Last June 15th, the Australian Energy Market Operator (AEMO) suspended the spot market for wholesale electricity as a result of an ever worsening power crisis.

This was the first time in its history that AEMO took the drastic decision to suspend the whole National Electricity Market (NEM) as it had become impossible to opearte the market within the rules.

Should any market intervention in the EU be necessary to address the current energy crisis, here we shall look into the main reasons that led to the Australian power spot market suspension and the tools available to the Market Operator to intervene the market.

As we all well know, the worldwide energy crisis we are currently facing showed its first signs back in September 2021 as economies started to come out of Covid-19 restrictions. Next, Russia´s invasion of Ukraine at the end of February of this year only added to the crisis given that Russia is one of the largest energy exporters in the world. This hit Europe in particular, which is highly reliant on Russian oil and, to a much higher extent, on Russian gas. As a result, not only Europe, but others, too, have been struggling to find alternative energy sources, leading to overall energy prices to spike.

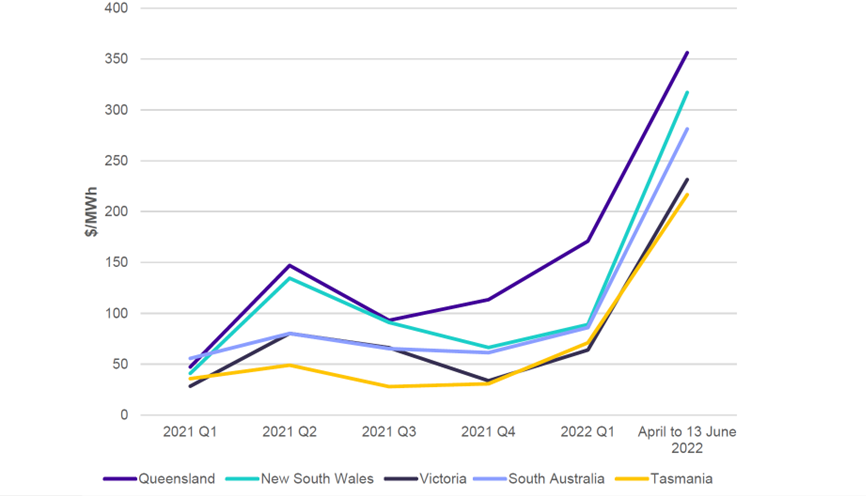

In the case of Australia, and to make things even worse, adverse weather conditions – including some floodings and a cold snap -, periods of low wind and solar output, and plenty of coal-fired power plants ‘alleged’ outages, all contributed to create the ‘perfect storm’. As a result, wholesale power prices rocketed during wk24 in all five NEM regions (see Figure 1 below).

Figure 1. Quarterly wholesale power prices across NEM regions

(Source: ACCC – Inquiry into the National Energy Martket – Addendum to May 2022 report)

In response to this, the Australian Electricity Market Operator (AEMO) set a price cap on the spot market ($300/MWh) on June 12th. In view of this price cap, power generators (mostly coal-based, which account for more than 50% of the total generatioin share) stopped producing as much power because they could not cover variable costs (c. 3GW of coal-fired power capacity was offline through ‘alleged’ unplanned outages alone), which led to a lack of supply and triggered a number of blackout warnings. To keep power flowing, AEMO continued to repeatedly issue a flurry of lack of reserve alerts, that is, ordered generators to produce enough electricity to meet the demand. It should be noted here that, prior to suspending the market, c. 5GW of directions had been issued, equivalent to c. 20% of the total demand.

Given that it was impossible to operate the system within the rules[1] under such conditions while ensuring reliable, secure supply of electricity to Australian homes and businesses, AEMO decided to suspend the spot market on June 15th which would, in turn, allow AEMO to have true visibility of which generators were available and when in advance, rather than relying on last-minute interventions. The market suspension was to be reviewed on a daily basis and a previously agreed suspension pricing schedule would be applied to cover each of the regions conforming the power market.

On June 22nd, AEMO announced that it would lift the spot power market suspension in stages, starting on June 23rd, as a return of some coal-fired power plants capacity had eased the country´s electricity crisis. In fact, 4GW of capacity had already returned to service, making the market more functional. Finally, in the morning of June 24th, AEMO lifted the suspension, not before the Australian Energy Regulator (AER) warned electricity generators that it would exercise its compulsory powers while an in-depth analysis of the situation leading to the market suspension was being carried out and reminded them thery are ‘on notice’ that they must comply with AEMO directions and with the energy rules and law at all times, or face enforccement action from the AER.

Not surprisingly, what has only just happened in Australia (and might repeat itself again) is cause of great concern if we extrapolate the main factors driving the Australian energy crisis to the EU.

The implications of the post-pandemic economy recovery and the Russian-Ukrainian war, both of which have resulted in spiking energy prices, are something we are far too familiar with by now. To this we need to add: i) Russian gas supplies to several EU countries having already been cut (Poland, Bulgaria the Netherlands), and Germany – Europe´s larget economy – likely to find itself in the same situation in the very shor-term term plus, ii) France´s ageing nuclear power fleet, whose reliability nowadays is far from what it used to be, an issue which is increasing power prices, especially those of NWE, even further. Both problems will doubtlessly affect overall energy prices in Europe and, more specifically, result in even higher electriciy prices whose cost European citizens can hardly cope with nowadays, anyway (see our article “Rising energy prices: national measures to protect European end-users”).

So, were we faced with a similar situation to that seen in Australia, how will different countries react and, for that matter, the EC?

For the time being, and given the extremely high gas prices we are seeing in the market, many Member States have already decided to delay the retirment of coal plants scheduled to close and re-activate reserve capacity or increase overall coal-fired power plants output. This, of course, completely contravenes the basis of the ‘Fit-for-55’ package both the EC and Member States have worked so hard on in order to accelerate energy transition towards a greener, more climate-friendly energy landscape.

As for the design of current electricity markets – also a matter of concern in the case of Australia – Eurpean power markets are outdated. They no longer reflect the reality they were initially created for some 20 years ago, i.e., create a single European Electricity Market based on fossil-fueled generation. Though the recently published REPowerEU Plan (refer to our article “REPowerEU: green and economic cost at stake?”) did not foresee any mayor changes to the electricity markets, the EC has now admitted that these markets are not prepared to adquately price the flexibility required in an ever increasing RES power generation context and that they should now be subject to a significant reform.

Finally, should any power market need to be, not only intervened (see our article “THE TIMES THEY ARE A-CHANGIN’ – Iberian Singularity” but even suspended, our first question here would be whether Member States have the right tools in place to proceed with such a complex task. And the answer is no. Contrary to Australian Electricty Market Rules, which foresee the possibility of suspending the market under specific circumstances and provides for a whole set of rules (which range from setting a price limit to the market above which a price cap is immediately put in place, when to enforce a market suspension, how long for, range of prices, to the amount of reimbursements to be made to those market actors who have incurred any losses), EU countries lack this sort of legal framework, and would be advised to consider individually implementing it as soon as possible.

Though currently we are all very concentrated, and with good reason, on how to best survive this coming winter season at the least possible loss (both in monetary and social terms), it would be advisable if both the EC and Member States also made it their priority to start thinking on how to best adapt or reform electricity markets, be it to overcome a very stressed situation, as is the case now, or to mirror the underlying, predominantely RES power generation we intend to achieve, and implement a completely new electricity market design.

[1] Note: Price limits are imposed when spot prices reach almost $1.4m over 2016 five-minute intervals over a rolling seven-day period. When the market was suspended, prices in Queensland had topped $9m, NSW about $8m, Victoria $4.5m and South Australia $3.9m. Hence, market suspension was needed because under the existing rules the price threshold could have lasted weeks if not longer.

Michaela STERNHAGEN