Among the work left unfinished by the previous government, reforming third-party access to natural gas storage (ATS) features prominently. Indeed, significant preparation and consultation work had been put forth by all parties involved (the ministry, the CRE [Energy Regulatory Commission], suppliers, etc.) as a consequence of the French Energy Transition for Green Growth Law (LTECV) of August 2015, but that has never come to fruition.

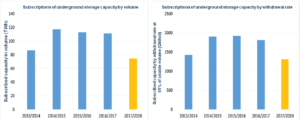

Yet, France experienced a tense situation with regard to its gas supply last winter, particularly in the southern region, and when it comes to the 2017/2018 winter, the storage situation looks more worrisome than ever: at the start of April, the level of subscriptions was more than 30% lower than those levels observed over the past three years, and the situation has not improved since:

At the end of May, GRTgaz and TIGF published their ‘Winter Outlook 2017/2018’ quite early on, presenting the gas system prospects for next winter so as to alert market players as soon as possible to the pressures observed on the gas network and the uncertainties hovering over the 2017/2018 winter.

With a new government team arriving on the scene, what’s the state of play? And what solutions could be visualised?

Based on the situation of last winter, TSOs fear ‘a strong likelihood’ of congestion in the South-East and ‘probable’ congestion in the North, notably due to the insufficient number of storage subscriptions already registered. Network operators emphasised that ‘without an increase in subscriptions for underground gas storage, rapid arrivals of LNG [liquefied natural gas] in the network will be vital towards ensuring gas supply for consumers in the event of cold spikes next winter lasting ten days’.

However, if gas storage remains so desperately empty, the reason is simple: they are placed on the market at prices that are disconnected from those of the underlying market (winter-summer spread), according to a so-called ‘negotiated’ regulation on third-party access to storage.

The LTECV has provided the means to proceed through an order to ‘modify the obligations surrounding suppliers’ holding natural gas inventories, the terms of access to natural gas storage infrastructures and the tasks of the transmission system operators in natural gas storage, as well as those of the French Energy Regulatory Commission (…), in order to strengthen the security of gas supply and, if necessary for achieving this objective, to regulate rates for underground storage capacities for natural gas’.

A drafted order was ready in the summer of 2016 but was withdrawn from the agenda of the Council of Ministers at the start of August last year, a priori because of tax considerations introduced by the opinion of the Council of State. Since then, some attempts to resolve the issues raised have been launched, particularly by Storengy, but failed, before an inspection assignment was launched in the spring. They submitted their report to the Minister at the start of May, which was not made public.

In order to prevent a new gas crisis starting next winter, the subject of ATS reform should be resumed as a matter of urgency by making it part of the energy transition ‘roadmap’, which should be published just after the parliamentary elections. Yet, even acting with all due haste, the new system would not take effect until the winter of 2018/2019 at the earliest.

In any case, one important element could quickly push the subject onto the agenda: a decision from the European Court of Justice (CJUE) is expected in the coming weeks. This could lead to the cancellation of the Decree of 2014 which currently governs the storage obligations of suppliers. The legal vacuum thereby created would cause the regulation to return to that of the Decree of 2006, which had led to the low storage-filling rate of the 2013/2014 winter – hence today’s decree being questioned…

Without waiting for the regulatory modifications, network operators have looked for pragmatic solutions to avoid pressures on the gas supply next winter. The ‘local spread’ mechanism, prepared in cooperation with the market players and the regulator, will be the subject of a consultation with the CRE in the summer, within the context of the merger between the North and South regions planned in 2018. This mechanism must reduce physical congestion of the transmission network through simultaneous gas purchase/sale operations on the PEGAS exchange platform, operated by Powernext and capable of being activated through ‘Within Day’ at the request of GRTgaz. It’s an incentive system to encourage shippers to bring gas wherever the network requires it, combining a purchase on points downstream of the congestion and a sale on points upstream of it. Such a mechanism would make it possible to increase the value of the gas supplied downstream of congestion all while sharing any additional costs over the market as a whole.

Last-minute update: just after news spread that the presentation for the report of the Advocate General of the ECJ concerning the 2014 ‘storage obligations’ decree (see above) was postponed to the end of July, the DGEC [General Directorate for Energy and Climate] submitted a draft decree to the CSE (Conseil Supérieur de l’Energie) [Higher Council for Energy] dated 6 July ‘on the terms for taking into account other instruments of modulation to apply the obligation to declare and hold stocks and storage capacities of natural gas suppliers’.

This draft decree, intending to flesh out the grey area that has existed since 2014 concerning the definition of these ‘other instruments of modulation’, has thus come at a good time for addressing the grievances which may emerge from the ECJ’s decision. In order to fulfil their obligation to declare and hold stocks and storage capacities, suppliers would only be required to subscribe to a minimum of 50% of this obligation in underground natural gas storage capacities located in France.

Beyond that, and as a complement, modulation instruments providing a service equivalent to that of an underground stock of natural gas in terms of security of supply would be permitted, these being defined as follows:

- underground stocks of natural gas located in another Member State of the European Union ;

- stocks of liquefied natural gas stored in a LNG reception and regasification terminal located in France;

- stocks of liquefied natural gas stored in a LNG reception and regasification terminal located in another Member State of the European Union;

- unused production capacity of a natural gas field located in France;

- unused production capacity of a natural gas field located in another Member State of the European Union.

At first glance, the conditions ensuring that these instruments of modulation provide a service equivalent to that of an underground stock of natural gas in terms of security of supply are so restrictive that it seems virtually impossible to apply them… In addition, the minimum requirement of 50% for storage capacity held in France may not hold up against the arguments of the ECJ.

More generally, this ‘clarification’ decree should not call into question the new government’s willingness to reform third-party access to storage (ATS), the necessity of which is more pressing than ever: the fundamental problem with the current ATS essentially stems from the method of marketing for storage capacity in France, which are at prices disproportionate to market fundamentals (winter-summer spread of gas prices on the markets).