In a report made public on Friday 7 June (Gas 2019), the International Energy Agency (IEA) states that the demand for natural gas grew by 4.6% in 2018, its fastest annual rate since 2010. Gas represented nearly half of growth in primary energy consumption in the world.

Consumption of natural gas should grow at an average annual rate of 1.6% between now and 2024, returning to the pre-2017 trend. Even at a slower pace, the worldwide demand for natural gas will continue to increase, driven by high rates of consumption from fast-growing Asian economies, China’s support for fighting atmospheric pollution and the continuing development of the international gas trade. It should reach over 4,300 billion cubic metres in 2024, versus 3,900 in 2018. Electricity production remains the number one consumer of natural gas, representing nearly 40% of the total demand between now and 2024.

‘Natural gas has helped reduce atmospheric pollution and limit energy-related CO2 emissions by replacing coal and petrol in the production of electricity, heating and industrial uses,’ declared Fatih Birol, Executive Director of the IEA. ‘Natural gas may contribute to a cleaner global energy system. But it has its own challenges to face, particularly remaining competitive in emerging markets and reducing methane emissions along the entire natural gas supply chain.’

The key points of the IEA’s Gas 2019[1] report are the following:

- Demand for natural gas is still growing

The United States was a driver for growth in the demand for gas last year, with half of this growth attributable to the conversion from coal to gas. Weather conditions also had a major impact on the demand for gas in the United States, with a colder-than-average winter and a hotter summer. Demand for gas in China grew by nearly 18% since the country sped up its efforts to reduce local atmospheric pollution.

Over the next five years, demand for gas should be driven by Asia Pacific, which will supposedly represent nearly 60% of growth in the total consumption between now and 2024. China, despite being slower in recent years, will remain the primary driver of growth in the demand for gas, representing nearly 40% of the growth in the global demand for gas between now and 2024. Its annual growth rate will be 8% between now and 2024 due to a contraction in economic growth.

Electricity production will be the primary driver of growth in the Middle East. However, it’s the industrial sector that should represent nearly half of growth in the consumption of natural gas throughout the world, covering both energy needs and the use of natural gas as a raw material for chemical products.

- The United States is still at the head of production growth

Gas production in the United States surged up by 11.5% in 2018, its highest rate of growth since 1951, making the country the largest contributor to the growth of gas production in the world.

The United States and China will be the two primary individual contributors to the growing supply up to 2024, jointly representing over 50% of growth in the total production. However, as production will chiefly grow to meet the needs of internal markets in multiple regions, in certain cases – such as China or Southeast Asia – it will not be able to keep pace with the growing demand.

The development of exports will therefore be more concentrated, with the United States, Australia and Russia combined representing the vast majority of growth in exports of natural gas until 2024.

- LNG markets are changing

The LNG market should see profound changes over the next five years.

Investments in LNG projects rebounded in 2018 after several years of decline, and a great number of projects whose final investment decision is set for 2019 should lend more support to the expansion of the global LNG market. However, additional investments will be necessary in the future.

China and India will emerge as the primary purchasers of LNG, in parallel with the increased imports to Europe. While on the supply side, the emergence of a trio of large exporters will see Australia overtake Qatar in 2022, with the United States then overtaking Australia by 2024.

American liquefied natural gas (LNG) is, in fact, the main contributor to the growth of the global natural gas trade. In the absence of confirmed investment plans from Qatar, the United States will become the largest exporter of LNG in the world, with 113 billion cubic metres in 2024.

- Security of supply in Europe

While gas consumption in Europe should remain relatively stable in the coming years, local production should fall by an average of 3.5% per year, chiefly due to the gradual halt of extraction at the Groningen gas field in the Netherlands and the decreased production in the North Sea.

This structural decline of countries’ national production, combined with the expiry of several long-term pipeline import contracts, will create opportunities for new supply sources, such as the Eastern Mediterranean and LNG.

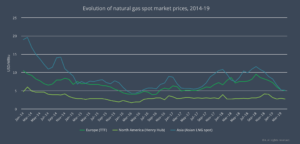

- Are we headed toward a global price convergence?

Gas market prices in large consumption areas are converging throughout the world. Pricing disparities have greatly decreased since the last quarter of 2018, particularly between Asia and Europe, thanks to well-supplied markets. But the Asian spot market is still facing greater volatility in prices due to increased seasonal variation.

The expansion of the LNG trade should most likely encourage a greater convergence of prices, while relieving the backlog of capacities from pipelines in the United States’ Permian Basin should help keep prices low. Nevertheless, in the absence of additional investments in LNG capacities, the outlook for a market under more pressure would also involve a return to greater disparities in regional pricing.

Philippe Lamboley