While discussions and speculations about the Arenh, its abolition, adaptation and replacement are in full swing, it seems relevant to us to look at the question of the price of electricity in France in its most fundamental component: the price of Baseload (constant power band across the 8760 hours of the year). Indeed, the Arenh mechanism, like the mechanisms that preceded it – regulated tariffs, Tartam – and probably also those that will succeed it, are intended to set the price of this Baseload in a regulatory manner and to control its volatility. While the main energy markets are overheating in line with the euphoria of the overall financial markets, we propose to take a closer look at the components of this price and its market references. We will then see that, even if the market is always right, its messages indications are not always easy to decipher, and the hand of the regulator and legislator are often clearly visible.

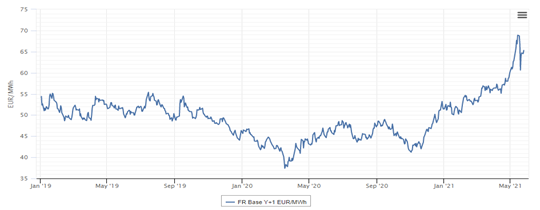

Let’s start with the liquid markets. These are all the futures products available on the European EEX platform. These futures products cover a wide time horizon: between 1 day (Day-Ahead market, often abusively called Spot market) and 3 years.

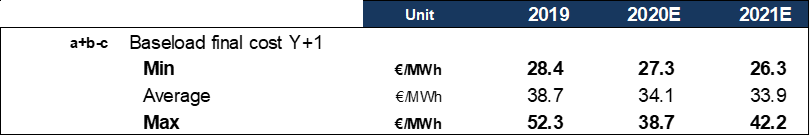

The main market indicator of these markets is generally given by the value of the Baseload product for the following year:

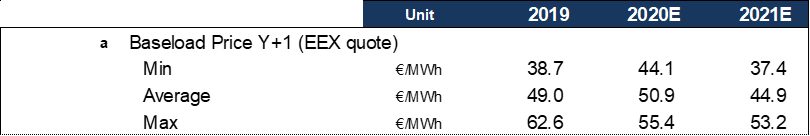

What does this mean for the market value of Baseload in France? Because of the volatility of these markets and the different time horizons (between 1 day and 3 years), the value range of this market reference is large:

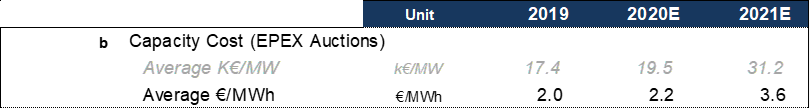

However, with these values we do not yet have the value of Baseload in France because the value of capacity is missing (limiting ourselves to the auctions preceding the delivery year):

Thus, for any given value of the Baseload range, 2 to 3.6 €/MWh of additional costs – due to the capacity mechanism – must be added.

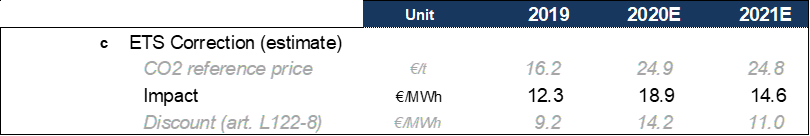

These values, which extend over a wide range (almost from simple to double), do not yet reflect a market value as in the sense given to it by the World Trade Organisation. Indeed, the European Commission acknowledges that these prices are strongly impacted by the European ETS (“CO2 market”). Thus, these prices should be corrected – at least for those sectors subject to international competition, i.e., sectors subject to the risks of carbon leakage – by adding the price of CO2 on these electricity prices (cf. European Commission Communication of 21 September 2020 on guidelines for certain State aid measures in the context of the greenhouse gas emission allowance trading scheme after 2021).

The impact of the price of CO2 on electro-intensive industrial consumers in France depends on the emission factor associated with the electricity market in France. For the period 2012-2020, this factor was 0.76 tCO2/MWh and is expected to change to 0.59 tCO2€/MWh for 2021 (see CRE deliberation of 6/5/21).

Thus, taking into account 100% of this impact (even if the European Commission considers that, as of 2019, 25% should be borne by consumers), the range of market prices becomes:

Let us now turn to the long-term markets (illiquid markets)

These markets should represent the full long-term costs of production (LCOE – Levelized Cost of Energy). For the French market – almost totally decarbonised – we will limit ourselves to nuclear and renewable “PPAs”.

For nuclear, the most famous “PPA” is the Exeltium contract, under which pricing takes some liberties with regards to the orthodoxy of the LCOE concept. Instead, it rather reflects, to a higher or lesser degree, the value of the Arenh (42 €/MWh). This value should however evolve so as to take into account, among other things, the Flamanville fiasco. Future values should be around 48-49 €/MWh (according to a confidential CRE report), whereas EDF estimated this value at around 53 €/MWh. As a nuclear PPA is likely to provide a Baseload product, these values would represent the long-term market value of Baseload in France.

As far as renewable energy is concerned – though with some exceptions –, long-term contracts are those benefiting from a remuneration complement guaranteed by the State. The latest average references are:

- Offshore wind (Dunkirk): 44 €/MWh

- Solar (2020 call for tender): 57.4 €/MWh

- Onshore wind (2020 call for tender): 59.7 €/MWh

However, and given that these technologies are not able to provide a Baseload product, it would therefore be appropriate to add the following to these prices:

- The discount of these profiles compared to Baseload products (currently this discount is around 1.5 €/MWh, for solar and onshore wind, and should increase with the development of these generation sectors due to their synchronism)

- The capacity component (these sectors have low reference rates in terms of the capacity market: 25% for offshore wind, 20% for onshore wind, and 5% for solar. This means, in the case of solar, that around 95% of the capacity price would have to be added to a solar “PPP”)

Thus, and only under certain fairly aggressive assumptions, could these values be within the ranges of liquid market prices (but without being able to claim to be impacted by the price of CO2).

Conclusion:

While the question seemed simple, the perplexity into which this avalanche of figures can plunge us is the translation of the inadequacy of the liquid markets to give a representative value of Baseload in France. This inadequacy is mainly due to the combination of:

- High dependence on CO2 and fossil fuel prices (Baseload value Y+1) although the French generation fleet is largely decarbonised,

- High dependence on the volatility of carbon marginality in the event of a drop in consumption (cf. average Day-Ahead market in 2020), a volatility that points to the changes in an increasingly decarbonised system,

- Low correlation with full production costs (LTCOE).

Faced with this inadequacy, consumers are fairly unanimously calling on the regulator and are still waiting for the promise of the Multiannual Energy Programme (PPE), which states that “the government will propose the terms of a new regulation of existing nuclear power that will guarantee the protection of consumers against market price increases beyond 2025 by allowing them to benefit from the competitive advantage linked to the investment made in the historic nuclear fleet, while giving EDF the financial capacity to ensure the economic sustainability of the production tool to meet the needs of the PPE under its low price scenarios. “

But the Commission, in its defence of the single market, does not seem to see such initiatives in a very positive light. We will have the opportunity to talk about this again in a future article. To be continued…

Philippe Boulanger