Key Insights from the French Market Analysis

Analysis of the French energy market is key to understanding the dynamics and trends affecting the sector both locally and internationally. In this detailed analysis, we address the important factors influencing energy prices, supply and demand, and the latest regulatory policies. This comprehensive overview will allow you to keep up to date with weekly changes and anticipate possible market variations, both in France and in other relevant markets such as Spain.

Table of Contents

March 2025

Key figures of the month

Energy demand and generation mix

In March 2025, electricity consumption in France during peaks in demand averaged 60.5 GW. The peak in electricity demand in March was reached on Monday 03 March, with 70.7 GW, below the levels seen the previous month (79 GW).

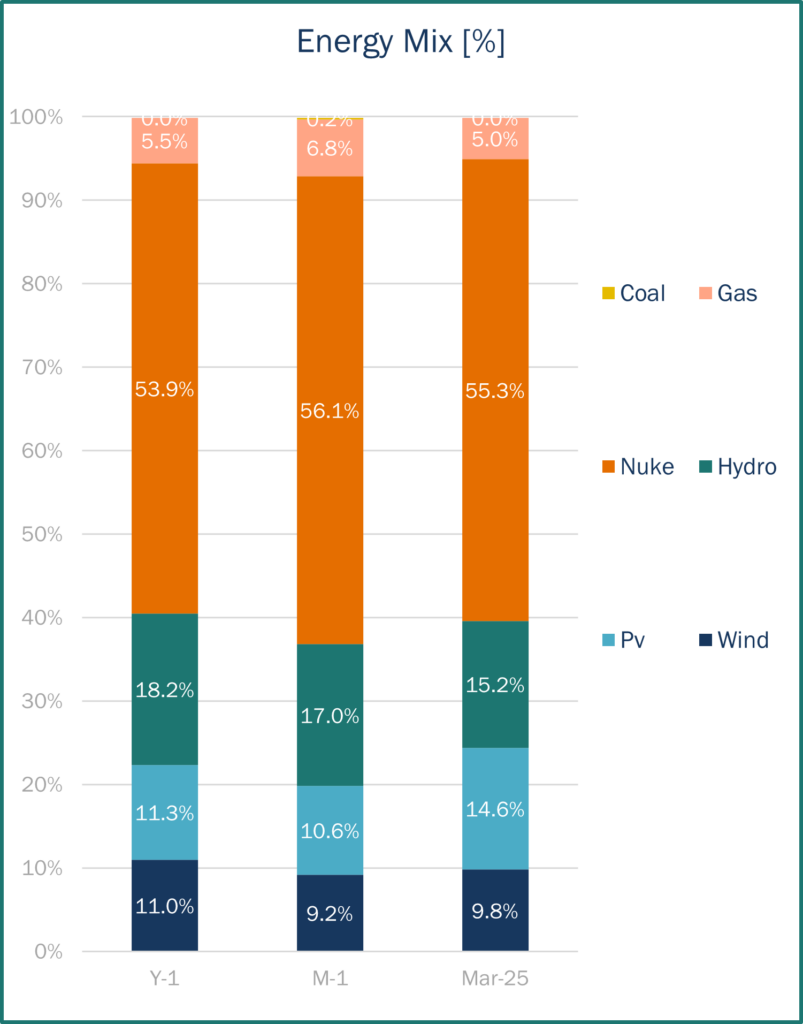

In terms of the generation mix, average nuclear generation in the third month of the year was 45.5 GWh. The average maximum output was reached beginning of March (47.6 GWh), and the average minimum output was reached on Sunday 30th. The last week of the month, 13 reactors in the French nuclear fleet were on scheduled shutdown.

In terms of renewable energy sources, as you can see from the graph, hydro energy comes second in the total energy mix and first in the renewable energy category. This ranking has remained unchanged since October 2024. Hydroelectric stocks fell from 1,334 GWh (at the end of February) to 981 GWh (at the end of March), below last year’s level (1,267 GWh). However, the trend over the last few years shows a drop until the end of the first quarter, and periods of rain should arrive in the coming weeks. In March, the days were sunnier than in previous months, as can be seen from the graph (solar production represents 14.6% in the energy mix). To follow with February’s tendency, solar generation was positioned ahead of wind generation, (which was not the case in January 2025).

Source: Haya Energy Solutions

Energy prices & market panorama

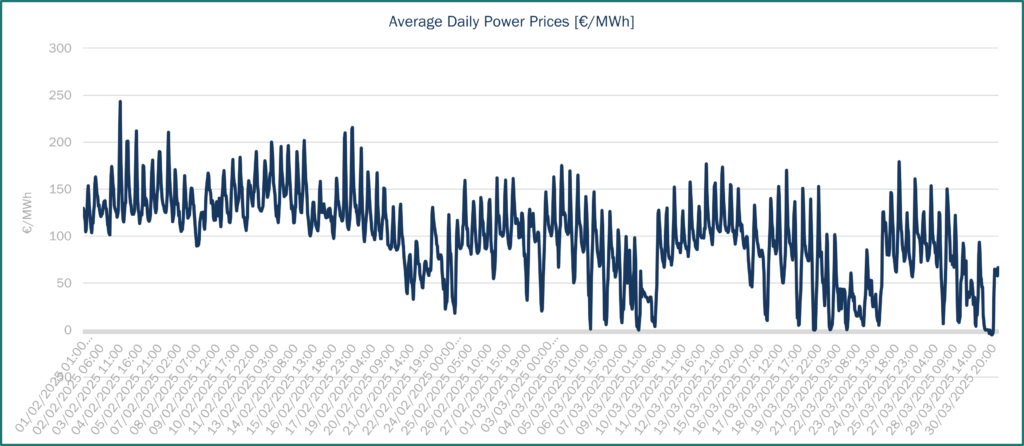

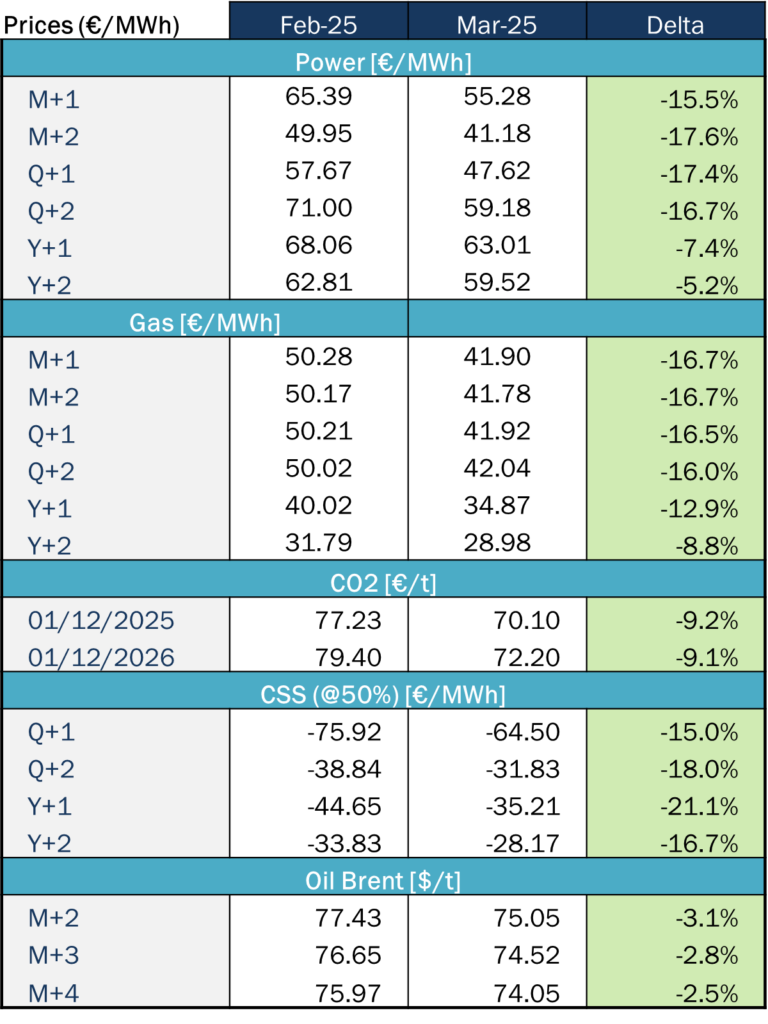

Average electricity prices for day-ahead base contracts in France reached €68.20/MWh, lower to February’s levels (€112.28/MWh) and close to Spanish contracts (€72.60/MWh) until mid-March, then Spanish prices were much lower thanks to renewable generation. As the graph shows, prices fluctuated considerably throughout the month with the minimum price for the day-ahead base contract being €17.31/MWh on 31st March, and the maximum price €121.68/MWh on 12 March. At the end of Q1, Spot prices fell under the combined effect of higher temperatures, low demand and high solar production. At the same time, with the return of solar generation, there were a large number of hours with negative prices.

Regarding imports and exports, in March, France was in a position of net exporter with all its borders, except for Spain, as seen last month, for which France imported more than it exported. Exports across the Germany-Belgium border were more frequent, but imports represented larger volumes at certain times. The maximum level of exports for the month was 15285 MW.

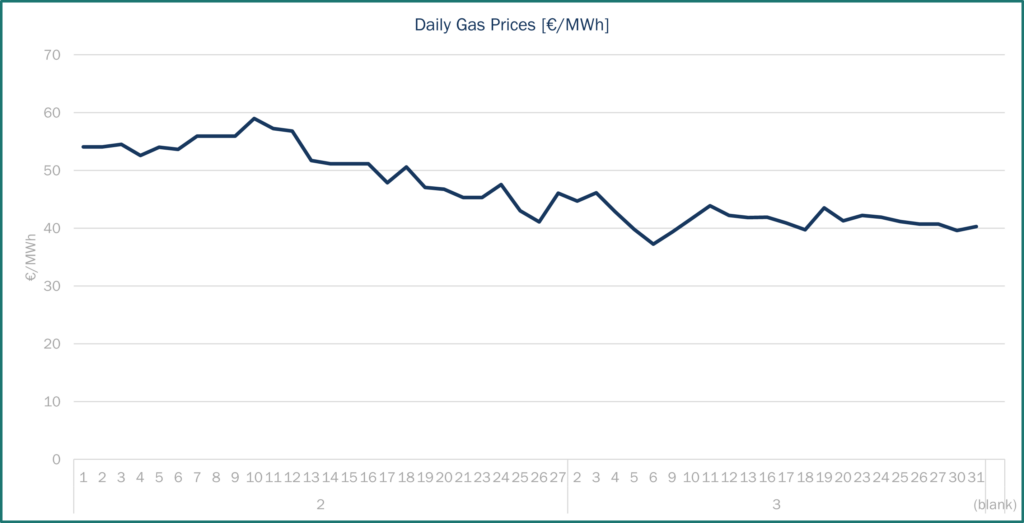

Gas prices: the TTF spot contract closed at €40.32/MWh on 31st March. Since the beginning of the year, the trend has been upwards, until mid-February when it reached its peak price (€58.98/MWh 10/02/2025), after which prices fell in fits and starts. At the beginning of March, the TTF spot contract reached its lowest level since the start of the year (€37.25/MWh).

At the end of March, France’s gas storage levels were at 24.5%, well below 2024 (37.5%). European gas stocks were depleted faster than expected this winter, but levels are close to the 2011-2021 average (33.7%).

In terms of pipeline supply, Norwegian flows have been below their maximum capacity since the beginning of the year (due to several maintenance works). As regards competition from LNG, imports from Asia and Europe remain strong, which is made possible by the increase in LNG supply.

Source: Haya Energy Solutions

Source: Haya Energy Solutions

Market trends and futures

Source: Haya Energy Solutions

Tensions and uncertainties remain in the medium term for European gas markets prospects. At the beginning of 2025, the end of the Gazprom-Naftogaz gas transit deal brought higher uncertainty to the gas market in Europe. This meant less gas supply coming to Europe, leaving the TurkStream line as the only route for Russian gas importation into Europe. In addition, the war between Russia and Ukraine is continuing. The latest news is about renewed contacts between Russian and US officials which were shown during February 2025 are towards the potential of a deal to bring a stop to the war but yet excluding the Ukrainian side. There were further talks during the beginning of March’25 to explore economic and investment opportunities between Ukraine and the US that could bring an end to the war and find “peace” throughout a deal with Russia.

In parallel, the geopolitical tensions in the Middle East continue impacting global energy developments due to the crucial role of the region in oil and gas production, thus jeopardizing Qatar LNG exports to Europe. If the conflict extends again into the Persian Gulf, it could affect the flow of LNG shipments coming to Europe from Qatar. The traffic through the Gulf is estimated to make up around 20% of the global gas exports.

Brent month-ahead oil contract prices fell slightly, from $75.05/b on February 27 to $71.30/b on March 31. Oil prices continued to decline driven by U.S. policy. Concerns over the trade war’s negative impact on demand are creating uncertainty, while efforts to quickly broker peace between Russia and Ukraine could result in a swift lifting of sanctions. Additionally, OPEC+ unexpectedly increasing production despite falling prices has further accelerated the decline.

In mid-March, the Nuclear Policy Council (Conseil de Politique Nucléaire – CPN) gave a progress report on the implementation of the “EPR2” programme, which aims to build 6 new high-power reactors at Penly, Gravelines and Bugey for initial commissioning by 2038. The financing plan is based on a government loan covering at least half the construction costs and a contract for difference on nuclear production at a maximum price of €100/MWh. Negotiations with the European Commission are due to begin shortly to validate the project. France’s nuclear fleet is getting a new look.

Regulation

PPE (Programmation pluriannuelle de l’énergie)

Work on the third multiannual energy programme (PPE) is due to be completed in the coming weeks. Following public debate until 5 April, the decree should be published, but political pressure is making the situation uncertain. The PPE involves choices between nuclear and renewable energy, and this is dividing the political parties. The PPE sets a target for the production of 577 TWh of carbon-free electricity by 2030.

Switch to a 15-minute time step

Pursuant to Regulation (EU) 2019/943, the period for settling imbalances on the electricity market has been reduced from 30 to 15 minutes since 1 January 2025. This change encourages market players to balance their injections and extractions over shorter periods and facilitates the exchange of 15-minute products on the wholesale markets. The daily market is planned for June 2025, for all European countries.

The aim of this change is to improve the integration of renewable energies by taking better account of variations in production, particularly for solar and wind power. It will also improve the flexibility of the electricity system, thanks to more accurate price signals that will encourage the development of batteries and demand response.

Against this backdrop, CRE is launching a consultation on the terms and conditions for adapting remuneration supplement (complément de remuneration). The switch from the spot market to a 15-minute granularity means that the calculation of the complément de remuneration paid needs to be modified, as does the incentive in the event of negative spot prices. Following this consultation, CRE will make recommendations to the government on adaptations to these contracts.