On 21 March, the first auction of capacity certificates for the 2020 year resulted in an exchange of 4.17 GW with a price of €20K/MW. This price remains consistent with 2019 prices (€17.365K/MW on average) and confirms the constant increase of the capacity price in France.

According to our analysis, the margin of the supply/demand balance for 2020 is decreasing with the closure of Fuel Oil power stations and certain cogeneration plants, as well as the scheduled unavailability of the nuclear fleet due to long-term maintenance. This deficit of conventional power production is partially offset by the rise in renewables generation. On the other hand, RTE´s [the French Electricity Transmission Network] scenarios envisage a flat supply trend, slightly shrinking in fact.

This first auction for 2020 delivery (AL2020) should set the trend for the remainder of the year. Unlike the intermediate auctions for the 2019 year (AL2019), this time EDF was indeed present in terms of demand, helping the value reach €20K, very close to the marginal offer of nuclear power. This confirms that the price offered for EDF’s nuclear capacity is once again becoming a marker for the certificate price in France, under current electricity market conditions. The difficulty for forecasters is to determine the relationship between this capacity’s marginal pricing, the implicit (or actual?) price of nuclear energy in the market and the nuclear power fleet’s corresponding ‘missing money’, an exercise that requires some imagination. Capacity buyers and sellers should dive into resolving this essential equation for future certificate quotations.

- Supply/demand balance for 2020 certificates

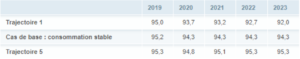

In terms of obligation, there are no massive changes for 2020. RTE has just published its latest consumption forecasts, in line with the earlier adequacy reports, which show a slight reduction in demand for the 2020 year (-0.5 GW / -1.3 GW) depending on the scenario chosen. Looking further ahead to 2023, it should be noted that none of such scenarios envisages an increase in demand.

However, when it comes to the certification side, the situation is more complex:

- Cross-border: the certification of cross-border capacities (6.3 GW) is going to be complicated. In addition to an agreement between neighbouring Transmission System Operators (TSOs), which will take some time, auctions for interconnection tickets will need to be implemented, as well as some verification mechanisms. We don’t believe that foreign capacities will directly participate for the 2020 year. With regards to failsoft mode, the simplified procedure stipulated under the rules of the capacity mechanism allows TSOs to directly manage foreign capacities, but only in 2021 for Y2020 capacities. Therefore these 6 GW will not be available in their entirety for the current year.

- Load shedding: RTE has just released a call for tenders for capacities that can handle load shedding, with a goal of 2.9 GW for 2020. According to the rules of this call for tenders, the sale of capacity certificates is, implicitly, deducted from their remuneration. This calculation will be made using only the value of the last auction for the year preceding the supply (December). As a result, the volume corresponding to the load shedding involved in the call for tenders will not be offered to the market until the 5 December auction.

- Evolution of the offering: the level of certification for the 2020 supply year will be fairly close to the 89.5 GW of the 2019 year, or even at a slightly higher level if the call for long-term tenders allows for new capacities to be certified for the 2020-2026 period. It is important, however, to pay careful attention to the evolution of nuclear availability, which may vary in line with the ten-year maintenance plans and the forced unavailabilities that are particular to this sector.

- What’s new this season

The French capacity mechanism, which is extremely complicated, also shows a concerning level of instability for a regulation called upon to issue long-term signals. For example, the 2018 year gave rise to seven consultations (CRE and RTE) and the establishment of no fewer than five working groups, which led to a few significant changes, as detailed below:

- A new rule for calculating the price of imbalances has just been adopted: in its decision of 28 February 2019, the CRE determined that the reference price for capacity imbalances, known as ‘PREC’, was to be defined as follows:

- For supply years (ALs) 2017 to 2019, the PREC is defined as the simple arithmetic mean of prices revealed by auctions held on organised exchange platforms, between 1 January AL-4 and 31 December AL-1;

- For supply years (ALs) 2020 and successive ones, the PREC is defined as the price revealed by the last auction held on organised exchange platforms preceding the supply year.

- Interconnection capacities are required to be available for AL2020, but…:

- For AL2019, only the failsoft mode is implemented, and RTE will therefore sell all of its capacities at the 16 May 2019 auction, with an ‘at-any-cost’ offer in accordance with RTE’s 22/11/18 communication;

- For AL2020, the deadline for signing a participation agreement (according to the procedures approved by the CRE in its decision of 24 January 2019) is 30/6/2019. After this date, we risk finding ourselves in the same situation as we did for 2019: resorting to failsoft mode.

- New multi-year capacity: RTE committed to releasing four calls for tenders between now and June 2019, for the 2020-2026, 2021-2027,2022-2028 and 2023-2029 periods. Successful tenderers will be awarded a seven-year contract for difference. The result of these calls for tender will be announced two months after the closing date, which is expected to be 5 December 2019. We therefore feel that this new system will have no impact on the offer level for this year, and thus on the capacity mechanism balance for the current year. However, this multi-year capacity would be entitled to participate in the capacity mechanism during any potential rebalancing auctions planned for AL2020 during 2020.

- 21 March auction for the 2020 year

This first auction for the 2020 supply did not go well. The certification level was extremely low (20% fewer certifications than in the 2019 year). This gave the impression that those involved were not in a hurry to have their capacities certified. Only 78.4 GW were certified as of 21/03/2019. This level of certification is a clear anomaly: certain sectors, including hydraulic pumping, dams, run-of-the-river facilities and locks were under-certified. More consistently, load shedding capacities were just as under-certified, in order to align with the call for tenders described above.

As usual, the demand from alternative suppliers was not expected in this intermediate auction. The dissuasive effect of cash payment for purchases made in the EPEX auctions, in the face of a deferred recovery at the time of supply, was one of the design flaws of the capacity mechanism, which has dried up the liquidity of auctions since the beginning. Hence, no surprises there. The CRE seems to be encouraging this trend through its emergency decision of 28 February, which includes the sole price of the last auction in AL-1 as a market reference (to calculate imbalances). Therefore, suppliers’ demand will most probably not be present until the December auction in the year preceding the supply year. It’s still possible, though, that certain suppliers will be looking to match the cost for capacity included in the regulated selling price (TRV), which involves simulating the AL-1 and AL-2 auction prices, but we fear that they will still be more attracted to the payment on delivery of OTC markets than to auctions with up-front payment.

On the other hand, and quite fortunately, EDF bore considerable weight at the latest auctions, ensuring continuity and proper functioning of the mechanism. Furthermore, this time EDF positioned itself on both the demand and supply sides to cover itself against market disruptions. An offer with two large enough nuclear thresholds which amounted to approx. 3.5 GW. The first threshold, of approx. 700 MW, was offered at a price of around €17.6K/MW, and the second threshold, of approx. 2.8 GW, at a price in the region of €18.8K/MW, combined with an ‘at-any-cost’ demand of 3.5 GW (capped at €60K/MW), which could only end with a higher result than the marginal pricing of nuclear power generation.

Conclusions

The price for AL2020 is therefore set around the threshold of €20K/MW, most likely with an upward trend in the coming auctions. AL2021 and AL2022 prices, depending on the supply/demand balance, should follow this upward trend.

CRE’s decision to set the price for imbalances using the auction from the December preceding the supply year (AL-1), as illustrated by RTE’s 2020 load shedding call for tenders, runs the risk of pushing players to use the PERC as a reference for market prices and withdrawing their participation from the 14 previous auctions. Hence, only EDF would have the need to participate in each of these end-of-year auctions (December AL-4 to AL-2) to fulfil the obligation imposed on them by the Commission to place a certain quantity of certificates on the market, counterbalancing it with a certain demand in order to reach an equilibrium price. As with the March auction, we shall then see EDF opposite EDF. And the rest of the market left as passive spectators… and recipients of prices decided by EDF.

And this is what we call deregulating the markets…

Antonio Haya