Analyse du marché France

L’analyse du marché français de l’énergie est essentielle pour comprendre les dynamiques et les tendances qui affectent le secteur au niveau local et international. Dans cette analyse détaillée, nous abordons les facteurs importants qui influencent les prix de l’énergie, l’offre et la demande, ainsi que les dernières politiques réglementaires. Cette vue d’ensemble permet de vous maintenir au courant des changements hebdomadaires et d’anticiper les variations possibles du marché, à la fois en France et sur d’autres marchés pertinents tels que l’Espagne.

Sommaire

Juin 2025

Figures clés du mois

Demande d’énergie et mix de production

En juin 2025, la consommation d’électricité en France lors des pics de demande a représenté en moyenne 49,6 GWh. Le pic de la demande d’électricité en juin a été atteint lundi 30 juin, avec 57,9 GWh, bien au-dessus des niveaux observés le mois précédent (43,4 GWh). Cela est dû à la canicule qui touche la France depuis la dernière semaine du mois de juin. Idem pour la production de gaz, les températures élevées ont boosté la demande et donc la production de gaz, cette tendance n’a pas été remarquée l’année dernière.

En termes de mix de production, la production nucléaire moyenne lors du sixième mois de l’année était de 39,8 GWh. La production maximale moyenne a été atteinte mi-juin (41,8 GWh), et la production minimale moyenne a été atteinte le dimanche 30. La dernière semaine du mois, 12 réacteurs du parc nucléaire français étaient en arrêt programmé.

En ce qui concerne les sources d’énergie renouvelables, comme vous pouvez le voir sur le graphique, les jours ont été plus ensoleillés que les mois précédents et la production photovoltaïque arrive en deuxième position dans le mix énergétique total, représentant 19,6 % de la production totale et première dans la catégorie des énergies renouvelables ce qui n’était pas le cas, en juin 2024, la production hydroélectrique était deuxième après le nucléaire. L’énergie hydraulique arrive en troisième position dans le mix énergétique total, avec 14,5 %. Les stocks hydroélectriques sont passés de 2077 GWh (fin mai) à 2630 GWh (fin juin), en dessous du niveau de l’an dernier (2945 GWh). Cependant, les stocks ont considérablement augmenté depuis le début du mois de mai et étaient proches des niveaux de l’année dernière jusqu’à début juin.

Source: Haya Energy Solutions

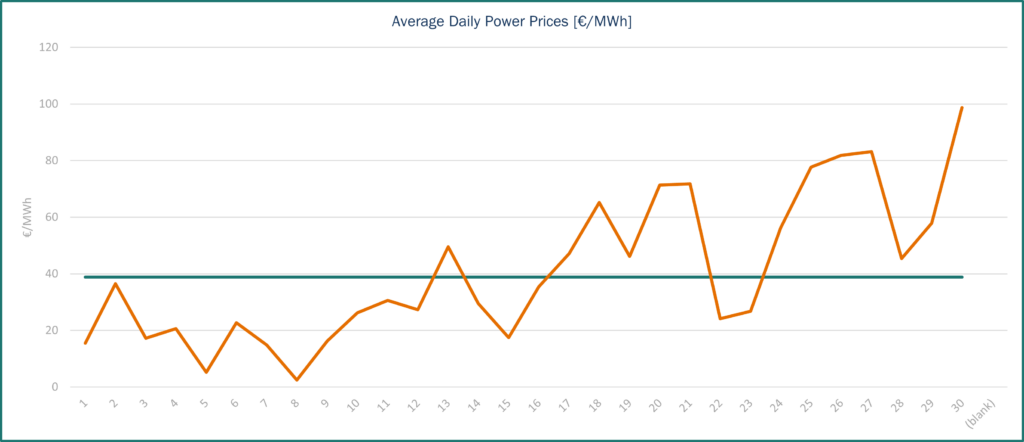

Prix de l’énergie et panorama du marché

Au début du mois de juin 2025, les prix de l’électricité en France ont éte influencés par différents facteurs. La production d’énergie nucléaire a contribué à maintenir les prix bas pendant les heures intermédiaires, soutenus par des températures douces. Cependant, entre la mi- et fin juin, plusieurs facteurs haussiers sont apparus, faisant grimper les prix de l’électricité. La découverte de la corrosion sous contrainte sur le réacteur nucléaire de Civaux-2 a provoqué une onde de choc sur le marché de l’électricité, faisant écho à la situation d’il y a deux ans, lorsque des arrêts généralisés de réacteurs dus à des problèmes similaires avaient entraîné d’importantes contraintes d’approvisionnement. En conséquence, le contrat français Cal-26 a bondi de 6,3 % en une seule journée, la majeure partie de la hausse étant concentrée sur les trimestres d’hiver, périodes généralement marquées par un resserrement de l’offre et une plus grande dépendance de la production nucléaire. De plus, une importante vague de chaleur a frappé la France, poussant les températures jusqu’à 6°C au-dessus des normales saisonnières. Cela a entraîné une hausse de la demande de refroidissement et a également réduit la production hydroélectrique au fil-de-l’eau en raison du temps sec associé.

Concernant les importations et les exportations, en juin, la France était en position d’exportation nette avec toutes ses frontières, y compris l’Espagne, ce qui n’était pas le cas les mois précédents. Le niveau maximal des exportations pour le mois a été de 15 832 MW.

Source: Haya Energy Solutions

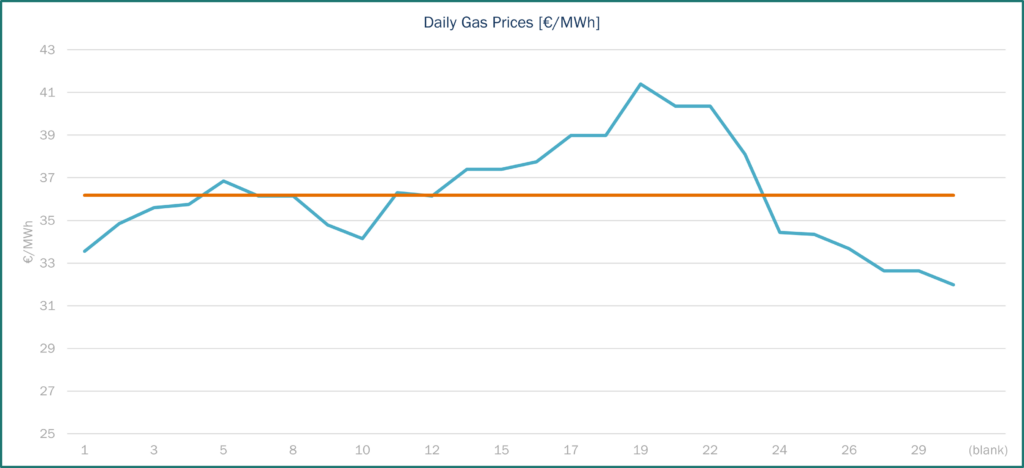

Prix du gaz, le contrat spot TTF s’est clôturé à 31,97 €/MWh le 30 juin. Depuis le début de l’année, la tendance était à la baisse, sauf mi-février où le gaz TTF a atteint son prix record (58,98 €/MWh 10/02/2025), par la suite, les prix ont baissé en dents de scie. Puis, la tendance a repris une trajectoire ascendante à partir de début mai, avec un pic le 19 juin (41,40 €/MWh), son plus haut niveau depuis début avril. Enfin, les prix spot TTF ont fortement baissé (moins 10€) pour revenir aux niveaux de début mai (juste avant la hausse).

Source: Haya Energy Solutions

Le bilan gazier européen reste tendu et les stocks de gaz de l’UE sont remplis à 58,9 % en moyenne, contre 77,42 % l’année dernière. Les niveaux de stockage de gaz en France sont à 66,29 %, en–dessous des niveaux de 2024 (68,04 %). Le remplissage estival des réserves de gaz de l’Europe progresse plus lentement que d’habitude.

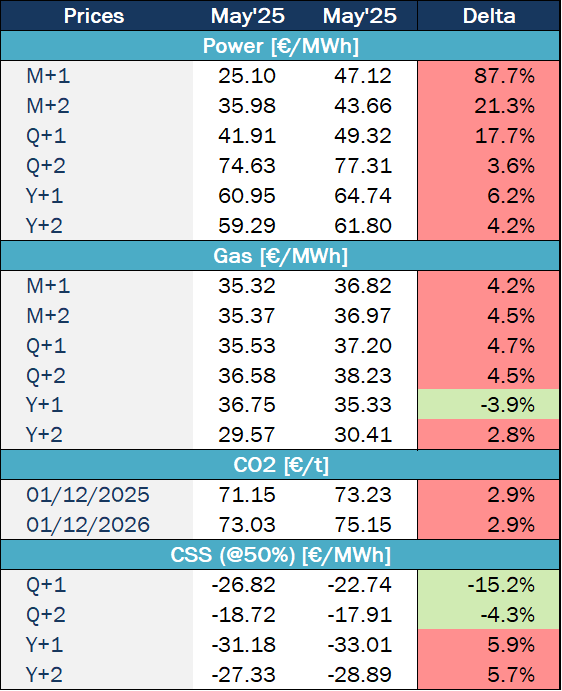

Market trends and futures

Source: Haya Energy Solutions

Le mois de juin a été marqué par des tensions géopolitiques accrues, en particulier au Moyen-Orient, alors que l’intensification entre Israël, les États-Unis et l’Iran a fait la une des journaux. Le 13 juin, Israël a lancé une attaque à grande échelle contre l’infrastructure nucléaire et militaire de l’Iran. Cela a déclenché une réaction immédiate sur les marchés du pétrole et du gaz, le Brent ayant augmenté en deux jours, passant de 72,70 $/br à 74,60 $/br. Les prix du gaz en Europe ont également grimpé, la hausse du TTF reflétant l’augmentation du risque géopolitique et les inquiétudes du marché concernant les perturbations potentielles.

Les tensions se sont encore intensifiées les 21 et 22 juin, lorsque les États-Unis ont mené des frappes coordonnées visant les installations nucléaires iraniennes. Le Brent a grimpé à plus de 80 $/br. Le marché du gaz a réagi de manière plus modérée, avec une légère augmentation, le conflit n’ayant pas eu d’impact direct sur les flux physiques de gaz.

Un cessez-le-feu a été annoncé le 23 juin et est entré en vigueur le 24 juin, ce qui a considérablement atténué les tensions. En conséquence, les prix du pétrole ont commencé à reculer, le Brent revenant à 68 $/br, proche des niveaux d’avant le conflit. De même, le TTF est retombé à 34€/MWh, ainsi, le mois s’est terminé stable par rapport à début juin, le marché réévaluant les risques réels d’approvisionnement.

Régulation

Le 17 juin, la Commission européenne a proposé une interdiction progressive des importations de gaz et de pétrole russes d’ici la fin 2027, dans le but d’éliminer complètement la dépendance de l’UE vis-à-vis des combustibles fossiles russes. La proposition comprend une interdiction de nouveaux contrats de gaz russe à partir de janvier 2026, les contrats à court terme existants prenant fin en juin 2026 et les contrats à long terme étant complètement supprimés d’ici décembre 2027. De plus, à partir de 2028, les contrats de service de terminal GNL contrôlés par la Russie seront interdits. Ce changement suscite des inquiétudes quant à la nécessité de plans de diversification suffisants et robustes entre les États membres européens.

Dans le même temps, l’UE est confrontée à un débat interne sur sa loi sur les émissions de méthane récemment adoptée, qui impose des exigences strictes en matière de surveillance et de déclaration pour les importations de gaz. Certains États membres et exportateurs américains de GNL font valoir que les règles pourraient mettre en péril le commerce transatlantique du gaz, en particulier compte tenu de la nature fragmentée de l’infrastructure en amont des États-Unis. Des discussions sont en cours sur la mise en place de mécanismes de flexibilité ou d’accords d’équivalence pour éviter de perturber l’approvisionnement tout en maintenant les objectifs climatiques.

Le mois dernier, nous avons mentionné que le Parlement européen avait approuvé une plus grande flexibilité concernant les obligations de stockage de gaz ; les règles révisées permettent aux États membres d’atteindre l’objectif de 90% de remplissage à tout moment entre le 1er octobre et le 1er décembre, en fonction de leurs calendriers de retrait. Ce mois-ci, un accord informel a été proposé le 24 juin pour prolonger le règlement de l’UE de 2022 sur le stockage du gaz jusqu’au 31 décembre 2027, au-delà de sa date de fin initiale de 2025. De plus, une fois l’objectif de 90 % atteint, il ne devrait pas être tenu de maintenir ce niveau jusqu’au 1er décembre. Les États membres peuvent s’écarter de l’objectif d’une marge pouvant aller jusqu’à 10 points de pourcentage dans des conditions de marché difficiles, la Commission européenne pouvant autoriser une flexibilité supplémentaire pour une saison si ces conditions persistent. L’accord informel devait faire l’objet d’un vote en commission à la fin du mois de juin.