On Thursday, May 28th, UNIPER announced its decision to bring back Irsching 4 & 5 CCGT power plants in Bavaria to the market as of October 1st, 2020. Since these are the two most modern (built in 2010 and 2011, respectively) and most efficient gas power plants in Germany, with yields of 60.4% for Irsching 4 (561 MW) and 59.7% (846 MW) for Irsching 5, this announcement certainly poses the question: why were these power plants stopped?

As a matter of fact, this anomaly, this scandal, seeing as these power plants are in a country where CO2 emissions derived from the electricity sector exceeded 250 million tonnes in 2019, is as old as these machines, which have only operated sporadically and under various mechanisms (the so-called grid reserve regulation most of the time) since their commissioning ten years ago. The most recent precedent, an announcement which dates back to September 2019, called once more for their mothballing from October 2020. This situation arose due to complex economic considerations linked with the operation of the market (Clean Spark Spread, Clean Dark Spread, ETS, etc.); however, in view of the ambitions and budget announced as part of the European Green Deal, are these lines of argument still relevant and genuinely admissible?

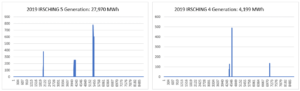

Let’s take a closer look at the year 2019. According to public data from the German regulator (smard.de), production from the Irsching 4 & 5 power plants was practically non-existent (with 7 and 33 EOH, respectively):

It is well known that the ‘switch’ from coal to gas power plants, with the development of renewable energies, is the most powerful lever for reducing greenhouse gas emissions. The United States is the best illustration of this.

Thus, let us dream, the Irshing power plant had been in a position to avoid some coal production in Germany for the year 2019, with the following impact:

These units would have been operating around 3260h (average duration of use for German coal power plants in 2018) and would have saved nearly 3 million tonnes of CO2. Admittedly, these 3Mt are modest if compared to the 250Mt emitted by the German electricity sector (~1%), but they do, in fact, represent over 15% if compared to emissions from the French electricity sector.

While we’re on the subject, and were we to be even more ambitious, these two units would have just as easily been able to avoid lignite production, given that their average period of use is nearly double that of coal (6490h on average in 2018); thus, the environmental impact would have been doubled (6Mt CO2), representing more than 10% of the reduction effort remaining to be completed in Germany in order to achieve the country´s 2020 target.

But, of course, in an economic system where neither the environment nor resources are taken into consideration, these production modes would have led to additional costs and as dealing with imported raw materials, would have also affected the German foreign trade balance.

In the case of an operation substituting coal plants (3260h), the added cost (based on the 2019 average future prices in 2018) would have been in the range of €52 million – compared with a trade surplus of $255 billion (0.02%). In the case of an operation substituting lignite power plants, the added cost would have doubled, but it’s the full cost of gas which would have affected the foreign trade balance, that being €350 million out of €250 billion (1.4%). Is such impact reasonable? Is it tolerable? In light of the situation in the United Kingdom (trade deficit of $223 billion) and France (trade deficit of $81 billion), it seems to us the answer is yes.

Let us translate these calculations in term of CO2 abatement costs, as this element is supposed to be taken into consideration in the EU Emissions Trading System (EU ETS), which seems to have, once again, demonstrated its inefficiency in this instance.

By using the average cost of gas and coal prices for the 2019 supply year recorded in 2018, this average additional cost is in the range of €17-18 per tonne of CO2 (whereas, as a matter of fact, the average EUA price in 2018 was €15!).

Despite the competitiveness of this path towards reducing emissions, a new 300 MW generation unit will be built on the same site (Irsching 6) for 2022… and will be solely dedicated to the network operator (TenneT) to ensure the stability of the system (consequently not preventing coal-fired power plants from emitting the million tonnes of CO2 that Irsching 6 could have been in a position to avoid annually).

Lastly, the coronavirus crisis is rearranging everything: the price of natural gas is collapsing (as well as that of coal, incidentally), the EUA price remains,, strangely enough, near its highest levels, Irsching will resume service and, against all odds (see our article from July 2018[1]), even Germany is well on its way towards achieving its ambitious 2020 greenhouse gas emissions reduction target (a 40% reduction compared to 1990)…

Once again, at the end of the day, Germany wins!

Philippe Boulanger

[1] https://hayaenergy.com/meanwhile-in-germany/