Analyse du marché France

L’analyse du marché français de l’énergie est essentielle pour comprendre les dynamiques et les tendances qui affectent le secteur tant au niveau local qu’international. Dans cette analyse détaillée, nous abordons les facteurs clés qui influencent les prix de l’énergie, l’offre et la demande, ainsi que les dernières politiques réglementaires. Cet aperçu complet permettra de vous tenir au courant des changements mensuels et d’anticiper les variations possibles du marché, tant en France que sur d’autres marchés pertinents tels que l’Espagne.

Sommaire

Décembre 2025

Chiffres du mois

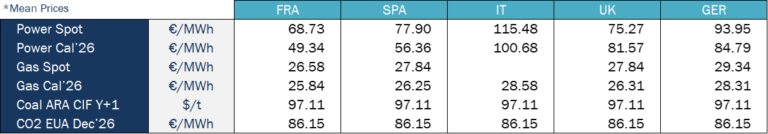

Au cours du dernier mois, les prix spot de l’électricité sur les marchés européens ont différé de ceux du mois précédent. L’Allemagne et le Royaume-Uni ont connu une nette baisse d’un mois à l’autre, tandis que l’Espagne et la France ont enregistré des prix moyens plus élevés. L’Italie est restée globalement inchangée. En revanche, pour le Power Cal’26, on constate que tous les pays ont connu une tendance à la baisse par rapport au mois précédent, ce qui indique une perspective de prix à moyen terme plus favorable.

En termes de niveaux de prix, la France a enregistré la moyenne mensuelle la plus basse du continent à 64,97 €/MWh, dépassant l’Espagne. Le Royaume-Uni (75,27 €/MWh) et l’Espagne (77,90 €/MWh) ont suivi à des niveaux globalement similaires, tandis que l’Italie est restée le marché le plus cher avec 115,48 €/MWh.

Les fondamentaux du marché, en particulier la production renouvelable et la météo, ont été les principaux moteurs des fluctuations des prix en décembre

Au cours de la première semaine du mois, la plupart des marchés européens de l’électricité ont connu des prix plus bas, soutenus par une augmentation de la production éolienne et photovoltaïque, ainsi que par des prix du gaz atteignant leur plus bas niveau depuis avril 2024.

Les prix ont de nouveau baissé sur la plupart des marchés lors de la deuxième semaine, les températures plus douces réduisant la demande. La principale exception fut le marché ibérique, où les prix augmentèrent.

Au cours de la troisième semaine, les prix ont légèrement augmenté sur la plupart des marchés en raison du froid, de la hausse des prix du gaz et du CO₂, ainsi que d’un changement dans le mix des énergies renouvelables (plus d’éolien et moins de solaire). Les prix du CO₂ ont atteint leur plus haut niveau depuis octobre 2024.

Au cours de la quatrième semaine, les prix ont de nouveau baissé en raison d’une demande plus faible pour les fêtes et de l’augmentation de la production éolienne et photovoltaïque. Le PV a atteint des records de génération quotidienne en décembre en Allemagne, en Italie et en France.

Demande d’énergie et mix de production

En décembre 2025, la consommation d’électricité en France lors des pics de demande a représenté en moyenne 66 GW, soit 2 % de moins qu’en décembre 2024. De plus, le pic de demande électrique durant ce mois a été atteint le dernier jour de l’année, avec 75 GW, en accord avec les niveaux du mois précédent (75,1 GW). Ce pic correspond à l’arrivée de la masse d’air polaire qui a affecté le pays durant les derniers jours de l’année où les températures étaient négatives.

En termes de mix de production, la production nucléaire moyenne en décembre était de 54 GWh. La production maximale moyenne a été atteinte à la fin du mois (56 GWh), et la production minimale moyenne a été atteinte le dimanche 7 décembre (51,1 GWh). Une forte production nucléaire contribue à des conditions d’approvisionnement confortables. La dernière semaine du mois, 7 des 57 réacteurs du parc nucléaire français étaient en arrêt programmé. En décembre, l’EDF a annoncé que le réacteur EPR de Flamanville avait atteint sa pleine puissance le dimanche 14 décembre. L’entreprise a expliqué que pour la première fois atteindre 100 % de puissance permet aux équipes de tester les équipements en pleine charge, de collecter des données opérationnelles et de vérifier que tous les systèmes fonctionnent correctement. Le réacteur est resté à pleine puissance jusqu’à 16h00 dimanche, après quoi la production a progressivement été réduite à un niveau stable de 1 220 MW. La phase dite de mise en service industrielle devrait avoir lieu quelques semaines après l’achèvement des essais à pleine puissance. Cette étape marque la fin du programme initial de tests mené lors du premier démarrage du réacteur.

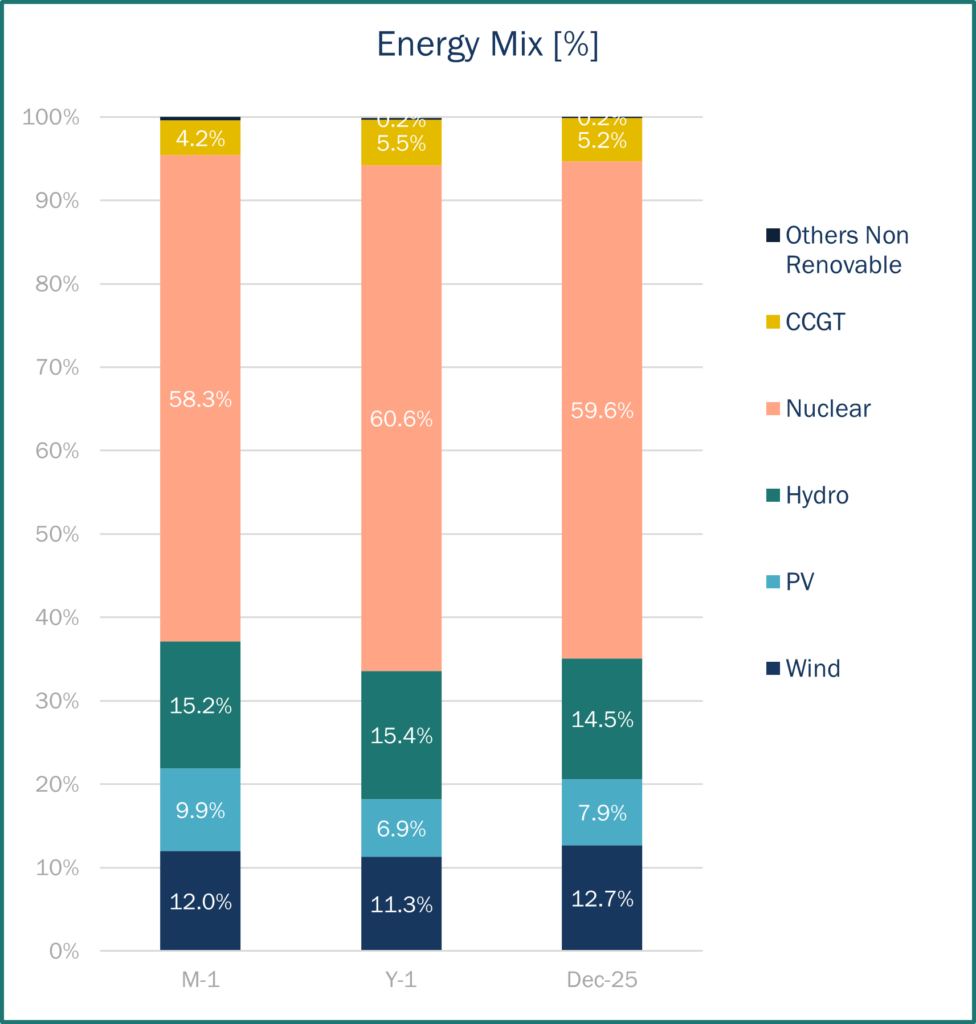

En ce qui concerne les sources d’énergie renouvelable, comme vous pouvez le voir sur le graphique, la production hydroélectrique arrive en deuxième position dans le mix énergétique total , représentant 14,5 % de la production totale et première dans la catégorie des énergies renouvelables. Les stocks hydroélectriques sont passés de 2 285 GWh (fin novembre) à 2 010 GWh (fin décembre), en dessous du niveau de l’an dernier (2 379 GWh). L’énergie éolienne occupe la troisième place dans le mix énergétique total, représentant 12,7 % (en accord avec les niveaux du mois dernier – 12 GWh). Enfin, la production photovoltaïque a considérablement diminué (7,1 GWh) ; nous sommes dans la période la moins ensoleillée de l’année (de novembre à février). Nous pouvons nous attendre à ces niveaux de production solaire dans les mois à venir.

Source: Haya Energy Solutions

Prix de l’énergie et panorama du marché

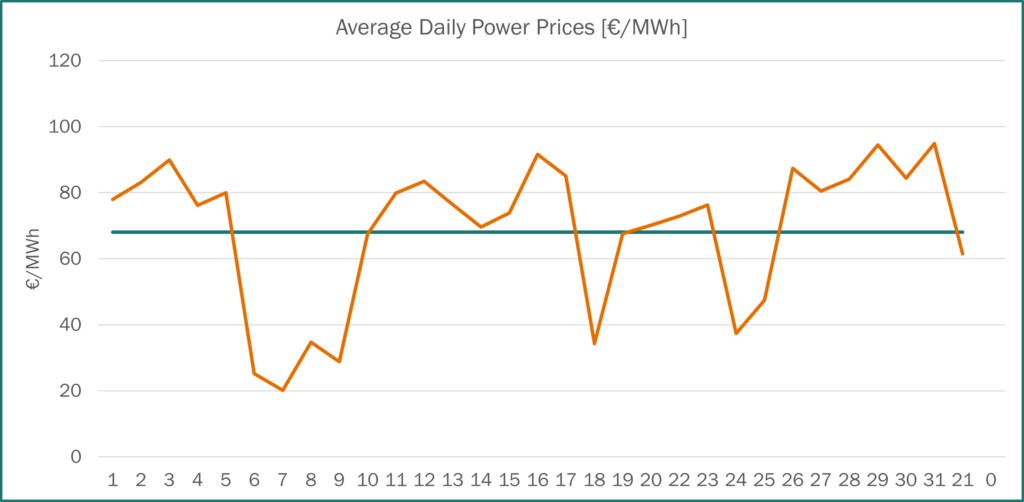

Premièrement, les prix moyens de l’électricité pour les contrats base day-ahead en France ont atteint 64,97 €/MWh – le plus prix le plus bas du continent –, 38 % en baisse par rapport aux niveaux de décembre 2024 (110,48 €/MWh). Comme le montre le graphique, les prix ont fluctué considérablement tout au long du mois, le prix minimum pour le contrat day-ahead étant de 20,18 €/MWh le 8 décembre, et le prix maximal de 89,92 €/MWh le 2 décembre. Les prix de l’électricité ont fortement baissé début décembre en raison d’un climat clément, d’une forte production éolienne et d’une forte disponibilité nucléaire, ce qui a réduit la demande et augmenté l’offre. À la fin du mois, une vague de froid a frappé le pays avec des températures inférieures à la normale ce qui a affecté les prix de l’électricité (au-dessus de 80 €/MWh).

Concernant les importations et exportations, en décembre, la France était en position d’exportateur net avec toutes ses frontières, sauf l’Espagne. Le niveau maximal d’exportations pour le mois a été de 20 671 MW. RTE a annoncé que 2025 était une année record pour les exportations d’électricité françaises. Elles ont atteint 92,3 TWh, confirmant une suroffre structurelle et limitant le potentiel de hausse (Italie + 22,6 TWh, Allemagne et Belgique + 23,1 TWh, Royaume-Uni + 22,6 TWh, Suisse + 20,1 TWh et Espagne + 0,2 TWh).

Source: Haya Energy Solutions

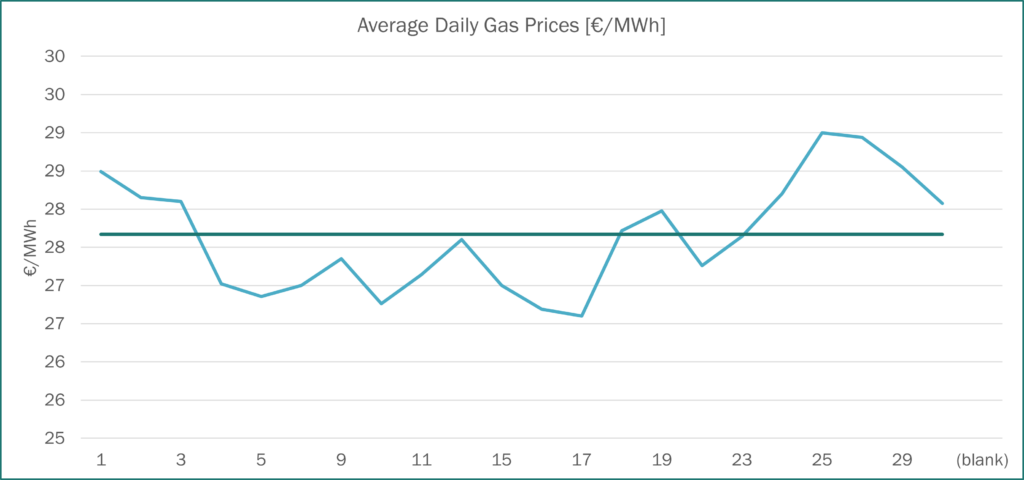

Deuxièmement, pour les prix du gaz, le contrat TTF spot a clôturé à 28,30 €/MWh le 31 décembre. Au cours du mois, les prix TTF spot ont légèrement varié entre 26,6 € et 29,0 €/MWh. Depuis le 25 février, les prix des contrats TTF sont en baisses (sauf de mai à juin). Son prix le plus bas depuis le début de l’année a été atteint à la mi-décembre. Les stocks de gaz ne sont pas très pleins comparés aux années précédentes, donc l’explication semble davantage liée à la géopolitique et à la possibilité d’un accord de paix entre l’Ukraine et la Russie sous l’égide des États-Unis. Cela signifierait que les marchés croient que le gaz russe reviendra en Europe, même si l’Europe s’est engagée à acheter une certaine quantité d’énergie aux États-Unis et a signé un accord pour éliminer progressivement les importations de gaz russe.

Source: Haya Energy Solutions

Les stocks de gaz de l’UE sont remplis à 61,97 %, contre 86,27 % l’an dernier. Les niveaux de stockage de gaz en France sont de 60,04 %, en dessous de 2024 (83,62 %). Il convient de noter que depuis juillet 2025, le Parlement européen a assoupli l’exigence minimale de stockage de 90 %, permettant aux États membres d’atteindre cet objectif à tout moment entre le 1er octobre et le 1er décembre chaque année. Une fois le seuil atteint, il n’est plus obligatoire de le maintenir jusqu’à la fin de l’année, offrant ainsi aux pays une plus grande flexibilité opérationnelle.

Tendances du marché et produits futurs

Source: Haya Energy Solutions

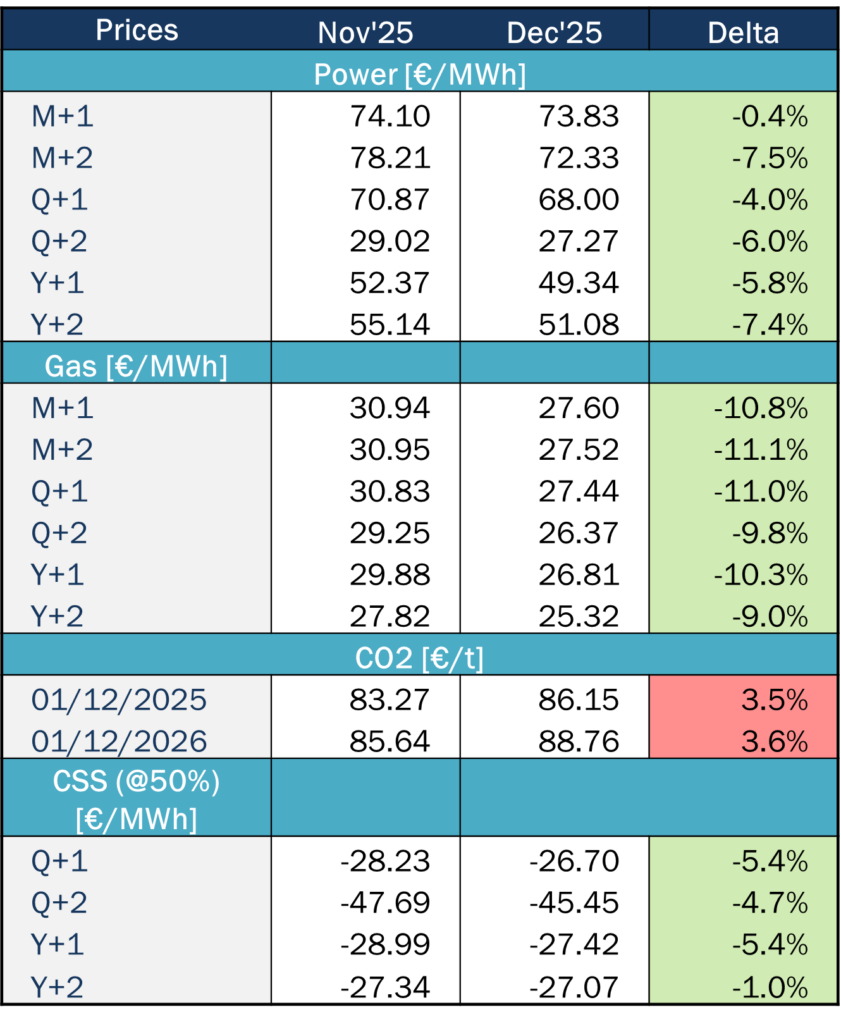

En décembre, les prix de l’électricité français ont considérablement diminué sur toutes les échéances (comme c’est le cas depuis octobre 2025), les baisses les plus significatives se produisant dans les contrats à long terme, comme Y+2, qui a chuté d’environ 7 %. La courbe du calendrier français est en contango clair, avec le Cal-26 se négociant autour de 49,34 €/MWh et le Cal-27 à 51,08 €/MWh, tandis que d’autres marchés d’Europe occidentale restent en backwardation. Les prix du calendrier français ont atteint leur plus bas niveau depuis les dernières années.

De même, les prix du gaz ont encore chuté, d’environ 10 % sur toute la courbe. La confiance croissante des marchés dans un accord de paix Russie–Ukraine sous la pression américaine a réduit les primes de risque géopolitique sur les marchés de l’énergie, en particulier pour le pétrole et le gaz, renforçant la pression à la baisse des prix malgré l’incertitude persistante.

Les prix du CO₂ ont connu une augmentation d’environ 3 % pour les échéances 2025 et 2026 par rapport au mois précédent. Les prix du carbone ont explosé à la mi-décembre, approchant des sommets annuels, stimulés par un resserrement de l’offre mené par la politique plutôt que par la demande. Le début de la période des enchères gratuites, les enchères de fin d’année et l’annulation confirmée de 52 Mt d’allocations ont créé un rythme haussier soutenu jusqu’à la fin de l’année.

Les prix du pétrole se sont légèrement rétablis début décembre, soutenus par les tensions autour du Venezuela, avec un Brent supérieur à 63 $/b. Ce soutien s’est estompé à mesure que les marchés se sont orientés vers l’excédent mondial d’offre attendu, faisant baisser les prix. L’optimisme à la mi-décembre autour d’un accord de paix Russie-Ukraine a poussé le Brent à 58–59 $/b, son niveau le plus bas depuis cinq mois. Bien que les gros titres géopolitiques (Venezuela, Ukraine) aient continué à provoquer de brefs rebonds, ces effets ont diminué. Début janvier, même une intervention majeure des États-Unis au Venezuela n’a pas réussi à faire bouger les prix, confirmant que les attentes de suroffre plafonnent le potentiel haussier.

Réglementation

La Commission européenne a approuvé la réforme du mécanisme français de capacité, en vigueur à partir de décembre 2026 pour dix ans. Bien que cette décision améliore la sécurité de l’approvisionnement à long terme et la visibilité des investissements, elle a un impact immédiat limité sur les prix. À moyen terme, cela pourrait aider à limiter les pics extrêmes des prix hivernaux en assurant une capacité suffisante, contribuant ainsi à une volatilité plus faible plutôt qu’à des prix plus élevés.

Bilan prévisionnel 2025-2035

Le Bilan prévisionnel de RTE 2025-2035 met à jour les projections pour le système électrique français jusqu’en 2035. Cela confirme la pertinence de la stratégie à long terme de la France visant à réduire la dépendance aux combustibles fossiles importés, à améliorer la balance commerciale et à soutenir la réindustrialisation. Les bénéfices climatiques, économiques et énergétiques de cette stratégie, ainsi que les conditions nécessaires à son succès, sont réaffirmés.

À court terme, la demande d’électricité reste stable, tandis que la production d’électricité à faible émission de carbone augmente désormais à un rythme conforme aux objectifs climatiques. En conséquence, la France connaît actuellement une abondance d’électricité décarbonée. Cette situation est très favorable au développement de nouveaux usages de l’électricité, mais devrait rester temporaire. La manière la plus efficace d’absorber cette capacité excédentaire est d’accélérer l’électrification de l’économie, en suivant une voie de décarbonation rapide. Dans un scénario de décarbonation plus lent, ajuster le rythme du développement de la production à faible émission de carbone peut également aider, mais cette approche est moins efficace économiquement et doit être gérée avec soin pour préserver les secteurs énergétiques existants.