As attention in France is focused on the political primaries, another primary is being reorganised on the quiet: The primary reserve is the automatic response by production facilities to a variation in frequency on the grid.

On 16 January this year, RTE completely changed the organisation of this primary reserve: Until 2016, participation was mandatory with a set price the same for all players but from now on the composition of the primary reserve is ensured, on a voluntary basis, by all European producers on the European continental synchronous area, their contribution being decided in weekly auctions.

And this changes everything!

Until 2016, each production unit retained part of its available capacity for the frequency control needs of the grid, and was compensated with a capacity price at the same level for all.

From 16 January 2017, the generator units connected to the German, Belgian, Dutch, Swiss, French and Austrian grids participate in an auction.

Electrical Europe set to Berlin time

These new methods for primary regulation are actually using the mechanism already in force in Germany for primary power control (Primärregelleistung) and tertiary control (Minute Reserve): The auction is held every Tuesday to select the reserve output for the whole of the coming week.

RTE is therefore abandoning a more flexible capacity reserve system, settled at 5.30pm for the following day. This move is considered as the first step towards an integrated grid regulation across Europe, and the mechanism should gain in flexibility as the years go by.

Limitations of a pan-European primary capacity reserve

Aside from issues of interconnection saturation, various metering and qualification criteria of the units according to the grids, there is a visibility issue: to take part in the primary reserve, most of the units must be in operation. However, operation of flexible machines (fossil-fuel units) is determined by the day-ahead price. Betting on operation 12 days ahead would already be risky (as their operating schedule is not yet fixed), so the cost of proposing a 7-day based sub-optimal operation would be prohibitive.

System security, at what price?

In the context of falling peak needs for the system, the future of the system flexibility participants is uncertain. RTE’s provisional forecast emphasises the need for greater security and flexibility, especially because of the intermittent nature of renewable energy supply not contributing to automatic frequency control.

How can the capacity needed to ensure system security be kept on line?

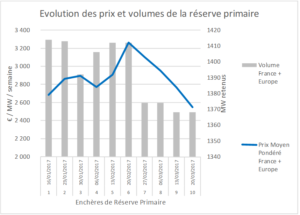

The supply of the primary reserve relates to under-optimised production in order to ensure system security. Primary adjustment therefore generally involves loss of earnings for producers. However, the prices resulting from the auctions, already below the 2016 annual average, have collapsed in the last few weeks.

There are three factors that might explain this fall in revenue:

- EdF generating fleet which is structurally surplus in terms of “fatal” primary reserve,

- Contribution of load-shedding players (demand response), benefiting from a more favourable situation of overlapping remuneration systems,

- And participation by cross-border players, especially in hydro-power

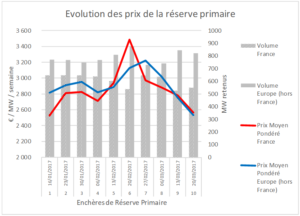

Looking more closely at the results of the auctions, the more bitter is the fact that France contributes a considerable share (up to 47%!) to the European primary reserve, most average price of the reservation retained by ENTSO elsewhere in Europe is higher than the reserve adopted in France (up to 11% more). In other words, Germany, Switzerland, Austria and the Netherlands benefit from less costly primary controls, but this reduction mainly affects the incomes of French producers, particularly thermal producers.

The situation experienced by the nuclear sector at the end of 2016 recalled the decisive role of fossil-fuel generation to ensure system security. This dependency will continue until Smart grid technologies have reached maturity, with batteries for grid control response and dispatchable renewable generation.

It remains that this new method for compensation for primary reserve will further blur the already wavering signals for investment in peak production. All the more so since the brief history so far of this primary reserve system shows significant price uncertainty (30% variation over 10 weeks), with no change to the contracted volumes by RTE (less than 3% variation).

“Will RTE find the means to integrate European grids without weakening the security of the French grid?”

Jean Charles Bissié