The famous capacity auction of June 25th, 2020 has given its verdict and the results are exceptional!

As a reminder, last Thursday, June 11th, RTE stated the risk regarding the security of supply for next winter (2020/2021) to be high. The balances between supply and demand for capacity guarantees show the following situation:

- for the 2020 delivery year: a clear trend towards an overall deficit of more than 2 GW (deficit in the range of 4.6 GW to 7.9 GW depending on the scenario considered for the level of obligation)

- for the 2021 delivery year: no clear trend but the possibility of an overall deficit of more than 2 GW (possibility of a surplus of 1.3 GW or a deficit of 2.1 GW depending on the scenario considered for the level of obligation)

With this new perspective, we were expecting the price of capacity for the 2020 delivery year to increase, at least, until the level of suppliers’ obligation is updated. Same for 2021, but to a lesser extent.

In the end, the results have been as follows:

- 2019 Delivery year: Price = 394.5 €/MW, Volume = 1 970.8 MW

- 2020 Delivery year: Price = 45 000.8 €/MW, Volume = 498.2 MW

- 2021 Delivery year: Price = 47 401.0 €/MW, Volume = 3 859.6 MW

- 2022 Delivery year: Price = 38 966.4 €/MW, Volume = 4 333.5 MW

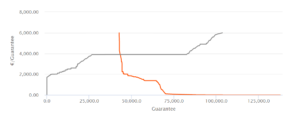

For the 2020 delivery year, looking at the aggregated auction curves, we can see that the high clearing price was the result of a lack of supply, especially of nuclear certificates. Ultimately, this lack of supply could have been slightly mitigated if the ARENH capacities, which would have to be recovered in case of a definitive suspension of certain contracts, had been included. However, there is still some uncertainty as to the final recipient/-s of these certificates.

Figure 1. AL 2020 auction aggregated curves

However, for the 2021 and 2022 delivery years, the long capacity plateau has set the price. The length of this plateau and the level of demand set at the cap price made it very difficult for another lower strike price to emerge.

Figure 2. AL 2021 auction aggregated curves // Figure 3. AL 2022 auction aggregated curves

While year 2022 did not seem, until now, to be the subject of particular attention from the point of view of security of supply, the result of these auctions for the 2022 delivery year may be surprising and may reflect a certain fragility of the system beyond 2021.

These results still fit in well with the follow-up of RTE´s announcements, the consequences of which will undoubtedly continue to be felt both on the future transaction of the capacity market and on the energy-only market.

As a reminder, after the decision of the Paris Commercial Court to rule in favour of the temporary suspension of the ARENH supply, EdF had announced the suspension of the contracts in question for the rest of 2020. As a result, and in view of the result of the 2020 delivery year auction, if such ARENH contracts became definitively suspended, players lacking capacity guarantees due to this suspension would probably have to buy them at high prices.

This conflict against alternative suppliers, which until now has been limited to the legal context, is now extending to the electricity markets with new developments still to be expected.

Ibrahima Baldé