We are approaching the energy winter, typically considered the period from November to March when the system becomes more strained due to low temperatures. As it is becoming a tradition in HES, this article will analyze the state of the energy market as we enter this period (see article published in November 2023: Fragile energy security for this winter). We will also investigate the situation of France as the energy cornerstone of Europe. The energy situation of this country starts from a comfortable position this winter; the balance of supply and demand seems unfazed.

According to RTE’s assessment, demand should rise until 2030 on a 1.6% yearly average basis due to the inclusion of hydrogen and the electrification of energy uses. However, we have not yet seen this occur. On the contrary, what has continued developing is energy sobriety and performance measures and technologies.

On the supply side, this might be the beginning of a winter season with one of the largest energy provisions, due to 3 main factors: (i) strong nuclear availability, (ii) large storage of natural gas, (iii) broad hydro production due to the intense rains during 2024, where the average annual rainfall volume has already been surpassed during September.

Situation of supply

- Nuclear Fleet

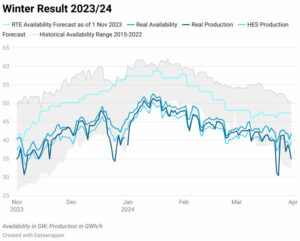

The previous winter saw an optimistic forecast given by EDF just before the winter began for the availability of its nuclear fleet that failed to reach, a result which we commented on in our previous newsletter in April (The end of 2023-2024 winter: Analysis of the situation).

Source: RTE, HES

We can see from the graph above that RTE (France’s transmission system operator) when taken from November 1st, 2023, forecasted a high availability of their nuclear fleet before the winter began, and after the conclusion of the winter, real availability was well below the forecast. HES has added its own production forecast along with the actual production for transparency and to showcase its new production comparison, available for viewing on our website (Nuclear Tracker).

This production forecast is a new function available for viewing on our website on the Nuclear Tracker page. Using historical data from the past ten years, we forecast production against the availability forecast RTE has given from the 1st of November for the winter and the real availability and real production. Our current understanding of the situation is that this year the nuclear fleet will once again undershoot their availability and production compared to the forecast RTE has set out.

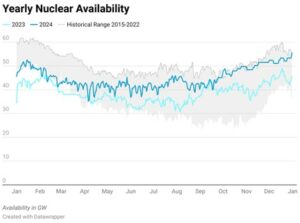

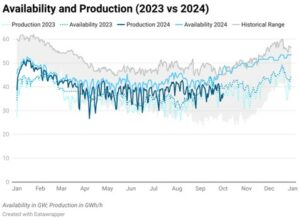

However, while we believe that RTE continues to be optimistic about the availability and production of the nuclear fleet, we can also see that this winter has already started stronger than the last, with availability and production much higher on average going into October this year than last year:

Source: RTE, HES

Source: RTE, HES

Nuclear production and availability have remained consistently above last year’s, and with the entrance of the Flamanville 3 nuclear reactor in the near future, we believe nuclear availability will be secure and strong this winter.

- Gas Storage

After the war in Ukraine began, Europe reparametrized its objective minimum level of gas storage from 80% to 90% on the 1st of November of each year to prepare for the high-demand months inside the gas winter. Since then, the storage levels of gas at the beginning of winter have always been comfortable. This year is no different, with a level of 94.37% and 92.43% on the 30th of September in Europe and France respectively.

Source: AGSIE (Aggregated Gas Storage Inventory)

Moreover, during August and September, Norway’s gas fields in the North Sea (the main gas source for Europe since the Ukraine conflict) entered their heavy yearly maintenance program and the market seemed mostly unaffected, highlighting the security of supply of our current market situation.

- Hydraulic Storage

This year’s intense rain has resulted in an especially humid France. Europe hasn’t stayed much behind with events such as the “Boris” storm during September which impacted parts of central Europe such as Germany, Poland, and Romania. This has resulted in an all-time high level of hydraulic stocks at the beginning of the winter season, which keeps adding to the already noted reliability of the system.

Source : RTE

Situation of consumption

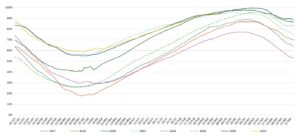

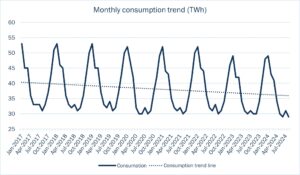

Following the trend set by the COVID-19 crisis and exacerbated by the Ukraine Conflict, when energy prices rose dramatically, consumption has declined consistently year after year thanksto the energy sobriety measures implemented and followed by the European countries and the increments in energy performance.

Notably, 2020 and 2023 were remarkably low in consumption. Last year was owed to mild winter temperatures that in addition to a comfortable gas stock provoked a decrease in prices when the winter tension started to calm.

According to RTE’s analysis, demand should start rising again due to the electrification of energy uses and the increment of hydrogen in industry. This should be felt in 2025, and it is estimated to have a y-o-y growth rate between 1.6% and 2.7% from 2025 to 2035. However, this year’s consumption does not show yet traces of this forecasted increase, having the lowest consumption since the year 2003.

Source : RTE

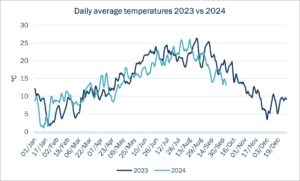

Nonetheless, this year we have already noted a sharp drop in temperatures below seasonal norms during September before the beginning of the winter season. This has not yet affected consumption, which was atypically similar to that of August, however, if this extends into the rest of the winter, we could face an increase in consumption with respect to previous years, particularly 2023.

Source : Enedis

To conclude with our analysis, Europe and France enter this winter with a high reliability on the supply security of our energy market which should add to the stability of the prices with a decreasing tendency. However, factors remain that could cause a sudden change in this stability. The geopolitical distress related to the conflicts of Israel, Palestine and Iran, and the conflict between Russia and Ukraine are primary concerns, but also those of the chain of provisioning of different energy commodities that affect the price of gas and so also the price of electricity, such as the balance supply-demand of LNG between Asia, USA, and Europe.

Here and now, the market stands stable and reliable, but the winter is dark and full of terrors, so keep a watchful eye for news that could impact the market. From HES we will remain at your disposal to inform you of the latest news and help you navigate this sea.

Guillermo Llanos Macías