The French capacity market continues to deliver auction after auction. In the last auctions, for 2025 and 2026 delivery years, prices were depressed to €6.19k/MW and €3.54k/MW respectively. The least we can say is that the French capacity mechanism has turned out to be an atypical market in terms of its design and volatility.

Since its implementation in 2017, HES has put significant effort into uncovering the intricacies of the French capacity market. Without needless triumphalism, we can confidently say that the clients we have guided through this market journey have been thoroughly satisfied. Whether “obliged” actors (certificate buyers) or “certified” actors (sellers), thanks to the expertise of HES, our clients have conducted their market operations with more than satisfactory results…Creation of the French capacity mechanism With the shift toward renewable energies, the gradual disappearance of coal and oil, and the aging of nuclear plants, France recognized the need to ensure sufficient capacity during peak demand hours. In 2011, it introduced the capacity mechanism (“Mecapa”) to tackle the emerging challenges in a particularly “thermo-sensitive” country, where electricity demand spikes with colder temperatures.

Once it was evident that marginal dispatchable plants — those operating only a few hours yearly due to high variable costs — would struggle in a renewables-driven market, capacity markets were established in the UK, Ireland, and later France. These markets aim to generate revenue for actors contributing to grid stability, even during exceptional demand. Though mechanisms vary, all share the goal of preserving endangered production capacities and encouraging new facility development. France opted for a universal mechanism, where all actors, who contribute to the stability of the system at peak demand times, are remunerated in the same way 1. And, somewhat more sui generis, it established a decentralised market, where buyers (obligated actors) and producers (certified actors) would meet freely to satisfy their needs 2. The rights and obligations on both sides of the equation would be traded through certificates. In an avant-garde gesture, the possibility was also included that demand management (demand reduction in the face of high prices) could participate in the market from the production side. A reduction in demand would be treated in the same way as an increase in production. After a long dialogue with the European Commission, which at the time was entrenched in the dogma of “energy-only”, France succeeded in obtaining the validation of its Mecapa, which would come into force in 2017 with a maximum validity until 2026.

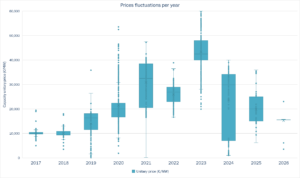

Capacity prices have been extremely volatile If we analyse Mecapa’s price history, it is not possible to conclude any short- or long-term trend. As can be seen in the graph, the prices of capacity certificates for different years vary significantly, going from €10k/MW in the initial years of the mechanism to a peak of €45k/MW in 2023, which then drops again in 2025 and 2026.

Source: HES, RTE

Even more surprising is the dispersion of prices within the same delivery year. For example, in 2020, prices ranged from €1.9k/MW to €53.7k/MW. We could expand on the reasons for this observed volatility, but we believe it is more useful to draw conclusions from this fact in optimising the buying or selling strategy.

The right strategy Many actors in the French energy sector have interpreted the capacity mechanism as a “levy” or tax proportional to the volume of their portfolio. Instead of exploring its particularities, they have limited themselves to buying or selling capacity to align with the market average (following the theory that it is better to be wrong together than right alone). This conservative approach, which seeks to comply with regulatory requirements without taking advantage of the particularities of the system, responds in part to the inherent complexity of the Mecapa and price volatility, factors that have discouraged players from taking more risky or innovative strategic positions.

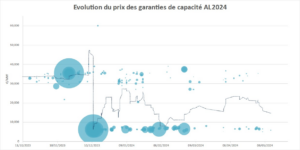

Over the years, HES has helped actors to understand and manage the fundamentals of the mechanism to obtain substantial economic benefits. Taking advantage of these conditions requires a deep understanding of the market and the definition of a rigorous strategy. If there is a range of more than €50k/MW for the same year of delivery depending on the time of purchase, it is essential to time these purchases appropriate.

Source: HES, RTE

Depending on the client’s interests and risk profile, the winning strategy is based on a detailed analysis of estimated certification levels, close monitoring of production in France (particularly nuclear generation) and, finally, a keen insight into the dynamics of auctions. At HES, we have developed a proprietary methodology and models that allow us to identify key trends in the system, analyse its fundamentals and design a precise capacity sale or purchase strategy. With this strategic tool, our clients can operate in the market in an informed and advantageous manner, maximising their profits, reducing costs and minimising risks.

New rules RTE has been preparing for years a fundamental change of the Mecapa rules. The new Mecapa will move from a decentralised to a centralised system, where RTE will assume the role of a single buyer. This change will come into effect by winter 2026-2027. From then on, suppliers will only be responsible for forecasting and correctly passing on capacity costs to their customers. Purchasing dynamics will no longer be.

For the delivery years 2023 to 2026, which will continue to be addressed until 3 years after the delivery period, there are still opportunities to capture. At HES we can help you take advantage of them!

Antonio Haya