Battery energy storage (BESS) has become a key element in the European energy transition. In the context of increasing renewable penetration, greater price volatility, and the need for flexibility, batteries are no longer analyzed solely from a technical point of view, but increasingly as strategic assets with economic potential.

In a previous article published in May 2025, “The role of batteries in the Spanish electricity market: key to the energy transition” we analyzed the role of BESS in the Spanish electricity system and how they fit into the current regulatory framework. Building on that foundation, this article broadens the focus to a central issue for developers, investors, and large consumers in Europe: the economic viability of BESS projects.

Beyond its technical functionality, the profitability of a storage system depends on multiple factors: accessible market revenues, asset design, investment and operating costs, and regulatory stability. Below, we analyze the main economic opportunities and limitations of BESS from a European perspective, incorporating references to markets such as Spain and France for illustrative purposes, and highlighting the importance of rigorous economic assessment as the basis for sound decision-making.

- Economic Factors

From an economic standpoint, the appeal of BESS in Europe is based on three points:

The first is the volatility of electricity prices, which creates arbitrage opportunities in the spot market. Increasing renewable cannibalization and the emergence of more pronounced hourly spreads allow batteries to capture value by buying energy at low prices and selling it at times of greater scarcity.

The second is access to flexibility markets, such as balancing or reserve services (e.g., aFRR). These markets can complement or supplement spot revenues and provide greater stability to cash flows, although their contribution varies significantly between countries depending on participation rules, the degree of competition, and market maturity.

Finally, the design and operating strategy of the BESS are decisive factors. Power, duration, efficiency, and dispatch logic directly influence the revenue captured and the wear and tear on the asset. From an economic perspective, this makes operational optimization as important a factor as market access itself.

- Limits and risks

Despite their potential, BESS have economic limitations that must be explicitly integrated into any economic analysis.

One of the main risks is regulatory uncertainty, especially in evolving markets. Changes in access rules, remuneration mechanisms, or technical requirements can significantly alter expected revenues over the life of the asset.

Another key factor is battery degradation, which affects both available capacity and future replacement costs. Cycle frequency, depth of discharge, and operating strategy have a direct impact on service life and, therefore, on the economic profile of the project.

Likewise, BESS revenues are highly sensitive to price assumptions. Optimistic projections without scenario analysis can lead to overestimating profitability, especially in the long term, where these systems are exposed to a structural risk of cannibalization associated with the adoption of the technology itself.

Consequently, the long-term economic sustainability of BESS depends not only on price levels, but also on the pace of technology deployment and the ability to adapt operating strategies to an increasingly efficient environment.

- Illustrative market figures: Spain and France

To illustrate these dynamics, consider a typical BESS operating[1] in 2024 in two European markets with different characteristics, such as Spain and France.

- Estimated annual income with a spot-only strategy:

- Spain: 126 k€/MW and year

- France: 117 k€/MW and year

- Revenue increase when combining spot + aFRR varies between 60 and 80% additional to the revenue obtained in the spot market.

These differences are not due to technology, but rather to market signals, the design of balancing services, and the degree of competition in each country. This example shows that the same BESS can have very different income profiles depending on the market in which it operates.

Furthermore, the analysis shows that participation in multiple markets and services is a key factor in achieving the expected levels of profitability in a storage investment. Combining different sources of income significantly increases the value captured by the asset compared to strategies limited to a single market, by taking advantage of complementary signals and reducing dependence on a single remuneration mechanism.

However, this multi-market approach involves greater complexity in the analysis, evaluation, and dispatch processes of the BESS, requiring advanced capabilities in both market interpretation and real-time operational control. In this context, the efficient management of multi-market strategies is often supported by companies specializing in the sector, such as Haya Energy Solutions, which are capable of integrating market vision, economic optimization, and technical operation of the asset.

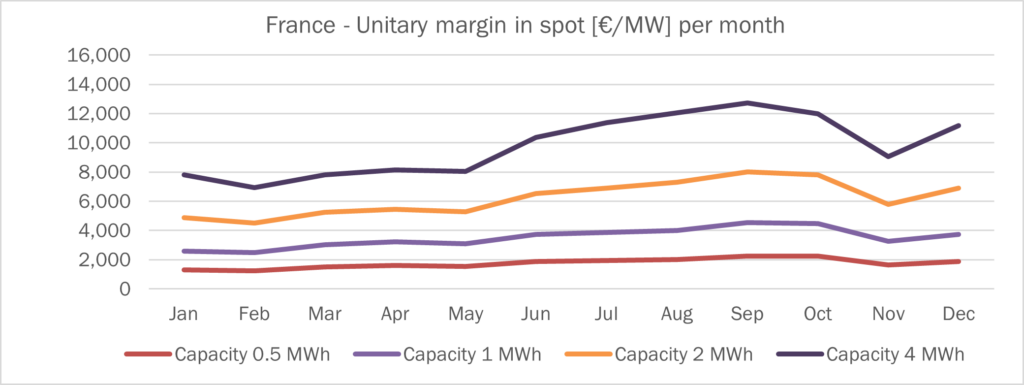

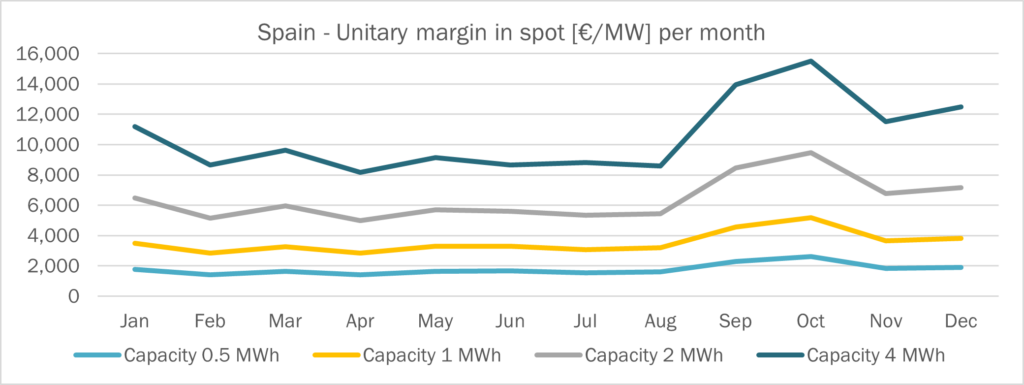

The monthly analysis of unit revenues highlights the direct impact of the system’s energy capacity (MWh) on the value captured by the BESS. In the above example for 2024, the scenarios with the longest duration (2 MWh and 4 MWh per MW installed) show, in general terms, higher unit revenues compared to lower capacity configurations, as they allow for greater operational flexibility and better adaptation to market signals in both arbitrage and balancing services.

However, this result should not be interpreted simplistically. While “greater capacity equals greater revenue” seems an intuitive conclusion from a purely operational standpoint, the optimal capacity of BESS is not universal, but rather depends on a balance between additional revenue, incremental investment cost, and technical and commercial constraints.

From an economic standpoint, increasing capacity entails a significant rise in CAPEX, while marginal revenues tend to show diminishing returns above certain thresholds, especially in markets with high competition or regulatory constraints on simultaneous participation in services. In addition, technical restrictions such as power limits, efficiency, accelerated degradation due to intensive strategies, or contractual conditions linked to the connection point or the type of consumer associated.

Therefore, the definition of optimal sizing—power and duration—must always be approached specifically for each project, relying on economic simulation models that integrate hourly prices, market rules, multi-market strategies, and degradation profiles. In this context, sizing ceases to be a purely technical decision and becomes a key strategic variable in the profitability of the BESS project.

The combination of revenue, CAPEX, and OPEX allows for the estimation of key metrics such as ROI, IRR, and payback period, the magnitude of which critically depends on market assumptions and the operating strategy adopted.

- CAPEX: For a utility-scale BESS in Europe, investment costs are around €1.1 million/MW, depending on the technology, duration, and context of the project.

- OPEX: include operating, maintenance, insurance, and market management costs, typically in the range of 3-5% of total CAPEX, i.e., around €40k/MW per year, in addition to provisions associated with degradation and replacement.

It should be noted that, although this exercise has illustrated the valuation of BESS through a combination of the spot market and secondary regulation services (aFRR), in practice there are other equally relevant configurations. In energy markets, combining the daily market with the intraday market is practically essential for achieving competitive levels of profitability, as it allows for more precise management of energy positions and deviations.

Likewise, in the field of balancing services, the mechanisms available vary significantly between countries and offer additional opportunities for value creation, such as primary regulation services—which are easier to implement and have established remuneration schemes in markets such as France and Germany—or the SRAD mechanism in Spain, where storage systems connected to large consumers can capture particularly high revenue potential.

In this environment, characterized by increasing operational complexity and a strong dependence on market signals, rigorous economic analysis and advanced simulation capabilities are key to decision-making. At Haya Energy, we support developers, investors, and large consumers in the evaluation and valuation of BESS projects, combining market analysis, hourly price simulations, optimal sizing studies, and economic models adapted to different European regulatory frameworks. Our experience in markets such as Spain, France, and Germany allows us to identify robust operating strategies and maximize the value captured by each asset based on its specific characteristics.

Conclusión

BESS offer significant economic opportunities in Europe, but their profitability depends on a complex combination of commercial strategy, optimal design, and risk assessment. Understanding these elements and evaluating them rigorously is essential to transforming the potential of storage into economically sound and sustainable projects over time.

Paloma Hepburn Jiménez

[1] Calculation hypothesis: 1 MW and 4 MWh (0.25C) battery limited to 1.7 cycles per day