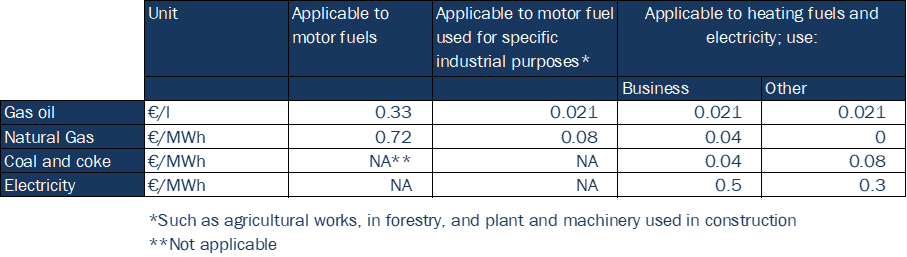

For information, the Energy Tax Directive minimum rates :

- Accounting methodologies in need of refreshing. New and less carbon-intensive fuels emerged after the 2003 adoption of the ETD are taxed at the same volume rate as the competing fossil fuel, discouraging the use of the former. For example, 1 litre of standard diesel has 39 MJ of energy, while the same volume of biodiesel has only 33MJ. This means that, for a tax of 0.33€/l, the equivalent tax for standard diesel is 8.5€/GJ while for biodiesel is 10€/GJ.

- Possibilities of tax reductions and exemptions on fossil fuels: including gas oil used in agriculture, gas oil and coal used by households to heat (understandable for vulnerable households) or fossil fuels used by energy intensive industries

- A mandatory tax exemption for maritime and aviation fuels.

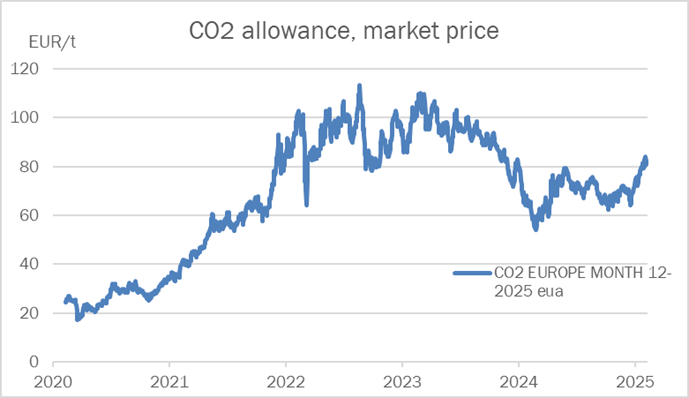

More climate-focused than the existing energy excise, the EU Emissions Trading System (ETS) sets a cap on emissions for industries and allocates allowances that can be traded, creating a market-driven approach to switching to greener energies and reducing carbon output.

The interaction between the EU ETS and energy taxation is complex: while the ETS covers large emitters like power plants and heavy industry, energy taxes often apply more broadly to smaller businesses and households. But there are risks of overlapping and double taxation.

For example, in France, an industrial plant consuming natural gas is covered by the EU ETS, which requires it to buy allowances for its CO₂ emissions. At around €80/tonne of CO2, with an emission factor typically of around 0.4 kg CO2/kWh, the cost of purchasing CO2 would be around €32/MWh for the plant. In addition, it is subject to excise duty on natural gas (TICGN) at €8.37/MWh, which already includes a carbon tax (CCE). As a result, the industrial plant must bear a cost of €40/MWh for its energy consumption (numerous exemptions exist, but they are sometimes partial or subject to strict conditions). These overlapping measures can lead to higher marginal abatement costs than necessary for optimal emission reductions. The revised Energy Tax Directive will be more aligned with other recent programs, such as the EU ETS, reducing the risk of overlapping measures.

- Establish a revised structure of tax rates based on the energy content and environmental performance of fuels and electricity and broadens the taxable base.

- Remove anomalies i.e. the mandatory tax exemption for maritime and aviation fuels.

- Be better aligned with and complement existing environmental programs, such as the ETS.

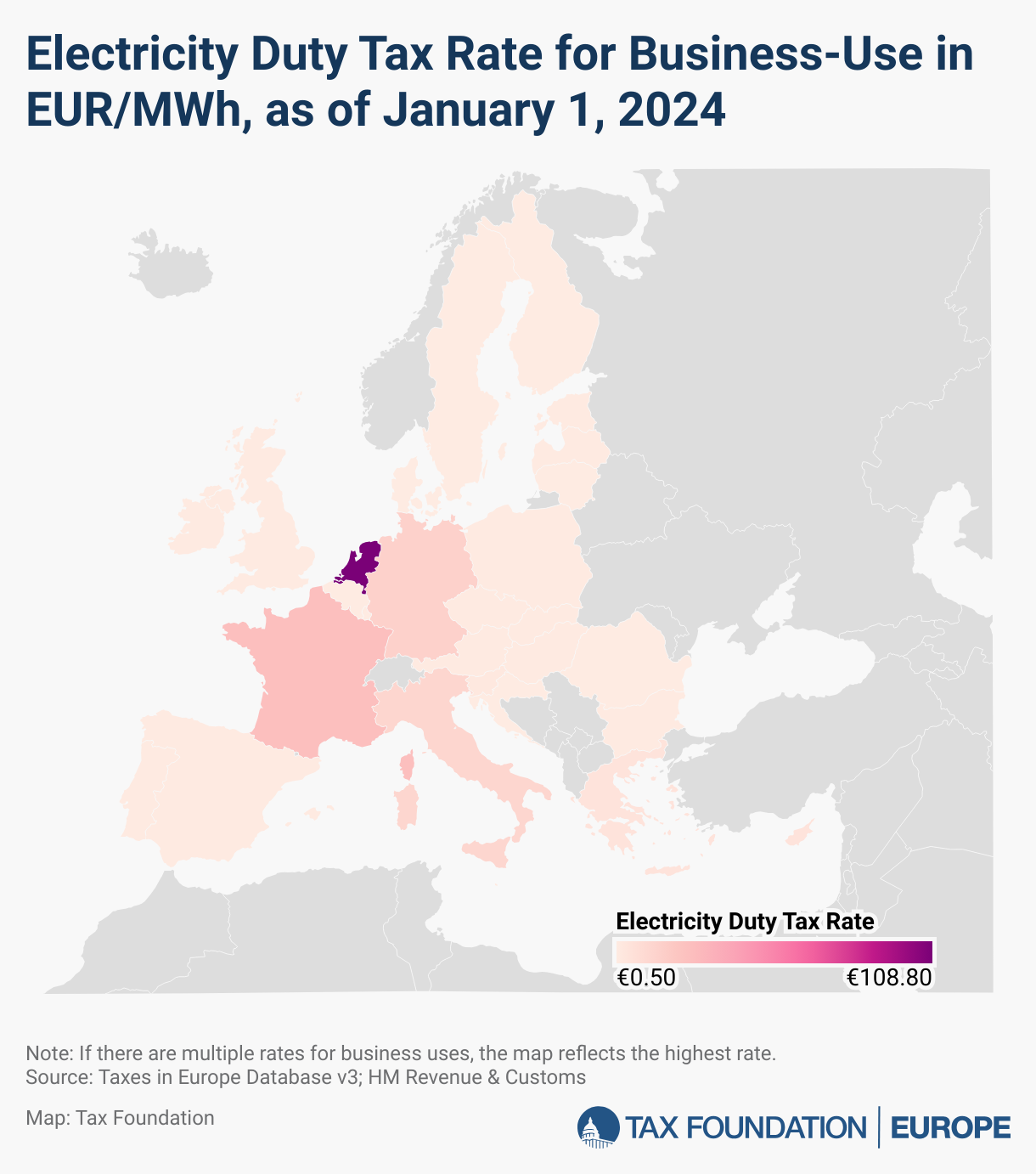

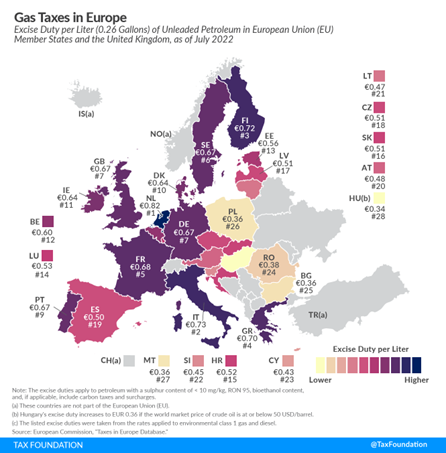

- Reduce geographical disparities by aligning countries with higher minimum fossil fuel taxes – pushing those with lower rates to raise them closer to the higher rates of other countries.

Thibault Uhl