Spanish Market Analysis

Analysis of the Spanish energy market is key to understanding the dynamics and trends affecting the sector both locally and internationally. In this detailed analysis, we address the important factors influencing energy prices, supply and demand, and the latest regulatory policies. This comprehensive overview will allow you to keep up to date with weekly changes and anticipate possible market variations, both in Spain and in other relevant markets such as France.

Table of Contents

December 2024

Evolution of demand and production mix

In December, renewable sources accounted for 47.64% of total energy production. This aligns with the increase in the renewable share of the electricity mix, which reached 56%. Notably, photovoltaic renewable generation capacity grew by 18% during 2024. Among the renewable sources, wind energy accounted for 23.1%, hydropower for 11.2%, and photovoltaics for 10.8%. Meanwhile, nuclear energy contributed 18.7%, and combined cycle plants comprised 22.6% of the total energy production. Compared to the previous month, there have been slight percentage decreases in photovoltaic and hydropower generation, which have been largely offset by increases in combined cycle generation, the technology experiencing the highest growth.

A notable trend emerged in early December, as combined cycle generation increased by 91.5% compared to the same period in 2023. This surge was primarily fuelled by a 24.5% decrease in wind energy output and a 35% decline in hydropower generation, which were both attributed to lower precipitation levels. Additionally, challenges in nuclear generation further affected the energy mix. Both reactors at the Ascó plant were offline, resulting in a 20% reduction in nuclear output across Spain’s nuclear fleet compared to the previous year. Ascó I was undergoing scheduled maintenance, while the return of Ascó II after an outage was delayed due to an incident.

The total energy generated during the month amounted to 22,663 GWh. In terms of electricity demand, an 8% increase was recorded, rising from 19,724 GWh in November to 21,473 GWh in December, driven by low temperatures. However, this figure is comparable to the same period of the previous year, when demand stood at 21,125 GWh.

REE also highlights that Spain closed 2024 as a net energy exporter for the third consecutive year, achieving a net surplus of 10 TWh.

The average electricity price in December stood at 111.70 €/MWh, marking a 5.75% increase compared to November’s average price of 105.63 €/MWh. The highest hourly price during the month was 181.00 €/MWh on the 10th, while the lowest was 0.44 €/MWh on the 8th.

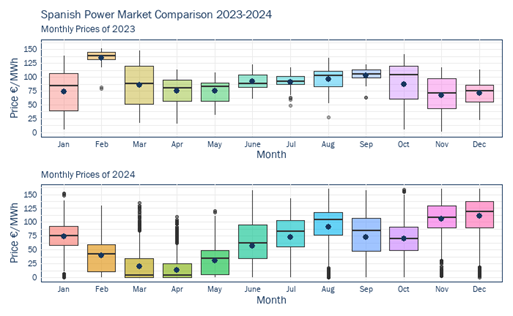

The wholesale electricity market closed 2024 with the lowest annual average price in four years, at 63.19 €/MWh. This represents a 28.4% decrease compared to the 2023 average of 88.27 €/MWh.

The significantly low prices seen during the spring, driven by substantial renewable energy production, played a key role in lowering the annual average. This period even saw negative prices during certain hours, a first for the Spanish market. As a result, the 2024 annual average closely resembles the 2018 figure of 57.29 €/MWh.

To summarize the end of 2024, a month-to-month comparison between 2023 and 2024 shows that prices were lower for almost all of 2024. The main difference compared to 2023 is that prices were higher at the end of the year. This increase can be attributed to effective preparations made in 2023 for the upcoming winter in 2024, alongside the impact of the conclusion of the gas transit deal between Russia and Ukraine. In November, the impact of gas network maintenance in Norway, along with concerns about gas supply shortages, led to uncertainty regarding incoming gas supplies and increased the volatility of power prices across Europe.

Gas Prices

In the Spanish gas market, the average spot price increased from 44.42€/MWh in November to 46.33€/MWh in December. The highest price of the month, and also the maximum recorded in 2024, was 52.80€/MWh on December 31st. The lowest price was 40.96€/MWh, observed on December 16th. The increase in gas prices is primarily attributed to the cessation of natural gas transit from Russia to Europe via Ukraine, as the agreement between the two countries expired on January 1st. The uncertainty regarding the gas supply levels to Europe will be growing during the beginning of the new year, more with the upcoming required storage previous to the end of the year.

Additionally, TTF gas futures peaked at 48.28€/MWh, reflecting market concerns. Expectations of higher demand due to falling winter temperatures further exacerbated the upward trend. Moreover, storage levels saw a significant decline, dropping from over 93.25% at the beginning of December to 82.47% by the end of the month.

Fuels

Regarding the forecast for Brent crude oil prices in the coming months, the projected average monthly prices are as follows: 72.98 $/bbl for February, 72.78 $/bbl for March, and 72.45 $/bbl for April. The expected maximum prices are 74.49 $/bbl, 74.64 $/bbl, and 74.24 $/bbl, respectively.

During 2024, the weakening of Chinese oil demand significantly influenced crude oil prices. This development compelled OPEC and the IEA to revise their oil demand growth forecasts downward for both 2024 and 2025. The reduction in Chinese oil demand is expected to extend through most of 2025.

Additionally, oil supply from non-OPEC producers is projected to increase. As a result, the IEA predicts that the oil market will experience a surplus in 2025, even though OPEC and its allies have postponed their plans to increase production until April 2025. Meanwhile, the EIA forecasts that U.S. oil production will reach a new record of 13.52 million bpd in 2025.

In terms of CO2 EUA, the price for December’25 is 69.07 €/t similar to 69.60 €/t in November. Similarly, the price for December’26 is even higher, reaching 71.07 €/t.

Future contracts trends

As is common during the winter season, electricity prices are expected to continue rising through January. In line, the mean price for January’25 is 92.25€/MWh. During the following months, a decrease in this trend is forecasted until April’25, when mean prices are expected to 44.95€/MWh. However, the mean price for May’25 rises again to 45.52€/MWh.

Power prices for the first quarters of 2025 have shown a decline. In December, the average price for Q1’25 dropped to 75.34 €/MWh, down from 76.57 €/MWh in November. Similarly, the average price for Q2’25 fell to 49.10 €/MWh, compared to 49.85 €/MWh in November. For Q3’25, prices decreased from 81.53 €/MWh in November to 78.41 €/MWh in December.

In the long term, the price of electricity for Cal’25 declined to 70.45 €/MWh in December, down from 71.83 €/MWh in November. However, for Cal’26, prices increased slightly, reaching 62.36 €/MWh compared to 61.82 €/MWh in November.

The MIBGas contracts for December closed at 44.83 €/MWh for Q1’25 and 43.69 €/MWh for Q2’25. These figures represent an increase compared to November, when the same products were traded at 44.51 €/MWh and 42.57 €/MWh, respectively.

Gas prices for Cal’25 and Cal’26 experienced an upward trend, rising from 42.20 €/MWh and 34.21 €/MWh in November to 43.07 €/MWh and 35.51 €/MWh, respectively, in December.

Meanwhile, EUA ETS prices showed a slight decline. EUADec’25 dropped from 69.60 €/t in November to 69.07 €/t in December, and EUADec’26 decreased from 71.71 €/t to 71.07 €/t over the same period.

At the regulatory level, an important change that will be felt by electricity bills is the increase of taxes starting from January 2025, going back to 21% after being reduced to 10% in 2024.

Another key point is the Government’s proposal for a new Royal Decree. This aims to update renewable energy rules to match the current electricity market and improve system management. It also suggests a new priority system for connecting power generation to the grid, encouraging energy storage.

SP Baseload Power price (€/MWh)

SP Peak load Power price (€/MWh)

EUA price (€/t)

MIBGas price (€/MWh)

Coal Price ($/Tn)

Gas efficiency: 52%

Coal efficiency: 38%

Gas vs. Coal Price (€/MWh)

Gas efficiency: 52%

Coal efficiency: 38%