Key Insights from the French Market Analysis

Analysis of the French energy market is key to understanding the dynamics and trends affecting the sector both locally and internationally. In this detailed analysis, we address the important factors influencing energy prices, supply and demand, and the latest regulatory policies. This comprehensive overview will allow you to keep up to date with weekly changes and anticipate possible market variations, both in France and in other relevant markets such as Spain.

Table of Contents

January 2026

Key figures of the month

The European energy markets have undergone significant changes compared to the previous month, with spot electricity prices experiencing a rebound across the majority of hubs following the increase in demand due to very low temperatures and the softness attributed to renewable sources observed in some cases. In contrast to last month’s notable declines in Germany and the United Kingdom, and France recording the lowest average, the latest data indicates a substantial increase in spot prices. The United Kingdom is once again prominent, with prices reaching 131.00 €/MWh, while Germany has risen to 110.20 €/MWh. This increase reflects renewed system tightness and elevated marginal generation costs. France has experienced a sharp increase to 100.65 €/MWh, thus relinquishing its status as the most economical market, whereas Spain remains the lowest-priced hub at 80.26 €/MWh, and Italy continues to operate at a structural premium of approximately 107.37 €/MWh.

In contrast to the rebound observed in spot prices, Power Cal’27 contracts have shown only limited upside compared to the previous month in the UK, Germany and Italy, while remaining broadly stable in Spain and France. This reflects a medium-term outlook in which markets anticipate some normalization of fuel costs as extreme cold conditions ease, while Spain and France continue to benefit from strong renewable generation and robust nuclear availability heading into 2026.

Gas prices have stabilized in the mid-30s €/MWh after reaching multi-month lows in December, with forward gas prices still trading at a discount, reinforcing expectations of a structurally looser market. Meanwhile, carbon prices remain elevated, providing ongoing support to thermal generation costs despite the softening of power forward curves.

Overall, the market has shifted from the weather- and renewables-driven bearish environment seen in December to a tighter and more volatile spot market, while forward prices continue to signal a softer trajectory beyond 2025.

Energy demand and generation mix

In January 2026, average electricity demand in France reached 66.2 GW. Peak demand of the month occurred on the 6th January, when consumption peaked at 90.3 GW, around 20% higher than in December (75.0 GW). This surge was primarily driven by very low temperatures combined with a strong rebound in industrial and commercial activity following the holiday period.

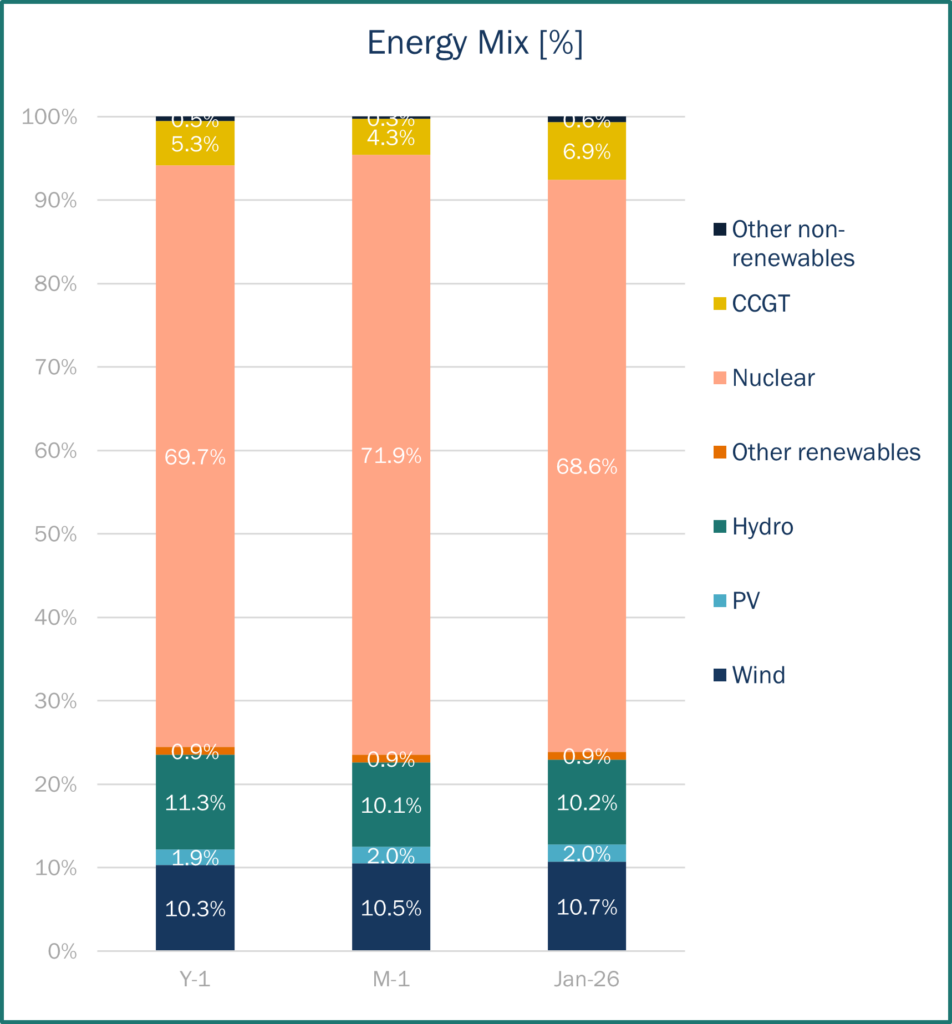

In terms of the generation mix, average nuclear output in January reached 51.3 GW, with an hourly peak of 55.1 GW at the beginning of the month and a minimum of 46.8 GW recorded on Saturday, 31 January. Nuclear power remains the backbone of the French generation mix, playing a key role in ensuring system security of supply. However, during the first half of January, the Flamanville nuclear power plant was taken offline due to technical issues linked to severe weather conditions during Storm Goretti, temporarily removing 2.6 GW of baseload capacity. This outage led to a higher reliance on thermal generation, with CCGT output increasing to 6.9% of the energy mix in January 2026, compared to 4.3% in December 2025.

In the matter of renewable energy sources, as you can see from the graph, wind production comes second in the total energy mix, representing a 10.7% out of the total production and first in the renewable energy category. Hydroelectric stocks decreased from 2,010 GWh (at the end of December) to 1.078 GWh (at the end of January), below last year’s level (2,309 GWh). Finally, photovoltaic production is minimum during these months as we are in the least sunny period of the year (November to February).

Source: Haya Energy Solutions

Energy prices & market panorama

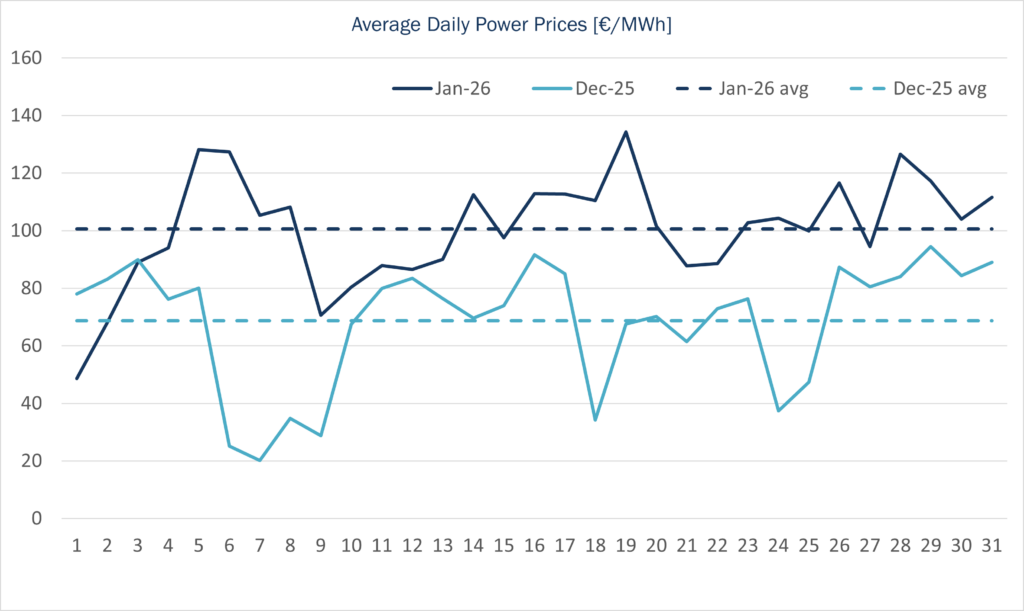

January’s average spot electricity price in France reached 100.7 €/MWh, broadly aligned with January-25’s levels (102.4 €/MWh). As the graph shows, prices fluctuated considerably throughout the month with the minimum average daily spot price reaching 48.7 €/MWh on the 1st January, and the maximum average daily spot price reaching 134.3 €/MWh on 19th January. Power prices rose sharply in January, mainly driven by cold weather conditions and reduced nuclear availability, with around 2.8 GW offline following the temporal shutdown of Flamanville, which significantly tightened supply.

Regarding imports and exports, in January, France was in a position of net exporter with all its borders, except Spain. The maximum level of exports for the month was 17,400 MW.

Source: Haya Energy Solutions

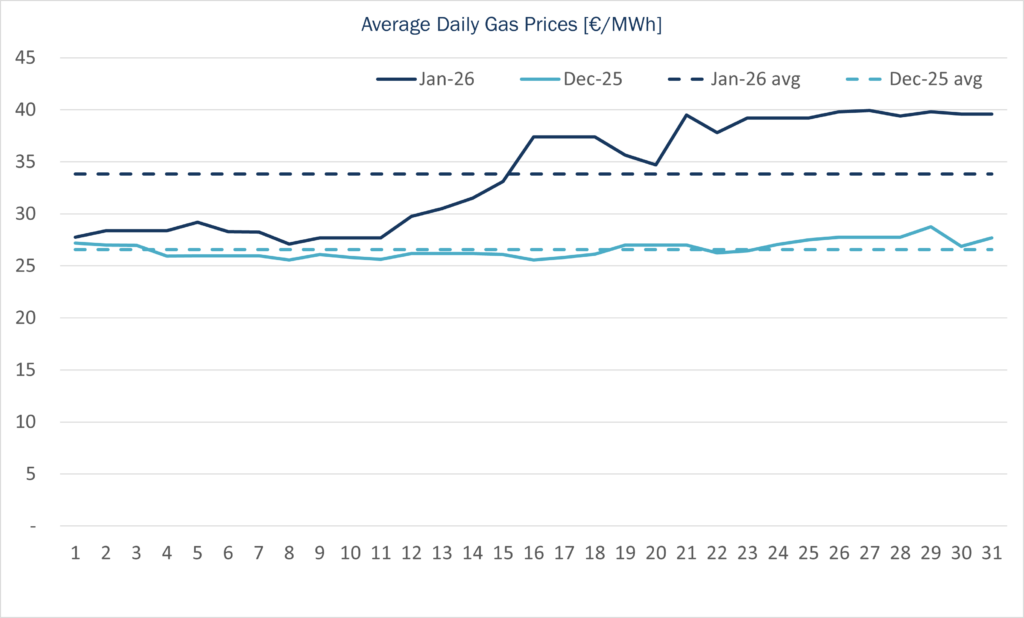

The TTF spot contract closed at 41.0 €/MWh on 31st January. Throughout January, spot prices rose steadily reaching peaks over 40 €/MWh. This rise has interrupted the TTF spot downward trend saw in the last year since February 2025 (except punctual weeks on May and June) where lowest price reached around c.27 €/MWh. The rally was driven by a combination of rising geopolitical tensions between the US and Iran, very low European gas storage levels, and persistent cold weather, all of which tightened short-term supply conditions. Overall, despite the rebound, January 2026 spot prices remained around 29% lower than the average monthly level observed in January 2025.

Source: Haya Energy Solutions

EU gas stocks are 41.08% full on average, compared to 53.59% last year. France’s gas storage levels are at 30.67%, below 2025 (36.09%).

Market trends and futures

Source: Haya Energy Solutions

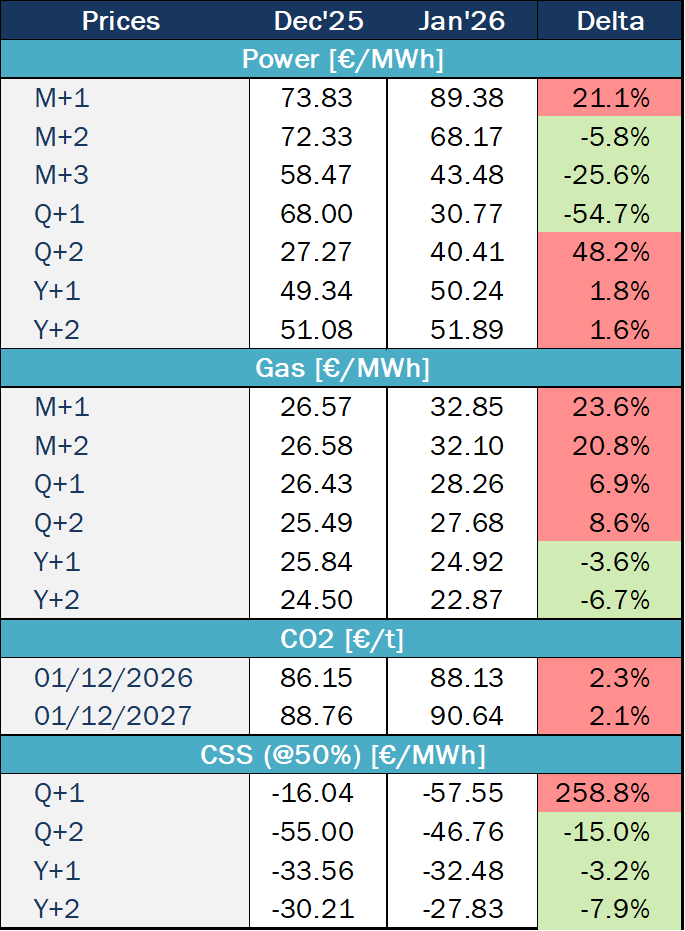

During January, French power futures were highly volatile, peaking around the third week of the month, mainly driven by sharp gas price fluctuations, heightened geopolitical tensions (notably around Iran and Greenland), and very cold weather across Europe. Towards the end of January, prices stabilised somewhat, although they remained above December closing levels, with February baseload futures around 89.4 €/MWh, March at 68.2 €/MWh, and Q3 2026 near 40.1 €/MWh. Overall, Cal-27 ended the month broadly unchanged compared with December 2025, despite significant intra-month volatility. Further along the curve, Cal-28 continued a downward trend, reaching its lowest levels in over a year, supported by lower gas dependency, improving demand expectations, and increasing renewable capacity.

European gas spot prices rose steadily throughout January, exceeding 40 €/MWh by month-end. The rally was driven by a combination of rising geopolitical tensions between the US and Iran, very low European gas storage levels, and persistent cold weather, all of which tightened short-term supply conditions. In parallel, the European Council adopted regulation confirming the phase-out of Russian pipeline gas and LNG imports by 2027, reinforcing longer-term supply concerns and adding structural support to prices.

In January 2026, EUA prices first rose on strong structural fundamentals (tight 2026 supply, higher industrial activity and colder, low-wind weather) but reversed in the second half of the month as macro and geopolitical uncertainties triggered a broad risk-off move. The sell-off intensified at the end of January following the announcement of Kevin Warsh’s appointment to the Fed, which weighed on global risk assets and briefly pushed EUAs below 80 €/t. Overall, prices ended the month close to November 2025 levels, but with significantly higher volatility and a clear macro-driven behaviour.

Brent prices showed a clear upward trend, rising from around 60–62 $/b to close to 70 $/b. The increase was mainly driven by a higher geopolitical risk premium, linked to heightened tensions in the Middle East, uncertainty around US–Iran relations, and a stronger US military presence in the region. Prices were also supported by slightly better demand expectations and temporary supply-side factors, notably cold weather in the US, which boosted energy consumption and disrupted some refinery operations. In addition, strong investor buying reinforced the rally. Towards the end of the month, however, rising macroeconomic uncertainty led investors to become more cautious, reducing new buying interest just as supply conditions were normalising, which caused prices to stabilise and set the stage for the correction seen in early February.

Regulation

PLF 2026

The 2026 Finance Bill (PLF 2026) proposes a rebalancing of energy taxation, with lower taxes on electricity and higher taxes on gas, aiming to support the energy transition and strengthen France’s energy independence. The draft also includes adjustments to excise duties and other energy-related levies as part of a broader rationalisation of the fiscal framework. However, as the PLF 2026 has not yet been definitively adopted, the tax rules and levels currently in force for 2025 continue to apply on a transitional basis, under a loi spéciale ensuring budgetary continuity.

French capacity mechanism

RTE has outlined the indicative timeline for the operational launch of the new French capacity mechanism. The certification window for the 2026–2027 delivery period is expected to open in mid-February 2026 for a duration of six weeks, allowing capacity providers to submit their certification applications. The certification phase is scheduled to close by end-June 2026, with the first auction planned for early July. RTE notes that these dates remain subject to confirmation, as the regulatory approval and parameter-setting process is still ongoing.