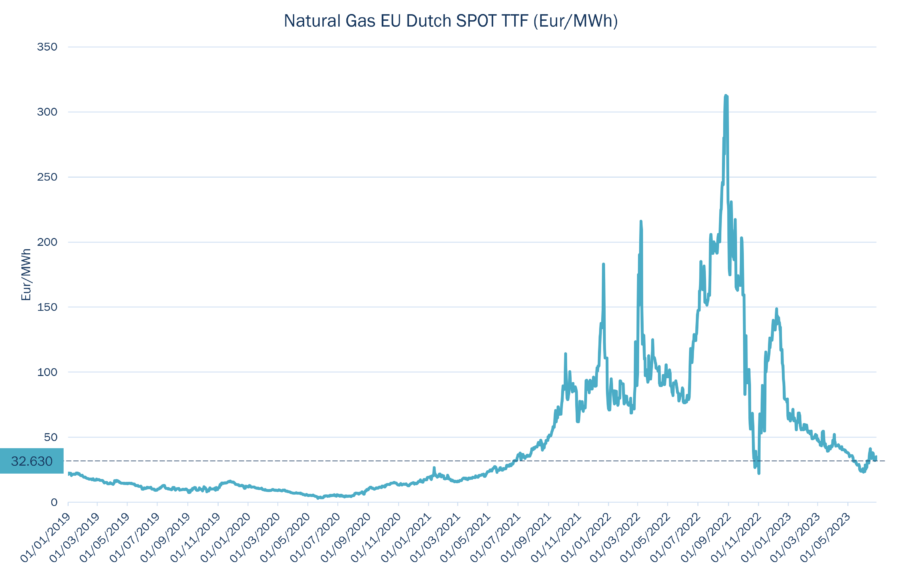

In the aftermath of the Russian attack on Ukraine in February 2022, European gas markets experienced a very bumpy road. Fears of empty storages and gas shortages for winter 2022/23 propelled prices to c. 350€/MWh at the end of August 2022.

One year on, thanks to a massive recourse to LNG from the US, sharp reductions in consumption (both domestic and industrial) and a mild winter, the situation seems to be back to the one prevailing until mid-2021 – when Russia started furtively reducing gas shipments to Europe, six months ahead of its attack on Ukraine.

Many steps have been taken both at EU and national levels to prepare for next winter. But is the situation as under control as it now looks?

Launched in May 2022, the REPowerEU plan helped the EU to get ready to replace Russian gas imports (see Newsletter June 2022: REPowerEU: “green” and economic cost at stake?). Amongst its key achievements, the EU has reduced its dependency on Russian fossil fuels, cut its energy consumption by almost 20% (15% for gas) and introduced a gas price cap mechanism.

Since September 2022, Russian gas accounts for only 8% of all pipeline gas imported into the EU, compared to 41% of EU imports from Russia in August 2021.

A common gas procurement platform has been implemented, allowing the EU to attract bids from a total number of 25 supplying companies last May, equivalent to more than 13.4 billion cubic meters of gas (bcm).

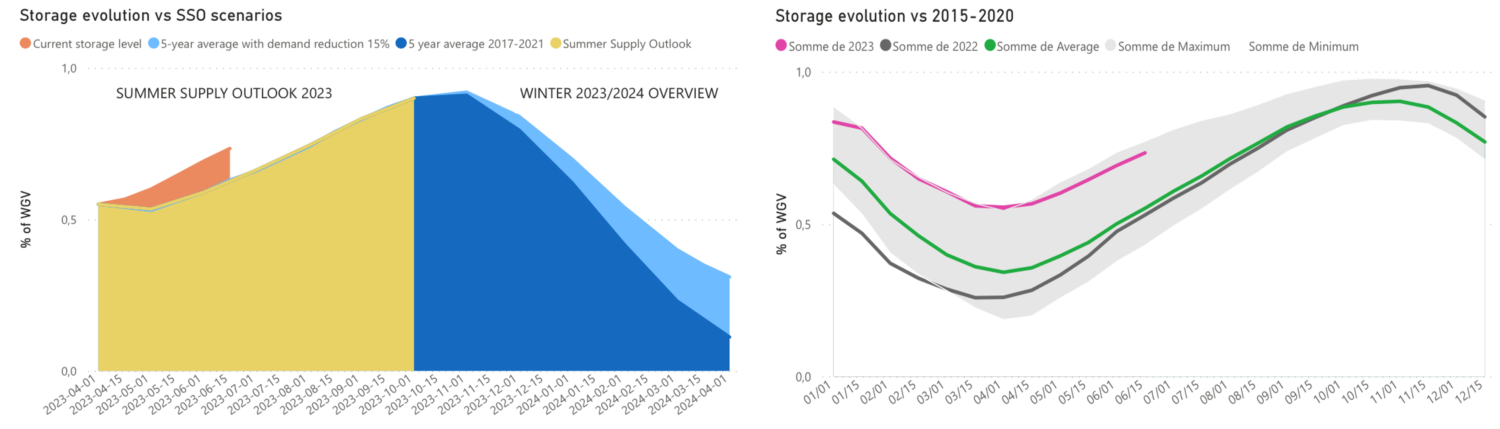

Even more importantly, the EU agreed to fill underground gas storages to 90% of capacity by 1st November each year, and is well underway to achieving this target ahead of the coming winter:

Seasonal Supply Outlook Monitoring – Source ENTSOG

Will that be sufficient? It is doubtful that gas consumption will continue declining as it did last year – industrial gas consumption was badly hit because of anticipated high prices, and the winter was mild. A cold winter could come as an unwanted surprise.

The level of gas demand for electricity generation will also play an important role – EDF’s nuclear power plants fleet unavailability added to problems last winter, and there are still 22 reactors unavailable – out of the 56 operated by EDF – at this time.

On the supply side, new LNG terminals will come online this winter, starting with TotalEnergies floating gas storage and unloading facility at Le Havre, planned for September.

However, LNG prices are international – dependent on the appetite for gas in other parts of the world, particularly in Eastern Asia. China is now experiencing an economic recovery, boosted by the end of Covid-era restrictions, but it still seems somewhat shaky. The strength of that recovery will play an important role in the level of LNG prices.

Europe is also now extremely dependent on Norwegian gas imports. Problems at the Norwegian Snøvit LNG plant, as well as maintenance works on gas production facilities on the Norwegian shelf, have recently led to restrictions in gas flows towards Europe, triggering a rebound in gas prices. This is a reminder of how much Europe is exposed to the least incident there, to replace curtailed Russian gas.

Finally, at the French level, the interruption in Russian gas imports since last summer has created a gas flow map never anticipated before:

Gas flow map – Source GRTgaz

Restrictions in flows are now seen in a South-West to North-East direction, while grid congestion limits used to happen in the opposite direction. A careful management of gas storage withdrawals will have to be implemented, with a view to preserving gas inventories in storages in the North, while maximizing withdrawals in the South-West.

Overall, maximum precautions have been taken to prepare for the coming winter, but it will continue to be work in progress. There is no safety net, and the least unanticipated problem on the supply side, e.g., disturbances in Norway, LNG moving to Eastern Asia etc., or on the demand side, e.g., a very cold winter, high demand for gas in power generation to make up for nuclear generation, etc., could lead to large price jumps. High volatility in gas prices will most likely be faced again this winter. Unfortunately!

Philippe Lamboley