Spanish Market Analysis

Analysis of the Spanish energy market is key to understanding the dynamics and trends affecting the sector both locally and internationally. In this detailed analysis, we address the important factors influencing energy prices, supply and demand, and the latest regulatory policies. This comprehensive overview will allow you to keep up to date with weekly changes and anticipate possible market variations, both in Spain and in other relevant markets such as France.

January 2026

Table of Contents

Key figures of the month

The European energy markets have undergone significant changes compared to the previous month, with spot electricity prices experiencing a rebound across the majority of hubs following the increase in demand due to very low temperatures and the softness attributed to renewable sources observed in some cases. In contrast to last month’s notable declines in Germany and the United Kingdom, and France recording the lowest average, the latest data indicates a substantial increase in spot prices. The United Kingdom is once again prominent, with prices reaching 131.00 €/MWh, while Germany has risen to 110.20 €/MWh. This increase reflects renewed system tightness and elevated marginal generation costs. France has experienced a sharp increase to 100.65 €/MWh, thus relinquishing its status as the most economical market, whereas Spain remains the lowest-priced hub at 80.26 €/MWh, and Italy continues to operate at a structural premium of approximately 107.37 €/MWh.

In contrast to the rebound observed in spot prices, Power Cal’27 contracts have shown only limited upside compared to the previous month in the UK, Germany and Italy, while remaining broadly stable in Spain and France. This reflects a medium-term outlook in which markets anticipate some normalization of fuel costs as extreme cold conditions ease, while Spain and France continue to benefit from strong renewable generation and robust nuclear availability heading into 2026.

Gas prices have stabilized in the mid-30s €/MWh after reaching multi-month lows in December, with forward gas prices still trading at a discount, reinforcing expectations of a structurally looser market. Meanwhile, carbon prices remain elevated, providing ongoing support to thermal generation costs despite the softening of power forward curves.

Overall, the market has shifted from the weather- and renewables-driven bearish environment seen in December to a tighter and more volatile spot market, while forward prices continue to signal a softer trajectory beyond 2025.

Energy demand and generation mix

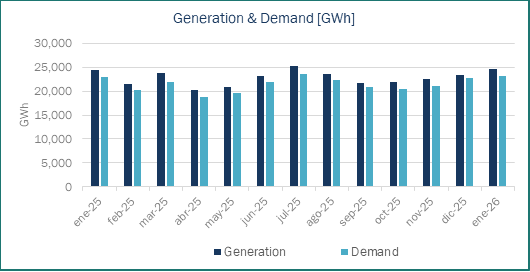

The chart shows how much electricity Spain produced and consumed each month from January 2025 to January 2026. Throughout this time, Spain produced more electricity than it needed, which shows that the country is in a good position to export electricity to other countries. This trend is especially clear at the end of 2025, when electricity demand in December was 22,581 GWh, while generation was 23,209 GWh, leaving about 628 GWh available for export.

Both the demand and the production of electricity increased during this period, as people used more power in the winter and there was more electricity available to meet that need. Over the year, electricity demand went up by 2.7% compared to 2024, returning to levels seen before 2021. Generation grew even more, by 3.6%. This growing difference between the electricity produced and the electricity consumed highlights Spain’s increasing role in exporting electricity. In fact, 2025 was the fourth straight year that Spain exported more electricity than it imported and the amount being exported significantly increased to nearly 13 TWh.

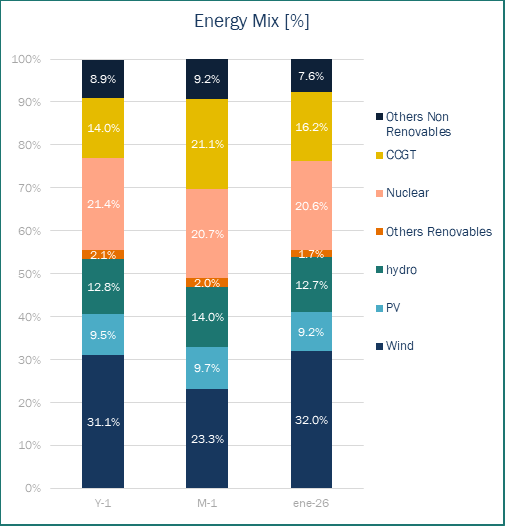

Spain’s electricity generation sources have changed comparing January 2026 to the previous month and the same month last year. The energy mix in Spain is heavily focused on renewable sources, with wind power being the top contributor. In January 2026, wind energy made up 32.0% of the total electricity produced, which is a bit higher than 31.1% from a year ago and significantly up from 23.3% the month before. This increase indicates better wind conditions this time of year.

Solar energy held steady at around 9.2%, while hydroelectric power, generated from rivers and dams, accounted for 12.7%. This is similar to the year before but slightly lower than the previous month’s 14.0%. On the traditional energy side, nuclear power remained consistent at about 20.6%, continuing to provide reliable energy.

Gas-powered generation, which uses combined cycle gas turbines (CCGTs), rose to 16.2% compared to 14.0% last year. However, this is lower than the higher 21.1% seen the month before, suggesting that with more wind energy available, there was less reliance on gas.

In summary, January 2026 shows that Spain’s electricity still comes mainly from renewable sources, particularly wind, which has reduced the need for gas-fired power plants compared to late 2025. Meanwhile, nuclear and hydroelectric sources continue to play a key role in maintaining a stable energy supply.

Source: Haya Energy Solutions

Energy prices & market panorama

Source: Haya Energy Solutions

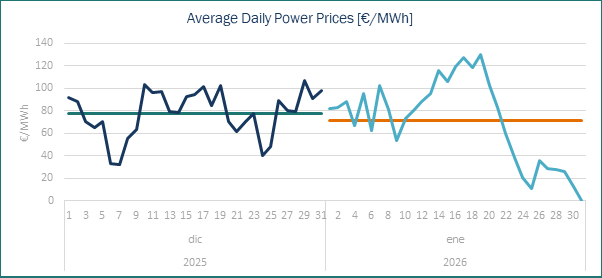

The average daily electricity prices in Spain during December 2025 and January 2026 showed a noticeable shift in the market behaviour between the two months. In December, prices mostly stayed within a range of 60 to 105 €/MWh, averaging in the high 70s to low 80s. This indicates a stable situation, supported by some renewable energy sources and moderate demand for electricity.

As January 2026 began, prices initially remained high but became much more unpredictable, peaking over 120 €/MWh in the middle of the month. This jump suggests that the market faced tighter conditions due to colder weather, increased production costs, or less availability of renewable energy.

However, in the latter half of January, prices dropped sharply, reaching very low levels by the month’s end. This significant decline points to a shift in the market, likely due to a boost in wind energy production, decreased demand, or better overall supply of electricity. In summary, the comparison shows a transition from steady prices in December to extreme fluctuations in January, ending with a notable decrease as renewable energy generation picked up and market pressures eased.

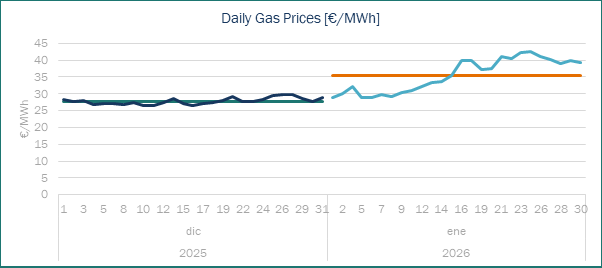

The daily gas prices in Spain changed during December 2025 and January 2026. In December, gas prices were pretty stable, mostly staying between 27 and 30 €/MWh. This stability indicates that there was a good balance in gas supply and not much extra demand for it at that time.

However, when January 2026 started, prices were still similar to those in December but began to rise steadily throughout the month. By mid-January, prices climbed above 35 €/MWh and peaked above 40 €/MWh toward the end of the month. This increase suggests that several factors were at play, including colder winter weather leading to higher heating needs and increased demand for power. Additionally, international prices for liquefied natural gas (LNG) also became stronger.

By the end of January, prices dipped slightly but were still higher than the average prices in December. Overall, this shift highlights a move from stable and lower gas prices in December to a much stronger and more active gas market in January, leading to higher costs for generating electricity during that time.

Market trends and futures

Source: Haya Energy Solutions

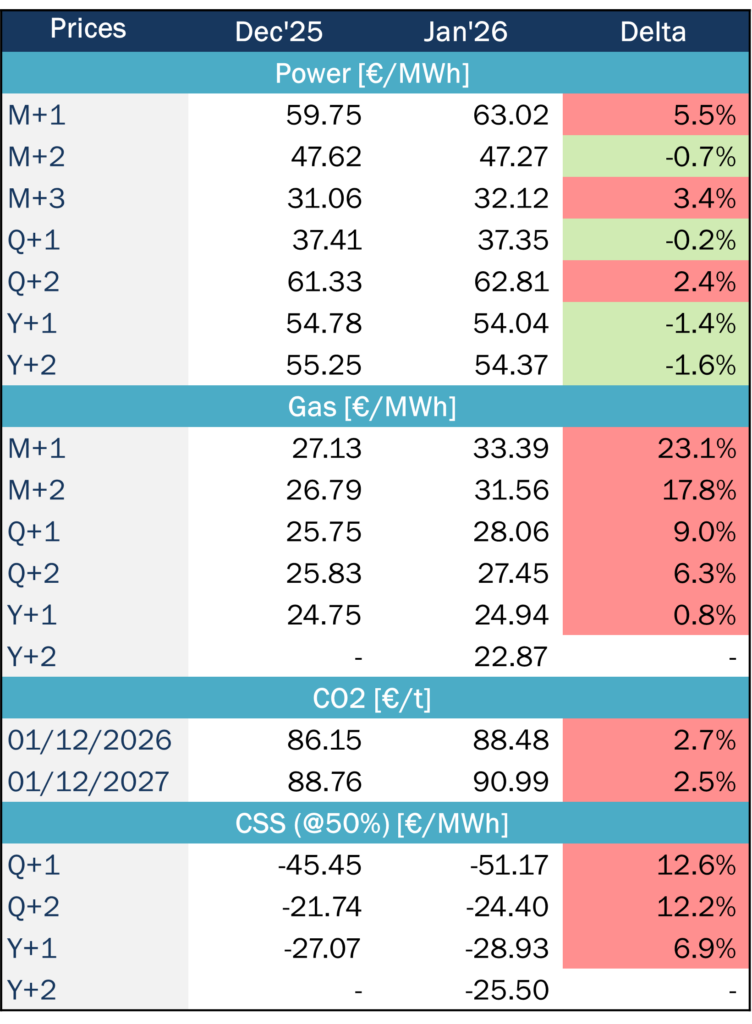

The forward markets indicate a clear divergence between the price dynamics of power and gas when comparing December 2025 with January 2026. On the power curve, movements were relatively limited. The front month (M+1) increased moderately by 5.5% to 63.02 €/MWh, while most other contracts remained broadly stable or slightly softened. Calendar products, such as Y+1 and Y+2, edged down by around 1.4% to 1.6%, confirming that the medium-term power outlook has not materially tightened despite short-term volatility.

In contrast, the gas curve experienced a much stronger bullish adjustment, with significant month-on-month increases across the front end. The M+1 contract rose by 23.1% to 33.39 €/MWh, while M+2 gained 17.8%. This reflects significantly tighter winter fundamentals and higher marginal fuel costs. Further along the curve, Q+1 and Q+2 also experienced increases, although the year-ahead contract remained almost unchanged, suggesting that the market views the tightening as largely seasonal rather than structural.

CO₂ prices continue to firm modestly, with EUA contracts for December 2026 and December 2027 rising by approximately 2.5% to 2.7%, reinforcing the ongoing carbon cost support for thermal generation. Finally, clean spark spreads (CSS) have become more negative across all horizons, deteriorating by over 12% in Q+1 and Q+2. This indicates that the rise in gas and carbon costs has outpaced power price gains, further compressing profitability for gas-fired generation at current hedge levels.

SP Baseload Power price (€/MWh)

SP Peak load Power price (€/MWh)

EUA price (€/t)

MIBGas price (€/MWh)

Coal Price ($/Tn)

Gas efficiency: 52%

Coal efficiency: 38%

Gas vs. Coal Price (€/MWh)

Gas efficiency: 52%

Coal efficiency: 38%