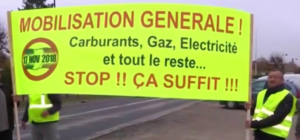

While the debate surrounding the ‘yellow vests’ seemed to focus primarily on the taxation of hydrocarbons – CO2-emitting fossil fuels -, the issue of the price of electricity – which, in France, rightfully crystallises around the evolution of regulated tariffs, as virtually all offers to individuals are indexed there – is beginning to gain momentum. It’s certainly not the prospect of having a ‘small’ law on energy at the start of 2019 that is going to put minds at ease. As is well known to all, electricity in France is largely low-carbon (between 50 and 100kg of CO2 per MWh on average currently), and French electricity consumers will be inclined to believe themselves shielded from any carbon price effects. Faced with the rumour, doubt sets in, and finally, the question is raised: does the cost of CO2 affect electricity prices? The answer is yes. A residential customer in France pays for CO2 emissions at a price equivalent to €92.80/Tn.

While the debate surrounding the ‘yellow vests’ seemed to focus primarily on the taxation of hydrocarbons – CO2-emitting fossil fuels -, the issue of the price of electricity – which, in France, rightfully crystallises around the evolution of regulated tariffs, as virtually all offers to individuals are indexed there – is beginning to gain momentum. It’s certainly not the prospect of having a ‘small’ law on energy at the start of 2019 that is going to put minds at ease. As is well known to all, electricity in France is largely low-carbon (between 50 and 100kg of CO2 per MWh on average currently), and French electricity consumers will be inclined to believe themselves shielded from any carbon price effects. Faced with the rumour, doubt sets in, and finally, the question is raised: does the cost of CO2 affect electricity prices? The answer is yes. A residential customer in France pays for CO2 emissions at a price equivalent to €92.80/Tn.

However, this time, the cause is neither the French CO2 tax, the Climate-Energy Contribution (CCE) – whose value according to the French Finance Law of 2018 is €44.6/Tn of CO2 in 2018, expected to be €55/Tn of CO2 in 2019 and €86.2/Tn of CO2 in 2022 – nor the CSPE, – which, thanks to the CCE, doesn’t seem to be rising from its rate set in January 2016 (€22.5/MWh) – but the value of CO2 in the European market, the European Union Allowances (EUAs) of the European trading system (ETS).

Here, we must include a disclaimer, as the ETS is a particularly sensitive subject in Europe, any questioning of which would be tantamount to opening a real Pandora’s Box. Even if the exercise of explanation sometimes requires demonstration of critical thinking, the author of this article wishes to express his complete commitment to the European environmental objectives in general and those established in the Paris Agreement in particular.

The value of EUAs has three-folded, even four-folded, in 2018 to reach a current price of approx. €25 (per tonne of CO2 equivalent) and, because of the organisation of the electricity markets, a €1 increase in EUAs rises the price per MWh of electricity by nearly €1… from Norway to France. This is a well-known phenomenon and is even quantified within the Energy Code[1] in France: €1 increase in the EUAs is reflected on average by a €0.76 increase for a MWh of electricity purchased on the French market.

On this basis, the market price of electricity in France (currently around €61/MWh for 2019) would include an estimated additional cost of 25×0.76=€19/MWh on account of the ETS. Thus, returning to the average of electricity production emissions in France (less than 0.1 tonne of carbon dioxide per megawatt hour), the weight of carbon taxes on electricity prices in France is therefore more than 19/0.1=€190/Tn of CO2! (More than 4 times higher than the CCE applied to fossil fuels!).

How can we justify that electricity is the most highly taxed energy for CO2 emissions in France?

France had placed limits on this incongruity by establishing the ARENH mechanism at €42/MWh, thereby largely eliminating the impact of the ETS (the difference between the market price and the ARENH is indeed in the order of the €19/MWh previously mentioned).

The current problem is that, for the first time since its establishment in 2011, on account of the competition’s development, the French Energy Regulatory Commission (CRE) announced on 29/11/2018 that the [ARENH] rights would be reduced for 2019. The part of regulated selling prices of electricity (TRV) that is market-driven will increase on account of this reduction (in the range of 25%). In their press release dated 29/11/2018, the CRE thus announced the next increase of the same regulated selling prices.

Until now, individual consumers were exposed to the market for the energy part of their supply that is not covered by the ARENH. Moreover, mainly owing to the low value of EUA prices in recent years, the difference between the ARENH price and the market prices was small (indeed, in certain years, like in 2016, the market price was even more competitive). However, the same cannot be said for 2019, as the consumer will suffer double the punishment: an increased part subject to the market price (on account of the ARENH reduction) and a higher market price resulting primarily from the increase of EUA prices.

In more specific terms, the average part of the ARENH rights in regulated prices is 68%[2]; thus, prior to ARENH reduction, 32% of the supply depended on markets prices. As the demand exceeded the ARENH ceiling, ARENH allocation will be reduced at 75.23% of the ARENH rights for 2019, and now such exposure increases to 48.84% of the supply. Thus, the ‘CO2 tax’ on account of the ETS is reduced to approximately 19×48.84%, or €9.28/MWh. Returning to a CO2 emission factor for French production of 100kg/MWh, this corresponds to a carbon tax of €92.80/Tn (which is doubled based on an emission factor of 50Kg/MWh!)

We’re sorry for the complexity of these explanations. Unfortunately, solutions to the current environmental taxation crisis (CSPE, CCE, TICGN [domestic consumption tax on natural gas], EUA, etc.) will only be found through the complete and open-minded understanding of mechanisms resulting from combinations of both national tax policies and European market-type mechanisms – combinations which, due to their nature, are poorly controlled.

Philippe Boulanger

[1] Article R122-14: ‘the emission factor for electricity consumed in France, cited under 2 in III of the same article, is set at 0.76 tonnes of carbon dioxide per megawatt hour. ’

[2] Deliberation by the Energy Regulatory Commission dated 12 July 2018 on proposed regulated tariffs for electricity sales.