gas (2Mll€) and the taxes and charges to the State (2Mll€) (this point would merit an article to itself). The CCGT still has to pay its employees, maintenance, interest, depreciation, etc., with what it finds in the energy market (which doesn’t give much, as we have already said). And the figures are even worse for GTs, which are units that operate fewer hours a year (peakers).

In the national debate, everyone has a position on the future of nuclear power in France and the target for market share in renewables. Some raise the issue of system security, and those who do so avoid mentioning thermal plants. In the distant future, it will be economically possible to store the intermittent energy produced by renewables. But this will not happen in the medium term. How can we ensure the stability of the system in the meantime, if there are more and more renewables and less and less dispatchable production?

With ageing nuclear plants (average age 30 years) and the new, exclusively renewable, installed power (intermittent and subject to climatic fluctuations), the system is becoming steadily less reliable. As the thermal facilities also disappear, episodes such as those we have experienced this winter will be more common unless we take the necessary steps.

In these circumstances, we think that efficient thermal power plants (CCGT, GT) should be protected. Apart from ensuring that the capacity mechanism sends the right signals, the Administration should considering changing strategy on this necessary back-up and show its firm support to ensure that these scant assets remain permanently in the system. For instance, turning some taxes (IFER) and gas transport costs into variable charges could help to ensure the survival of these plants. Finally, and above all, it is important to avoid the bad ideas that would ultimately break the fragile balance within which these plants survive, such as the unilateral French carbon tax or an increase in the storage requirements (which Storengy has just demanded for CCGTs).

Antonio Haya