Biogas is positioning itself as an alternative to traditional fossil fuels by allowing existing infrastructure to be maintained while helping to reduce greenhouse gas emissions. This is supported by technological improvement and encouragement from governments, which see this fuel as a solution to energy security problems through diversification of sources and agricultural development besides a more sustainable alternative.

In this article we introduce the main steps of the biogas production process. Furthermore, some of the advantages in comparison with current fuels and applications of interest are described. Nevertheless, there are challenges worth mentioning and other disadvantages to be aware of.

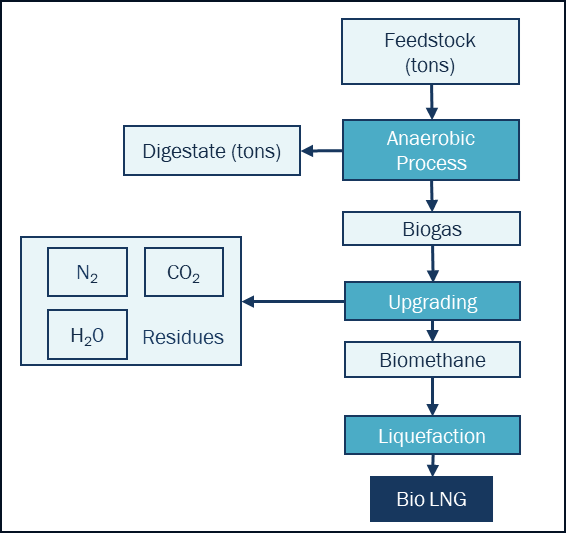

The biogas production process starts by obtaining biogas through an Anaerobic Digestion Process from various types of organic sources, e.g. wastewater residues, manure, agricultural residues, among others. The biogas generated contains mainly methane (CH4) – main component of the natural gas – and carbon dioxide (CO2), as well as other gases in smaller proportions considered as residues. These gases will normally be emitted to the atmosphere, while thought its treatment this can be avoided – note that CH4 contributes to green house effect almost 30 times more than CO2.

Depending on the type of organic material fed, the desired gases will be produced in different proportions and volumes. Therefore, the choice of menu is crucial for the process. Next, to increase its purity and thus its energy intensity, the biogas is converted into biomethane by separating the CO2 and residues through the Upgrading process. Finally, this biomethane, which is mostly composed of methane from natural renewable sources, will be i) converted into BioLNG through a liquefaction process, ii) injected into the natural gas network, or iii) used directly for electricity and heat generation.

Besides the gaseous outputs, solid residues are also obtained from anaerobic digestion which can be used as fertilizers due to their content of organic matter and minerals such as nitrogen or phosphorus.

This process is synthetized in the diagram below:

Source: Haya Energy Solutions

Besides the positive impact to reduce GHG emissions, as previously explained, biogas can be neutral or even negative carbon impact, the combustion of methane produces lower levels of air pollutants such as nitrogen oxides (NOx) and particulate matter (PM), in comparison to other fuels. All in all, biomethane brings all the energy system benefits of natural gas without the associated net emissions.

Additionally, biogas can be produced locally from readily available organic waste, reducing dependence on imported fossil fuels and enhancing energy security, is fully dispatchable (considering reactor loads and timings), and can use already existing infrastructure.

A detailed analysis performed by the IEA showed that the availability of sustainable feedstock for biomethane (not considering those that compete with food for agricultural land) is around 20% of global natural gas demand and is widely distributed around the world. The potential of EU is around 10% of global total.

Both environmental and energy independence has been a mayor driver for policy support from governments. Furthermore, REPowerEU Plan states that boosting sustailbnable production of biogas is a cost-efficient path to achieve EU’s ambition to reduce imports of natural gas from Russia.

Europe (and mainly Germany) leads the use of biogas, accounting for more than 45% of global production (205 TWh out of 450 TWh). It is closely followed by China, where household digesters were developed some decades ago to provide clean energy for cooking and residential use in rural areas, with almost 42 million household digesters installed by 2015. In 2015, however, government policy shifted towards combined heat and power generation (CHPs). By 2028, the IEA foresees that about 600 TWh will be produced each year, with 43% of those produced in Europe.

This biogas can have several uses, in Europe for example, is mainly used for electricity and heat generation, while in China, as previously mentioned, is mainly used for residential purposes. It can be injected into the natural grid, used for industrial transformation, or as a substitutive for transportation fuels, especially when liquified.

One of the main barriers for the deployment of biogas in Europe is the cost gap between the cost of producing biogas (between 54€/MWh and 109 €/MWh) and natural gas prices (currently under 40€/MWh), even with current CO2 prices. In order to support investments, governments are further incentivising the use of biogas. It is likely to see a trading network around Biogas in the coming years that will help expand the pace and scale of biomethane growth by connecting production and demand centres

These elevated costs can also be reduced through an improvement of the technology used that, largely developed for large scale utilities, for small scale distributed ones is still in development; and through an optimization of the feedstock supply and treatment. Another barrier to this deployment is the resistance from local communities to biogas plants due to concerns about odours, traffic, and other environmental impacts.

In conclusion, the diversification of the energy mix serves as an alternative way to improve energy security, decrease fossil fuel imports, and with the potential to provide local supply in the countries that were produced. Existing LNG infrastructure can be used for “connecting” the biogas produced without involving large sums of investment in infrastructure costs. The future of biogas should not be considered separately from the broader context of the global energy system.

Cheyenne Rueda Lagasse